Sunderland are on a downward spiral after 10 consecutive years in the Premier League, suffering relegation to the Championship after finishing bottom of the Premier League. Since then things have gotten even worse, suffering back-to-back relegations with issues rife throughout the club.

Financially, Sunderland are heading towards ruin unless they quickly turn things around, with high wages despite their newly found League 1 status, a want-away owner and a disgruntled fanbase.

This year was slightly rosier than usual financially anyway. This is despite making a loss of £9.5m, showcasing the sorry state of the club that this is a significant improvement on the loss last year of £33m.

Let’s delve into the numbers.

Revenue Analysis

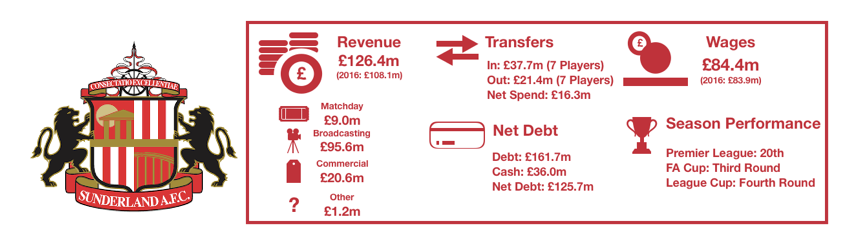

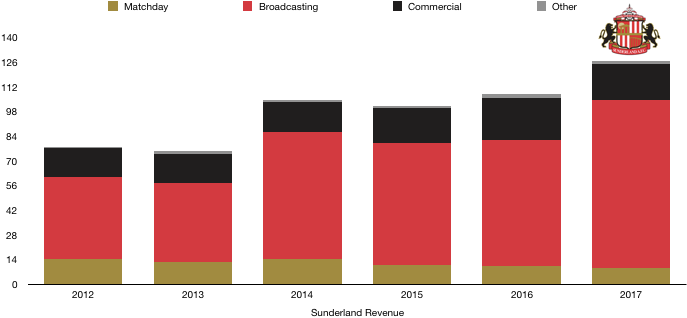

Sunderland saw revenue rise in their final Premier League season, increasing from £108.1m to £126.4m (16.9%) despite all areas bar broadcasting revenue falling.

Broadcasting revenue rose significantly, increasing from £71.6m to £95.6m (33.5%) due entirely to the new Premier League TV deal which helped all Premier League clubs to record revenues, even Sunderland despite finishing bottom.

Matchday revenue fell, dropping from £10.4m to £9.0m (13.5%) as tired fans stayed away after becoming disillusioned by the state of the club on and off the pitch.

Commercial revenue also fell, decreasing from £23.5m to £20.6m (12.3%) as sponsors started pulling their cash out of the club and Sunderland struggled to attract new interest due to performances on the pitch and the negativity surrounding the club.

After relegation from the Premier League, Sunderland can expect a cliff-edge drop in revenue dropping down to less than £40m after a terrible Championship campaign that ended in relegation. This second relegation will cause further issues for the club who can expect another sharp drop in revenue in all areas from this which may be hard to come back from.

Expense Analysis

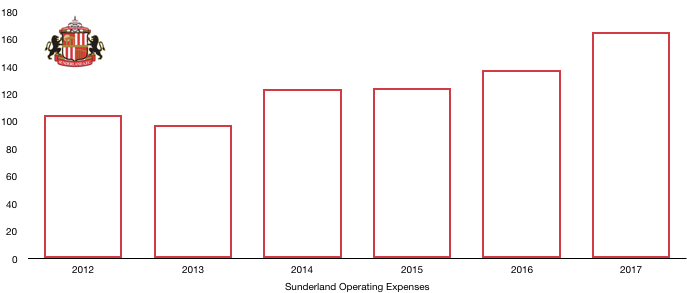

An area that will worry Sunderland directors is expenses and how quickly they can reduce these numbers after back to back relegations. It is likely to be difficult with expenses rising last year from £134.5m to £163.0m (21.2%) despite player investment being fairly low.

Amortisation costs rose significantly, increasing from £31.5m to £43.8m (39.0%), however this was not due to the usual cause of large player investment. Sunderland were required to impair a number of player’s value in the accounts as this was higher than their actual value, in most cases zero where they were let go on free transfers such as the imprisoned Adam Johnson and the want-away Jack Rodwell. This impairment was a huge £14.3m.

Sunderland also had depreciation costs of £2.5m in relation to their stadium and other equipment, up slightly from £2.4m last year.

Finance costs were down in a bit of good news for the club. Finance costs dropped from £8.1m to £4.1m (49.4%) after making a cool £3.8m gain on investments whilst bank borrowings costs fell slightly also.

Sunderland also had a huge exceptional cost after losing their court case against Inter Milan in relation to the signing of Ricky Alvarez, a poor signing who is no longer at the club. Sunderland contested that they did not activate the transfer clause in his contract that required them to buy him. This has been rejected by the courts and Sunderland had to pay a gut wrenching £9.7m to Inter Milan which they could of done without.

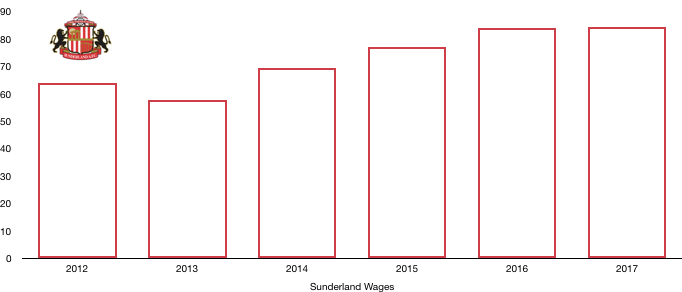

Wages stayed relatively stable, rising less than 1% from £83.9m to £84.4m due to a lack of player investment. Sunderland will see this figure drop significantly as relegation clauses kick in (other than Jack Rodwell) and will need a further drop to occur after their second successive relegation, although it is less certain whether relegation clauses exist this year with relegation never a thought going into the season.

Despite relegation, Sunderland paid directors £1.7m with the highest paid director, believed to be Martin Bain, earning himself a cool £1.2m despite their unsuccessful season.

The club also received tax credits of £0.3m after another year of losses.

Transfer Analysis

Sunderland went for quantity over quality with finances constrained with 7 players incoming whilst the same number left in a poor recruitment drive by the club.

In came Ndong (£18.0m), Djibobodji (£8.6m), McNair (£4.7m), Gibson (£2.3m), Oviedo (£1.8m), Mika (£1.4m) and Love (£1.0m), signing for a combined £37.7m.

Out went Van Aanholt (£9.5m), Coates (£4.3m), Kabul (£3.6m), Giaccherini (£1.4m), Bridcutt (£1.0m) and Vergini (£0.8m) whilst Lens left on loan for £0.9m. This brought in £21.4m to Sunderland.

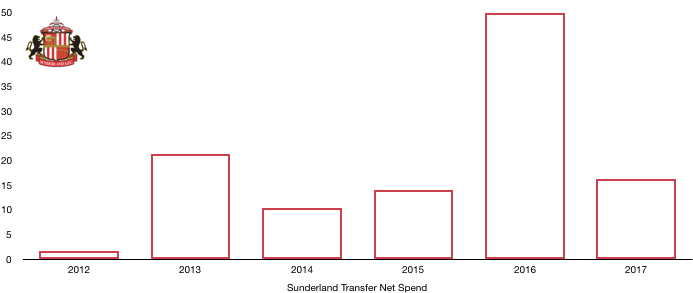

This showed a huge drop in spending as Sunderland’s net spend fell from £50m to £16.3m (67.4%) as the club tightened its purse strings.

The signings were all in all poor, not contributing anything of note whilst those who left mostly enjoyed good seasons elsewhere.

The club did however record an accounting profit on player sales of £33.1m, up significantly on last year’s £5.1m.

The club paid out net cash on transfers of only £2.7m compared to £11.0m last year as the club brought in significantly more cash as they looked to secure their financial future with £39.1m coming into their coffers.

Worryingly the club do still owe £46.7m in relation to past transfers with many unlikely to still be at the club as the club’s debts threaten to spiral. They are only owed £13.1m in comparison.

Sunderland also potentially owe a further £8.3m should current players meet certain transfers clauses.

Assets/Liabilities Analysis

Sunderland invested mildly last year in order to be more financially stable with their finances unravelling rapidly. They managed to stabilise their finances slightly with net debt increasing by a modest amount after cash levels rose at a faster rate than debt.

Cash levels soared form £26.9m to £36.0m (33.8%). This was despite another loss-making year which was offset by a big windfall from transfers and the owner pumping £24.4m into the club to help keep them afloat.

Debt levels hence rose after that investment from Ellis Short, rising from £137.3m to £161.7m (17.8%) as loans owed to owners rose £21.6m and bank debt rose £2.9m.

With Ellis Short looking to sell Sunderland now, it is unlikely he will want to pump anymore money into the club, making anymore loans unlikely and meaning Sunderland’s financial health is on the brink unless a buyer can be found who is willing to take on the huge debts owed to Ellis Short (unless he wavers some). An immediate bounce back to the Championship is vital.

Thanks for reading! Share with a Sunderland fan!