Scottish Champions Celtic are interested in purchasing an Australian top flight club, with Brisbane Roar and Central Coast Mariners both mooted as possible targets. The move signals a change in business strategy for Celtic as they look to build their global presence by investing in Australia and gaining first-option on any bright young players to come out of the club they acquire.

Celtic are rumoured to be looking at business and investment opportunities in Australian football with Celtic representatives recently travelling to Australia to visit the Central Coast Mariner’s new training centre, a potential target should they make a move. Central Coast is also a former club of Celtic player Tom Rojic, who Celtic brought the player from in 2013, so there is an existing relationship that could provide the foundations for talks.

Central Coast Mariner’s coach confirmed the interest, he stated: “I haven’t personally spoken to anyone at Celtic, that’s been handled by Shaun Mielekamp (CEO) and Kathy Duncan (CFO).”

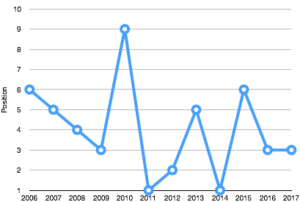

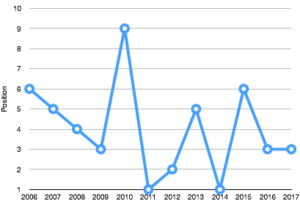

Central Coast are having a troubling period in the league finishing 8th twice and 10th in the 10 team league. This was after a good spell, finishing 3rd or higher in the 4 seasons prior to this recent dip. The recent dip may be good news for Celtic, making now a great time to buy the troubled team and there is potential if you look at their previous form. They are currently 5th this season as they look to put the last 3 seasons behind them.

The team has had success with high profile players, with former Crystal Palace Captain Miles Jedinak coming through the Central Coast ranks. Brighton Goalkeeper Matthew Ryan is another, as is Celtic’s Tom Rojic. Their most lucrative player was an unknown winger Roystyn Griffiths, who joined a Chinese team for around £1m. The last couple of years have seen little transfer activity for the team outside of Australia, with no monetary purchases or sales in the last year.

Another potential target is Brisbane Roar, whose future under their current ownership is under threat. The owners, Indonesian-Bakrie Group are dealing with financial difficulties, and the club was nearly wound down after threats by the Australian F.A. in 2015.

Brisbane Roar have been doing well in recent years, winning the league in 2014 and finishing 3rd in the last two seasons. However this season has taken a turn for the worse in light of their recent financial difficulties, they languish 8th in the table and will hope to turn things around quickly. Such poor league form, combined with their already poor financial situation, make the team a good proposition to buy cheaply.

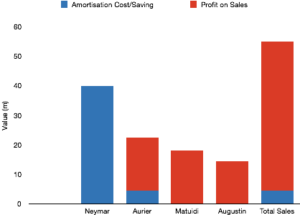

The team seems to have more talent coming through then Central Coast recently, with promising players moving to Europe in each of the last 4 seasons, bring in around £600k in profit. However their players have not had as much high-profile success in Europe as Central Coast. Tommy Oar, a left winger, played over a 100 games for Dutch side Utrecht and Micheal Theo had a spell at Burnley.

The interest in these clubs is in light of a potential new operating model in the A-League which is set to give clubs more autonomy in their dealings. However the deal failed to pass through Congress this week, meaning further uncertainty around the position of A-League clubs. FIFA are to work with the Australian FA to try and find a resolution, and may even end up taking over the operation of Australian football which could cause huge changes. Such news may delay formalisation of any bids for Australian clubs by Celtic and other interested European teams.

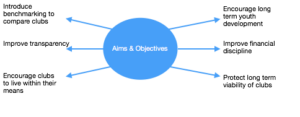

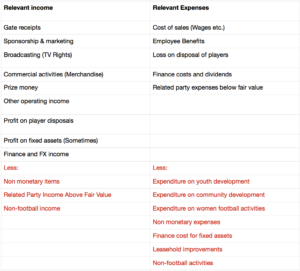

Celtic are in desperate need to grow commercially, with the Scottish Champions having exhausted all possible commercial streams in Scotland. Rangers are yet to provide any such competition to elevate Scottish football, meaning any increases in TV revenue are unlikely to be of any help if they wish to remain competitive in Europe, where their financial success comes from.he current TV deal, which has two years still to run, sees Scotland below the likes of to the Poland, Norway, Sweden and Denmark in terms of TV money.

A potential move to the Premier League was sought after, however the chances of that happening are remote.

Australian football is a relatively untapped market with Manchester City’s owners acquiring Melbourne City in 2014, helping to build their brand over in Australia to increase sponsorship deals and other commercial offerings. Australia are also 39th in the FIFA world ranking and will once again be at the World Cup in 2018, showing their ability on the pitch. Manchester City have already found success here, having sold Aaron Mooy to Huddersfield for £8.2m. City Group brought Melbourne City for around £12m, so this one transfer represents around a 75% return on their capital from that one transfer alone!

There is also huge potential to build brand exposure in the growing market. The A-League recently signed a TV rights deal with BT, representing a chance to increase viewership of Australian football, which will only be enhanced by a good World Cup showing.

Investment wise, increasing TV deals mean there is the potential to realise a share in any revenue growth which seems likely. The A-League agreed a deal with ESPN in Australia worth around £30-£35m a year until 2023, and although it is tiny in comparison to the Premier League, the size of investment required is also relatively smaller. There has been issues however surrounding the distribution of the TV revenue, with A-League clubs dissatisfied with the current arrangement. The TV rights have room to grow with it being dwarfed by the TV deals for Australian football (American football) and rugby.