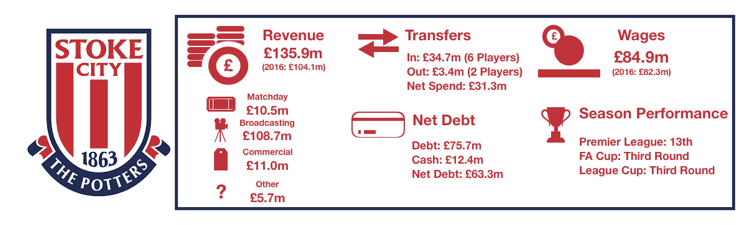

After 3 consecutive 9th placed finish in the Premier League for Stoke, things began to unravel for Stoke last season after a drop to 13th place, foreshadowing their struggles this season. This was compounded by early exits in both domestic cups in a season to forget for the Midlands side.

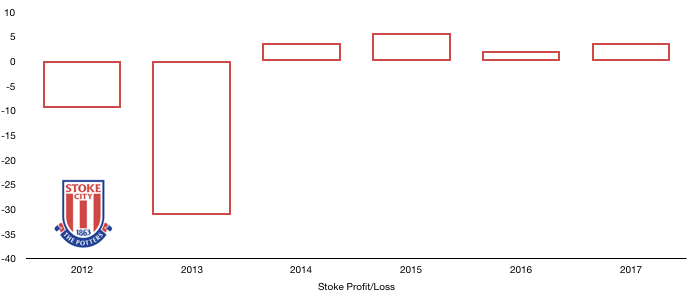

Despite this, their finances continued to improve albeit modestly, with profit up from £2.1m to £3.6m (71.4%) with moderate profits achieved for the fourth consecutive season.

Lets delve into the numbers.

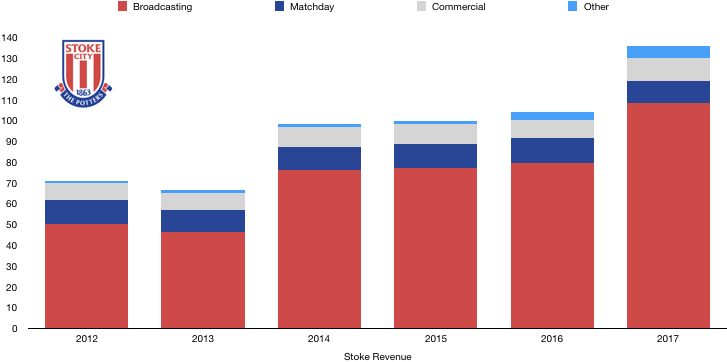

Revenue Analysis

Revenue rose to record levels, increasing from £104.1m to £135.9m despite a disappointing campaign, with growth in most areas of revenue.

Broadcasting revenue rose significantly due to the new Premier League TV Deal, increasing from £79.5m to £108.7m (36.7%) despite a lower league finish slightly taking a financial edge of these huge numbers.

Matchday revenue was the only area of revenue to fall, decreasing from £12m to £10.5m (12.5%) which will concern the club owners with less fans attending games, bored of the team after not only a lack of progression, but the regression they experienced last season. This decrease was compounded by the introduction of the away day ticket price cap of £30 which will reduce revenue from away days for all Premier League clubs.

More positively, commercial revenue was on the up, rising from £8.8m to £11m (25%) after a good commercial drive off the pitch, something the club will be hoping continues despite the real possibility of relegation.

Other revenue rose from £3.8m to £5.7m (50%).

Revenue is unfortunate likely to fall for Stoke next season after a miserable campaign that is looking more likelier by the day to end in relegation, such a season will inevitable lead to a drop in revenue from broadcasting while matchday and commercial revenue may also take a hit.

Relegation will also lead to a cliff edge drop in revenue the following season with the riches on offer in the EFL Championship in no way comparable to that in the Premier League.

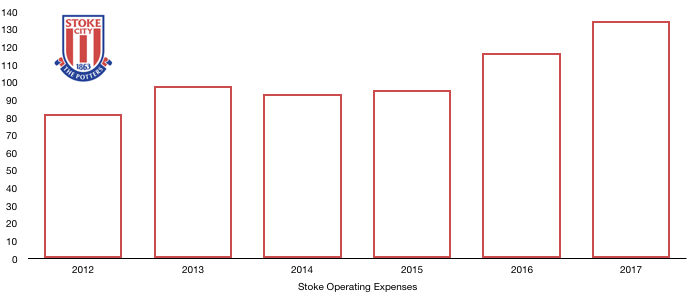

Expense Analysis

Stoke saw revenue increase to record levels, rising from £116.6m to £134.8m (16.0%) after significant player investment.

Amortisation costs, a key indicator of player investment costs, rose from £17.6m to £23.3m (32.4%) after player investment and little outgoings from the club.

The club also saw stadium and training facility leasing costs nearly doubling from £1.1m to £2.0m (81.2%) after rising prices.

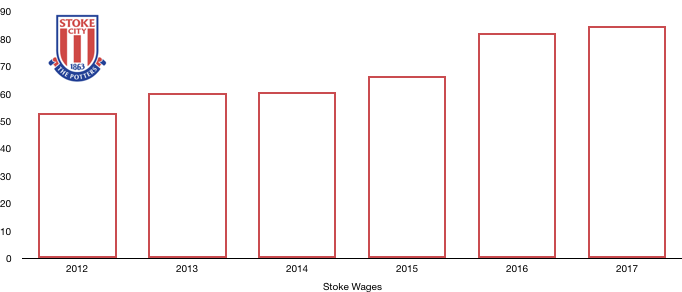

Wages stayed relatively stable despite player investment, increasing from £82.3m to £84.9m (3.2%) after the club managed to get a couple high earners of the books.

The club paid a tax bill of £1.4m, an effective tax rate of only 5.6%, with losses still available after a heavy loss of over £30m in 2013.

The club also have no finance costs with finance income of £41k.

Transfers Analysis

Stoke spent a fair bit last season, bringing in 6 players with only 2 leaving for transfer fees.

In came Allen (£14m), Berahino (£12.5m), Sobhi (£4.5m), Grant (£1.4m), Sweeney (£0.3m) and Bony on loan (£2.1m) for a combined £34.7m.

Leaving Stoke were Wilson (£2.1m) and Wollscheid on loan (£1.3m) for a combined £3.4m.

This led to a net outlay of £31.3m, an increase on the previous season’s £27.4m net outlay (14.2%).

The signings were a mixed success with Joe Allen, Sobhi and Grant all impressing in spells however Berahino and Bony failed to grab the goals to catapult the club to another top half finish.

Stoke made a profit on player disposal of only £3.7m competed to the £14.3m last season (74.1%) after a lack of departures.

Stoke spent £34.5m in cash this season on transfers compared to a huge £51.4m in the previous season while they also brought in less cash with only £3.9m reentering the coffers compared to last year’s £15.8m haul.

Stoke also have potential transfers fees payable of £7.1m, up from £3.2m last season after the clauses agreed for this year’s season.

Asset/Liability Analysis

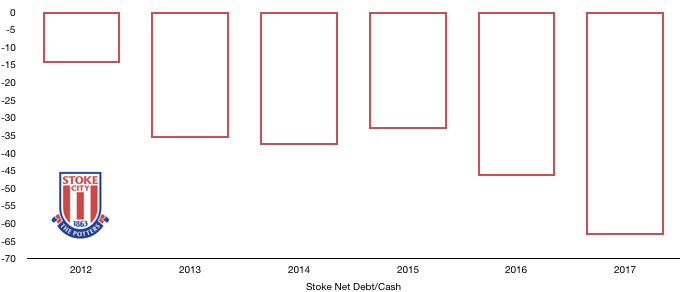

Stoke worryingly saw debt levels rise the season before potential relegation from the Premier League as Peter Coates attempted to revitalise the club.

Debt levels rose from £59.5m to £75.7m (27.2%), after new loans of £16.2m from the club’s owners, showing some commitment in sorting out Stoke’s current issues.

Cash levels experienced a slight drop, falling from £12.8m to £12.4m (3.1%) with the new loans making up for the smaller injection of cash from transfer fees.

This led to net debt rising to new heights, increasing from £46.7m to £63.3m (35.5%) which will worry with relegation potentially looming which may require another cash injection as costs tend to fall at a slower rate than revenue (parachute payments help here).

Thanks for reading, share with a Stoke fan!