As a publicly listed company in America, Manchester United are required to report their financial performance every 3 months, with an annual financial performance review in the final quarter of their financial year. This article will look at the financial performance this quarter of the Manchester club.

Season Review to date

Manchester United have enjoyed a mixed start to the season. Like all of the Premier League big boys, they have failed to keep up with the irresistible leader Manchester City, which means another season without a Premier League for the once dominant force of the division.

Other than that obvious disappointment the season has been efficient to say the least, easing their way to the knockout rounds of the Champions League and placing themselves comfortably (ish) in the Premier League top 4 in second place. A shock loss in the League Cup to Championship Bristol City robbed Manchester United of an early trophy and a face-off with Manchester City, however a strong showing in the second half of the season will hide this embarrassment.

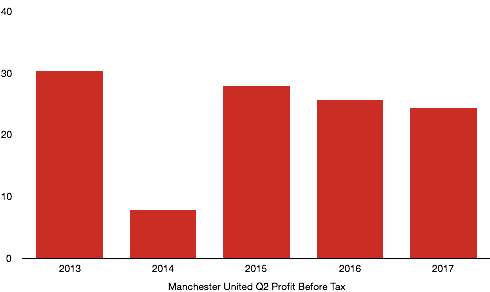

Manchester United disappointingly saw profits before tax fall 4.7% to £24.4m. Rising expenses outweighed increasing revenues due to rising wages and player amortisation costs. A large tax bill due to the US tax reform changes caused some accounting hocus pocus, leading to a loss after tax of £29.1m, despite recording a £17.5m profit after tax for this period last season.

A return to Champions League will be of great viewing to the club with the increased revenue already apparent this early into the season with the extra broadcasting revenue significantly contributing to a 4% increase on last years second quarter revenues.

Revenue Analysis

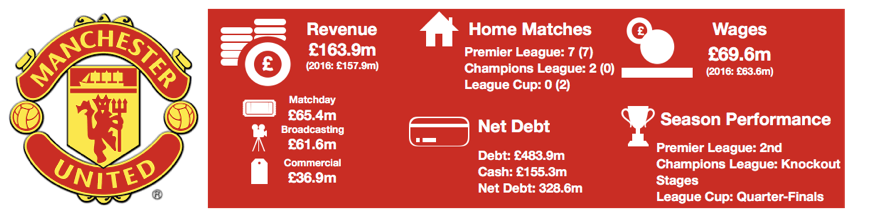

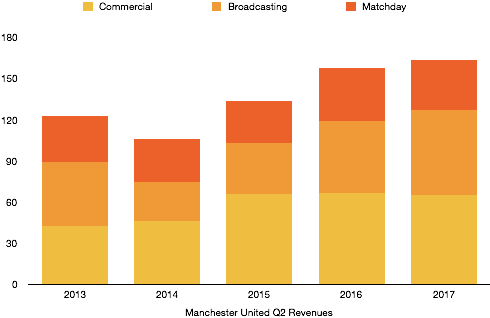

Revenue rose 4% on last years figures to £163.9m, leading to an expectation of revenue for the year of between £575m and £585m, a huge figure.

This rise was largely due to increased broadcasting revenue (up 17%) derived from a return to the Champions League and two more Premier League live games than last season than at this stage last season, something that will be smoothed out over the second half of the season.

The rising broadcasting fees received from the Premier League continue to see clubs breaking their previous broadcasting revenues year on year and Manchester United are no different.

Commercial revenue is down 2.1% for the quarter to £61.6m with the signing of Melitta as Manchester United’s official coffee partner being the only highlight over the last 3 months.

Matchday revenue fell 4.4% to £36.9m due to receiving no home draws in the two games they played in the League Cup this quarter, highlighting the importance of the luck of the draw as last year they had two home ties.

Expenses Analysis

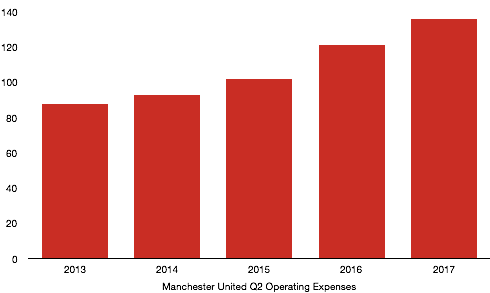

Operating expenses growth outstripped revenue growth as expenses grew 12.4% to £136.2m.

Operating expenses have grown year on year as Manchester United continue to strive towards a return to their glory days under Sir Alex Ferguson.

Staff costs contributed significantly to this figure, increasing 9.4% to £69.6m, largely due to Champions League participation bonuses to players that were part of their contracts. The wages of new signings Lukaku, Matic and Lindelof would have also contributed to this increase. Overall staff numbers were also on the up by 10%, increasing to 923 staff members.

Amortisation of player contracts increased 9.1% to £37.3m due to the above mentioned new signings, while other expenses increased by 4.7% to £26.5m in what proves to have been an expensive period for the club.

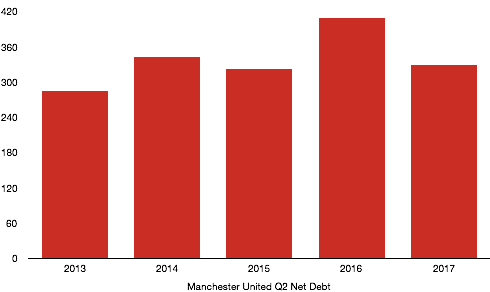

Debt Analysis

Debt levels were down an astonishing 20% to £328.6m from a record high of £409.6m, as the club begin to pay off their outstanding debt helped by favourable currency movements in the Pound against the US Dollar.

Currency movement has contributed to fluctuations in net debt levels over the years with the net debt levels fluctuations around an average of about £340m since 2012.

The currency movement led to a remarkable fall of 64.2% in financing costs of Manchester United’s US debt to £4.3m, a decrease of £7.7m.

The net debt position was improved further by an increase of 26.6% in their cash position to £155.3m. It is worth noting their cash position in June was significantly better, with cash reserves of £290.3m which would of been used for transfer purchases, debt repayments and other expenses in the close season.