Leicester City were always going to see a dip on the pitch after their momentous Premier winning campaign, however few would have thought that Ranieri would be gone within 12 months of lifting the Premier League with the club facing the real possibility of relegation.

However that is where they found themselves and the owners made the ruthless change required to lead the club to 12th and the Champions League Quarter-Finals, the last English team left in last years competition.

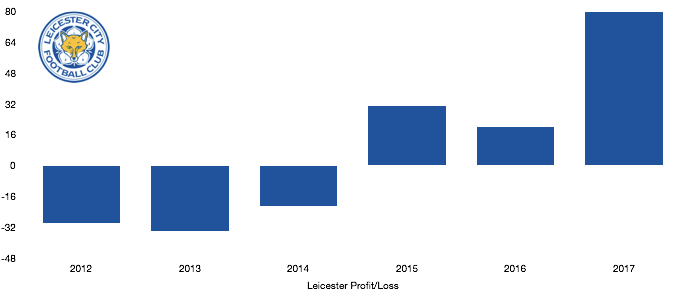

Off the pitch, Leicester realised the full benefit of THAT season with the added Champions League revenue leading the club to a £92.5m profit before tax, potentially the largest in Premier League history.

This article analyses this fascinating financial result.

Revenue Analysis

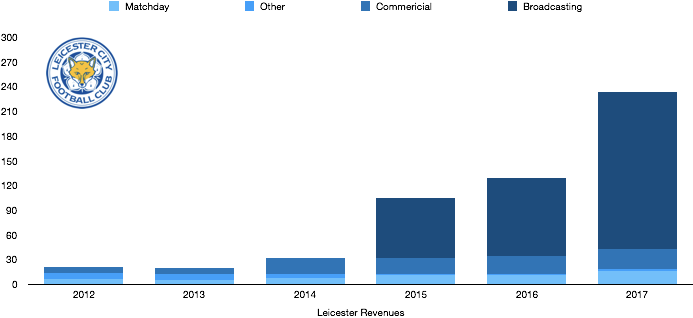

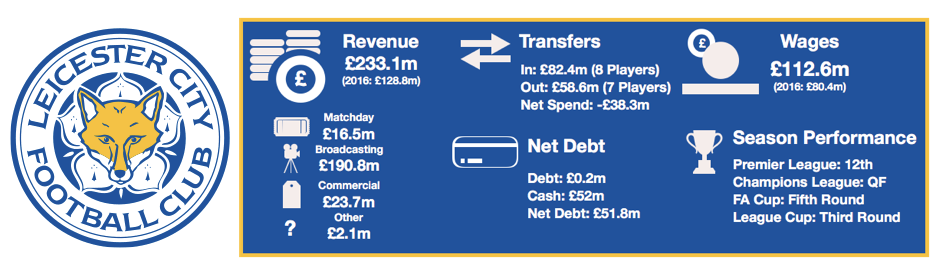

Revenue rose a spectacular 81% to £233.1m from £128.8m, an increase of over £100m.

Matchday Revenue rose to £16.5m from £11.6m (42%) as the club benefited from more games due to the Champions League and higher ticket prices in the Premier League.

Commercial revenue grew modestly from £21.6m to £23.7m (9.7%) as the club continue to battle for commercial revenue in order to exploit the Premier League title win, however they look to have run out of time on that and may see this as a missed opportunity.

Broadcasting revenue more than doubled in an extraordinary campaign, rising from £94.7m to 190.8m (101.3%) as Leicester experienced the perfect storm due to their Champions League money and the rising Premier League TV deal.

Leicester banked a huge £70.1m from their Champions League adventure, representing 30% of their total revenue, while Premier League broadcasting revenue rose despite finishing 11 places lower this season, rising from £94.7m to £120.7m (27.5%).

Leicester have acknowledged that revenue will fall dramatically next year without Champions League revenue, with both Broadcasting and Matchday revenue vulnerable. However they will be hoping to drive revenue with added commercial success, while they should recoup a few million as they look set to improve on last year’s 12th place finish.

Expenses Analysis

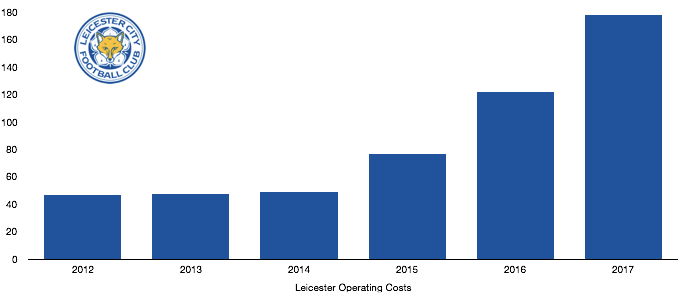

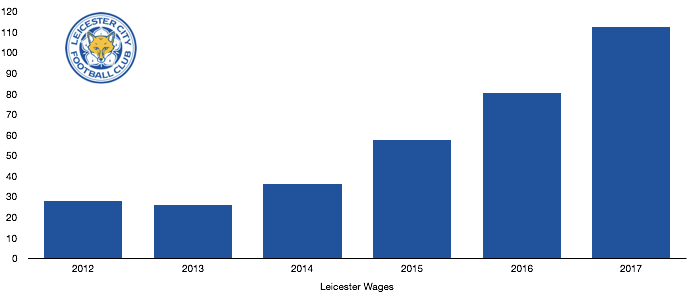

Expense grew significantly too, rising by 46.5% from £121.5m to £178m. This was largely due to rises in wages and amortisation costs as the club rewarded their stars and brought new ones.

Wages played a large part in this due to investment in new players (more in next section) and new contracts for their Premier League winners leading to a 40% increase in wage costs to £112.6m. The increase represents an astonishing £619k a week extra in wages.

Amortisation costs also rose significantly on the back of player investments, increasing 64% to £29.7m.

The club also had exceptional costs of £3.1m after receiving a fine from the EFL for a Financial Fair Play breach in the 2013/14 season. The club misunderstood the rules and have been punished for that, however the club have been relieved of any intentional wrongdoing.

Net interest expense rose 10% to £2.3m however this amount is minimal in the grand scheme of things.

With their high profit, tax would be due. The club have made profit for three consecutive years and have therefore used much of their losses and therefore paid a tax bill of £12.5m, representing a tax rate of 13.5% compared to the actual rate of 19%.

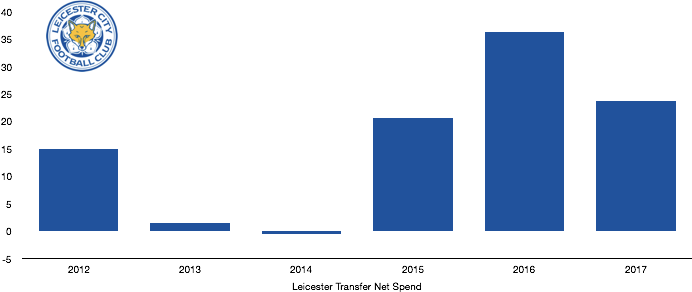

Transfer Analysis

The club spent significantly this season to prepare for having Champions League football while also facing Premier League games three days later.

In came 8 players for £82.4m:

Slimani (£27.5m), Musa (£17.6m), Ndidi (£15.8m), Mendy (£14m), Kaputska (£4.5m), Zieler (£3.2m) while Luis Hernandez and Wague joined on a bosman and loan respectively.

Off the signings only Ndidi has impressed with many of the rest no longer with the club or out on loan.

With the players joining the club, a massive hole could not be filled as Kante left for Chelsea for £32.2m with Leicester not being the same without him.

Joining him were Schlupp (£12.4m), Kramaric (£9m), De Laet (£1.8m), Moore (£1m) while Inler left on a free transfer and Schwarzer retired.

This led to a net spend of £23.8m, down 34.6% on last year despite the record revenues the club was expecting to received with the owners being prudent with the club’s new found riches.

Contributing significantly to the club’s high profit was a huge increase in profit on player disposal, increasing 259% to £38.8m due mainly to the huge profits realised on Kante and Schlupp.

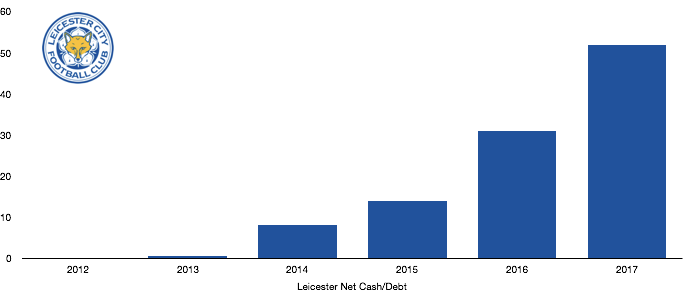

Asset/Liabilities Analysis

Leicester are a cash rich club as of late and have yet again reached new levels of cash in the bank after a 67.2% increase to £52m.

The club also has minimal debt of £0.2m and are an example to many mid table Premier League clubs on the sustainable running of a football club, with relegation less of a worry financially than their rivals. This makes their FFP fine even more ironic despite its accuracy.

This has led to the club having a net cash position of £51.8m which will delight owners, however fans will be hoping this is reinvested into transfers so the club can become a continual top half side.

Brilliant article for a brilliant club !