Rotherham were relegated from the Championship in 2017 but secured an immediate return via the play-offs with the hope of a longer stay this time around.

Promotion was much needed as the club experienced a sizeable drop in revenue, however due to good financial management the club managed to cut costs and also reduce the loss experienced in the Championship, with Rotherham making a loss of a measly £0.5m this year, down from £1.2m the previous season.

Let’s delve into the numbers.

Revenue Analysis

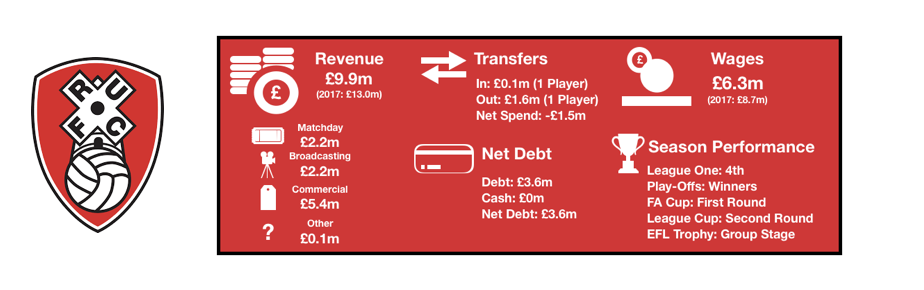

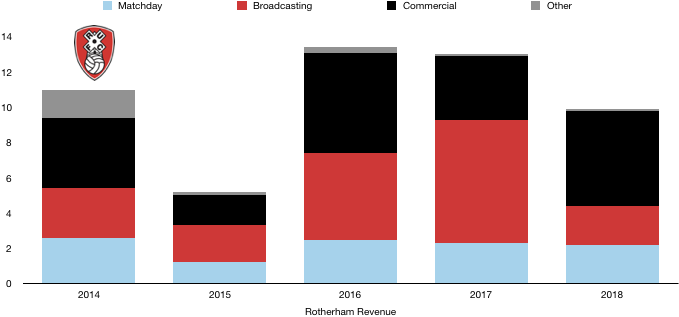

Relegation to League One saw revenue drop from £13.0m to £9.9m (24%) with the major reason being a drop-in prize money.

Matchday revenue stayed relatively stable however it did fall for the second successive season. Matchday income fell from £2.3m to £2.2m (4%) on the back of their fall back to League One. Rotherham will be hoping this increases slightly upon promotion.

Broadcasting revenue took a massive hit, more than halving from £7.0m to £2.2m (69%) as the club suffered from the effects of relegation. Their immediate return should see broadcasting revenue recover to these levels again fortunately.

Commercial revenue surprisingly increased, rising from £3.6m to £5.4m (50%) as their new flagship sponsor, ASD Lighting plc (who are a business of their owners) remained a sponsor of their stadium despite relegation, and much to the delight of the commercial team who did a great job of convincing their other key partners AESSEAL and Mears to remain as they plotted an immediate return to the Championship. Rotherham will look to enhance these relationships on their return to the Championship and build on this with new, lucrative deals.

The nature of their relationship with ASD means that they may be deemed to have artificially inflated their commercial revenue figure, this may have Financial Fair Play (FFP) implications if losses increase in future that push them close to the FFP thresholds. This isn’t a major concern currently as their finances (even without boosted commercial revenue) are well under control.

Other revenue remained at around £100k.

Looking ahead, promotion will see a sizeable rise in revenue for Rotherham. Matchday revenue and commercial revenue should see small rises while broadcasting revenue will more than triple to in excess of the £7m received in 2017.

Costs Analysis

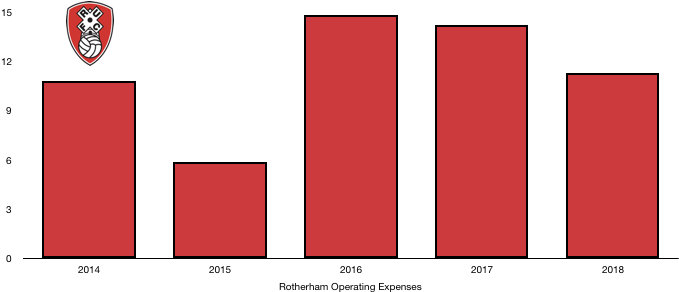

Rotherham did a good job of cutting costs following relegation in order to not let their finances spiral. Costs fell from £14.2m to £11.3m (20%) as the prudent club managed to reduce costs relatively in line with revenue, meaning profitability was not greatly affected.

Amortisation remained relatively stable at £0.5m as the club reduced investment slightly due to relegation. The club have relatively low levels of amortisation having historically not spent a great deal in the transfer market.

The club also saw a reduction in lease costs, which fell from £1.2m to £1.0m (17%). The leases are from R U Estates Limited which is owned by their owners, hence the slight fall.

Rotherham paid no taxes due to their loss-making status and had no finance costs.

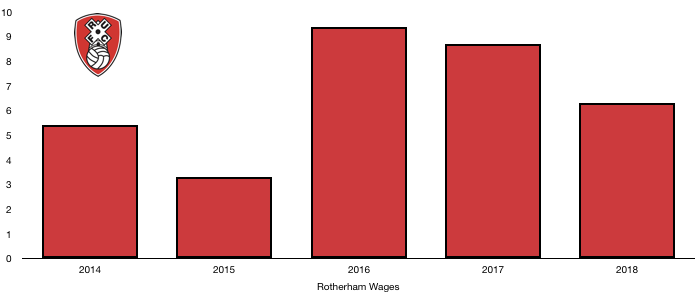

Wages were the big fallers as Rotherham cut wages from £8.7m to £6.3m (28%) on the back of relegation as relegation wage drop clauses came into effect and high-earners departed the club.

The wage drop is the equivalent of a reduction of a modest £46k a week, but a sizeable reduction for Rotherham.

Directors of Rotherham saw their pay increase from £350k to £469k (34%) despite relegation. These directors were also paid by ASD Lighting and hence did not affect the finances of Rotherham a great deal.

Transfer Analysis

Rotherham had a busy summer in the transfer market, however the majority of deals were on free transfers with one player joining and one departing for transfer fees.

In came Jamie Procter for around £0.1m and out went Danny Ward for £1.6m, giving Rotherham a net transfer income for £1.5m after a net spend of £1.3m last year.

Rotherham did well in the transfer market on a shoestring budget by achieving promotion and will be hoping they can repeat the trick this year after not spending a dime in the Championship.

The club managed to record an accounting profit on the sale of Danny Ward of £0.8m after his two and half year stay in Rotherham.

Rotherham had to spend cash of £0.3m of cash for transfers due to instalments due on previous signings. However, they received £0.8m from clubs (most likely Cardiff) for transfers.

The Millers are also owed a further £949k in transfer fees which will be well received as they also owe a further £859k themselves. This shouldn’t be a concern due to the amounts involved and that they are still, on a net basis, owed £90k.

There are minimal contingent transfer fees (£36k) within the club.

Debt Analysis

Rotherham have always been a financial well-run club, built for sustainability. This has meant debt levels are low, however with most clubs at their level, all the cash reserves are needed to compete.

The Millers ended the year with minimal cash (in their overdraft by £41k), down from £0.3m last year. The slight fall was mainly down to another year of losses and the £0.3m paid in transfer fees.

Debt levels fell from £3.9m to £3.6m (8%) as some debt was paid down to their owners.

This meant net debt remained stable at £3.6m as the two effects cancelled each other out.

There is not much to report on Rotherham’s debt levels as the club is financially stable and should be for the foreseeable future unless their owners lose interest in the club which seems unlikely. Despite their financially stability it is worth noting their finances are dependant on their owner’s company ASD lighting who plunge money into the club through commercial revenue and also charge the club leasing costs which may or may not be on commercial terms (although it is stated they are). Should this relationship change in anyway, it may have a significant effect on their finances.

Thanks for reading – Share with a Miller!