2018 was the first full year of new ownership for Nottingham Forest under Mr Marinakis and Mr Kominakis. However, it was another disappointing season with relegation always in the background as the club finished 17th.

After a period of bedding in and rebuilding, Nottingham Forest will hope that the significant investment made in the club will come good and see the club make its long-awaited return to the Premier League.

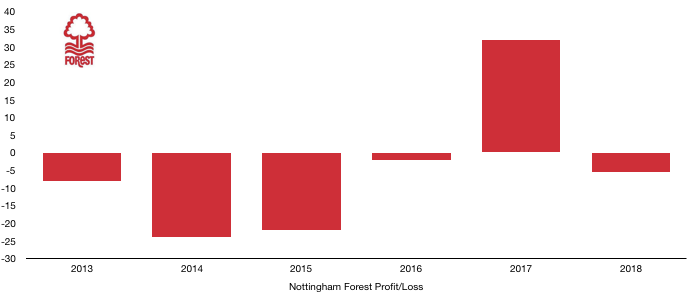

The investment made by the club had an immediate negative effect on their short term finances, as the club recorded a loss of £5.6m, a huge swing when taking into account a profit of £32.1m was recorded the previous season (although this was solely due to the write off of a loan that the club no longer had to pay, thus their loss excluding this amount actually shrunk).

Let’s delve into the numbers.

Revenue Analysis

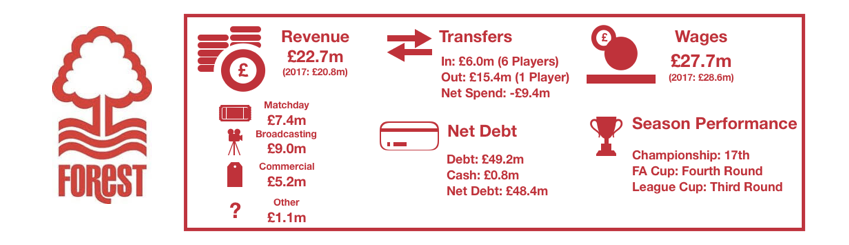

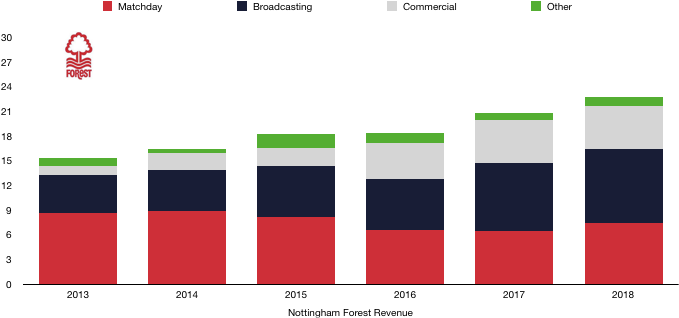

Nottingham Forest saw revenue rise from £20.8m to £22.7m (9%) after a strong rise in matchday earnings.

Matchday revenue rose from £6.5m to £7.4m (14%), which was largely down to an increase in season ticket sales and high-profile domestic cup games against Arsenal (won 4-2) and Chelsea (lost 5-1) which featured very different outcomes. The high-profile cup games are just by chance so cannot be relied upon, however, with new found optimism around the club, Nottingham Forest will hope to be able to increase attendances further and enhance matchday revenue.

Broadcasting revenue rose from £8.2m to £9.0m (10%) after finishing a league place higher and the after mentioned high profile cup draws which had a strong impact on their revenue.

Commercial revenue disappointingly remained stable at £5.2m. Nottingham Forest will be hoping to drive increased commercial revenue in the coming years by revitalising the club and exploiting the commercial value of their huge fan base.

It is worth noting that Nottingham Forest increased revenue with the assistance of strong growth in catering (19%) and retail (8%).

Other revenue increased from £0.9m to £1.1m (22%).

Looking ahead, Nottingham Forest should see a rise in revenue this year. Performances at the club are improving and hence the stadium is getting fuller and as such matchday revenue will rise. A higher league finish will increase broadcasting revenue; however, this may be set off by the lack of marquee ties in this year’s domestic cups. Nottingham Forest will be hoping their commercial team has managed to bring in new sponsors that will boost this area of revenue.

Cost Analysis

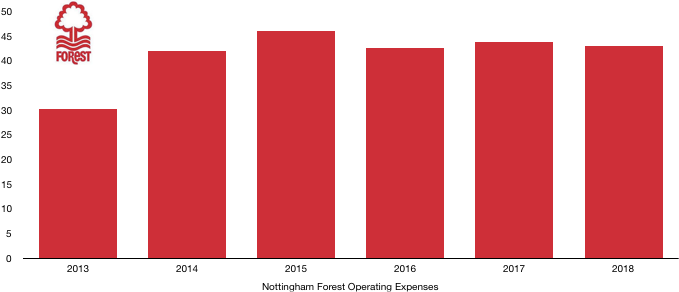

Despite the increasing investment in the club, Nottingham Forest have reduced their costs slightly this year as their owners looked to control costs for future growth. Costs fell from £43.8m to £43.0m (2%).

Amortisation rose significantly, increasing from £2.0m to £3.2m (60%), signifying a huge increase in investment under their new owners in players (despite a negative net spend as Assombalonga was brought cheap and as such, attracted low amortisation).

Interest expenses increased from £25k to £325k as the club took out new, interest bearing loans.

The club also had loans owed to their owners of £5.0m written off in a similar way to last year’s £40.4m, so Nottingham have a further £5.0m of loans they no longer have to repay.

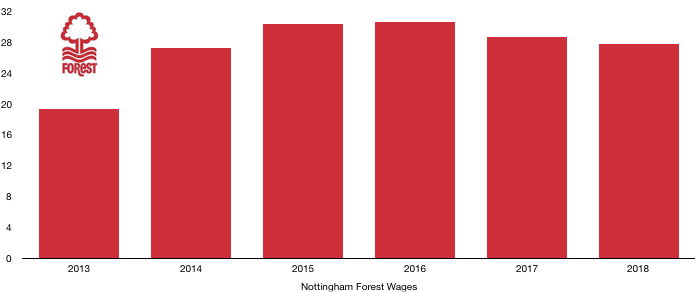

Nottingham Forest saw a slight deduction in wages as the owners exercised significant restraint in this regard, as wages fell from £28.6m to £27.7m (3%) after the club signed new players under a strict wage budget and let go of a couple of high earners.

The wage drop is minimal in context and works out at only £17k a week.

Interestingly, directors are the big winners under the new owners as their pay increased from £315k to £777k (147%).

Looking ahead, following a significant increase in investment, costs will rise next year as both wages and amortisation grow after a net spend in 2018/19 of £23.6m.

Transfers Analysis

Nottingham Forest were prudent in the transfer market last year, spending less than halve of the windfall earned from the sale of Assombalonga.

In came Murphy (£2.1m), Cummings (£1.0m), Bridcutt (£1.0m), Darikwa (£1.0m), McKay (£0.8m) and Figueiredo (Loan – £0.2m) for a combined total of £6.0m.

The only departure was of course the high-profile sale of Assombalonga to Middlesbrough for £15.4m.

This led to a negative net spend of £9.4m, the third successive year this had happened.

The sale of Assombalonga was healthy for their finances as the club recorded a profit on player sales of £10.1m, down however on last year’s £14.7m.

In terms of cash, Nottingham Forest spent cash of £4.8m on transfers and surprisingly only received £4.5m as Middlesbrough managed to negotiate favourable payment terms on the transfer of Assombalonga.

This does however mean that they are owed a further £10.3m of which £5.0m is due this year.

Nottingham Forest in contrast only owe £4.5m, of which £2.8m must be paid this year. This means net, the club are owed £5.8m which is a good position to be in.

The club do however also have contingent transfer/contract fees of £3.9m which may become payable if certain clauses are met.

Debt Analysis

Nottingham Forest have historically had high levels of debt within the club. However, following the introduction of their new owners, this has begun to fall after they wrote off a huge £40m of debt last year (and a further £5m this year).

Cash levels are low, as with almost all Championship clubs, with all their cash needed to be competitive in the Championship. Cash levels did however double from £0.4m to £0.8m on the back of the Assombalonga transfer, and new loans totalling £12.8m.

Debt levels did rise, increasing from £45.3m to £49.2m (9%) as the club wrote off £5m in loans but took out a further £12.8m in loans, being mainly external debt, hence the rise in interest costs.

Net debt hence rose from £48.4m to £44.9m (8%) as the increased cash slightly offset the rising debt, although the rise in debt is relatively low.

It will be interesting to see if, following the debt waivers, the owners decide to increase debt levels again by pumping more money into the club or if he looks to finance from within. It seems the club may decide to go for broke under this owner who may decide to put his money where his mouth is in a bid to secure promotion which was suggested by the club’s transfer activity this season.

Fans should hope he chooses to invest himself as the introduction of more external debt will put pressure on the club should they over-leverage which may come back to haunt them.

Thanks for reading – share with a Forest fan!