QPR endured their second successive year back in the Championship following relegation from the Premier League. It was a poor season for the West London club as they looked to re-acclimatise to the Championship with Jimmy Floyd Hasselbaink, however things did not go to plan and the club flirted with relegation before Ian Holloway steered them clear of the drop zone after taking over as manager.

A poor season led to yet another year of losses as they recorded a loss of £6.4m, however they continue to edge closer to breaking even after their recent financial troubles.

Revenue Analysis

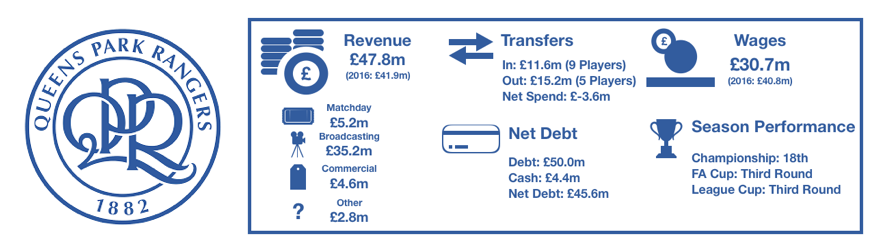

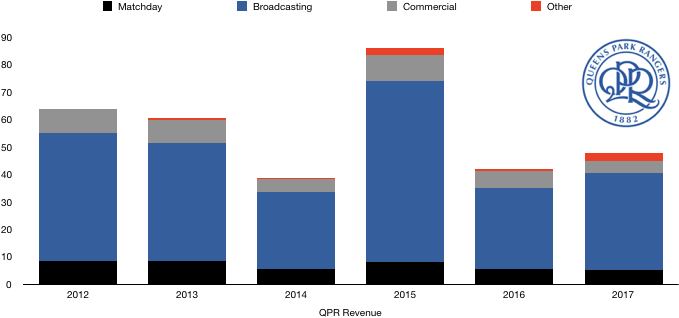

QPR saw revenue rise despite a disappointing campaign, increasing from £41.9m to £48.0m (14.6%) as the club indirectly benefitted from the increased TV deal.

Matchday revenue fell slightly from £5.5m to £5.2m (5.5%) as fans began to desert the stadium following relegation with revenue per game falling from £239k to £226k since their relegation.

Commercial revenue continued to fall, dropping from £6.3m to £4.7m (34%) as the loss of their Premier League status continues to affect QPR commercially and financially with the commercial team unable to replace the sponsors leaving with deals of similar stature. QPR have also suffered from lower merchandise sales.

Broadcasting revenue rose despite a lower Championship finish, rising from £29.6m to £35.3m (19.3%) on the back of the increased Premier League deal feeding through to their parachute payments, increasing their income.

Other income rose from £0.5m to £2.8m.

QPR are likely to see revenue fall next season as parachute payments drop. This will be offset slightly by a higher league finish however with commercial and matchday revenue likely to stay relatively stable meaning revenue will drop, likely to around the £43m mark.

Expense Analysis

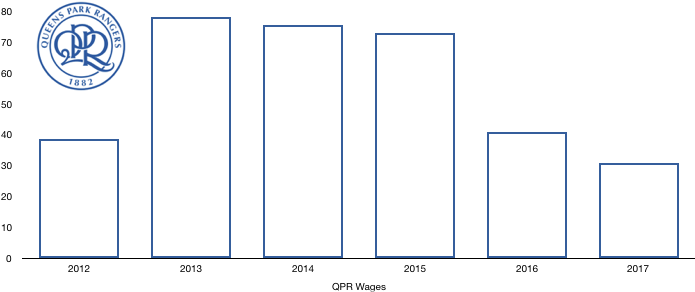

QPR saw expenses drop once again as they looked to get their finances under control, decreasing from £63.1m to £56.0m (11.3%), continuing a three-year downward trajectory if falling costs as they acclimatise to life back into the Championship and the lower financial rewards on offer.

Amortisation costs rose from £10.1m to £11.3m (11.9%) after player investment grew slightly after severely cutting costs last year after relegation.

Finances costs more than doubled from £2.4m to £5.7m (138%) as QPR saw an increase in interest payments on loans from their owners as their repayments became due with Tiny Fernandes being more confident on their financial health in repaying these.

Lease costs remained relatively stable at £0.6m on the costs of leasing their training facilities and Loftus Road.

Wages dropped from £40.8m to £30.7m (24.8%) despite player investment as more high earners departed the club following relegation as QPR finally get their finances under control and beginning to live within their means. This wage drop works out at 194k less a week on wages.

QPR management saw a slight wage bump despite a poor season from £1,496k to £1,518k (1.5%).

Tax was minimal after another year of losses.

Transfers Analysis

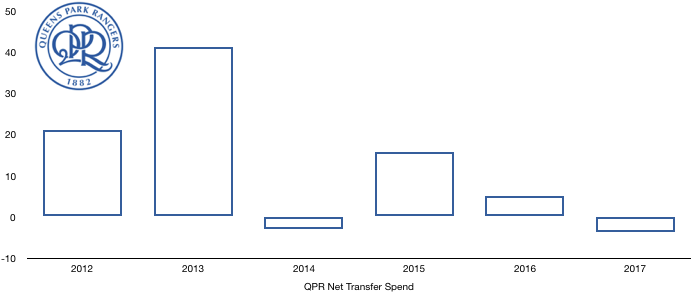

QPR saw significant transfer activity with 9 players incoming and 5 leaving with over £25m changing hands.

In came Sylla (£2.7m), Wszolek (£1.8m), Borysiuk (£1.6m), Bidwell (£1.4m), Cousins (£1.4m), Lynch (£1.3m), Goss (£0.5m), Smith (£0.5m) and Freeman (£0.3m) for a combined £11.6m.

Out went Phillips (£5.9m), Fer (£5.0m), Chery (£2.4m), Polter (£1.4m) and Kpekawa (£0.5m) for a combined £15.2m.

This put QPR in a net income position of £3.6m compared to a net spend of £5.1m last year, making this the third year of falling spending as they balance the books.

QPR led with the strategy of replacing high earners with lower wages as Fer and Phillips left however this strategy reaped no further rewards than better finances as their new recruits failed to achieve anything of note.

QPR made an accounting profit on player sales of £7.3m after the notable sales of Phillips and Fer.

QPR are also owed £4.9m in transfers while they only owe £4.2m themselves, putting them in a healthy position in this respect. QPR also have no contingent transfer fees which gives them some financial certainty when dealing in the transfer market.

QPR paid out cash of £19.7m during the year on transfers, including those from previous years that was due in instalments while they only received £11.9m leading to a net cash outlay of £7.8m despite having a net transfer income this year as past transfer windows continue to bite the club financially. However, with the majority of these now paid, the club should be in a position to spend again.

Assets/Liabilities Analysis

QPR saw debt levels rise after a huge reduction following relegation where Tony Fernandes and Ruben Gnanlingan effectively wrote off nearly £150m in loans owed to them which can now only be paid should he sale his shares.

Cash levels dropped from £7.4m to £4.4m (40.5%) due in part to the significant transfer fees paid out this year as well as another loss-making year. This was supplemented by new loans of £4.8m while the club also spent £0.9m on club infrastructure.

Debt levels rose from £46.9m to £50m (6.7%) on the back of those new loans of £4.8m as the club paid of bank debt and were handed more money by their owners to steady the ship as QPR looked to become more sustainable after the excess spending previously from their rash owners. The new funds came from their majority owner Ruben Gnanlingan.

The club is also appealing a Financial Fair Play (FFP) fine that directors expect to be overturned which may boost their finances slightly.

Net debt hence rose from £39.5m to £45.6m (15.4%) as their finances worsened slightly, however as they get their costs under control this may improve unless QPR decide to roll the dice once more to gain a quick return to the Premier League.

Thanks for reading – Share with a QPR fan!