Hull City were back in the big time, securing promotion back to the Premier League at the first attempt. They did not however learn from their previous relegation, with their lack of financial power making relegation almost inevitable, especially after the shock pre-season resignation of Steve Bruce. The late appointment of Marco Silva gave the club some hope, however this was not enough to prevent a return to the Championship.

A run to the League Cup Semi-Finals was a high note of the campaign while financially it was a great year, with profits rising to a record £34.8m after a loss in their only season back in the Championship of £20.7m, further highlighting the riches available at England’s top table.

Let’s delve into the numbers.

Revenue Analysis

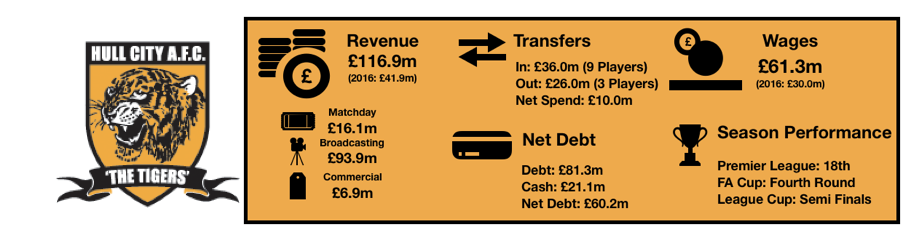

Returning to the Premier League pays, with Hull seeing revenue nearly triple from £41.9m to £116.9m (179%) on their return with huge increases in all areas of revenue.

The most vital increase was broadcasting revenue, more than tripling from £29.7m to £93.9m (216%) on the back of a huge uplift in TV payments as part of the new Premier League TV deal. This is even after considering the parachute payments received last year after relegation. The club also benefitted from their heroic League Cup run that further increased broadcasting revenue.

Matchday revenue surprisingly rose a huge amount, increasing from £9.2m to £16.1m (75%) on the back of fan excitement for a return to the Premier League. Ticket price increases plus fuller stadiums were apparent as fans flocked back to the stadium after promotion, whist their League Cup run also meant more home games in that competition than usual.

Commercial revenue more than doubled, increasing from a measly £3.0m to £6.9m (130%) as the club exploited its brief Premier League return successfully. The club will be hoping to keep some of these sponsors for next year, however a disappointing Championship season will make this very difficult.

Hull are going to see another huge drop in revenue next season after relegation, compounded by a poor Championship season where the club finished 18th in the Championship, the same position they finished in the Premier League last season. The club will see their plummeting revenue offset slightly by parachute payments with revenue likely to be around the £40m mark, a huge 65% drop.

Expense Analysis

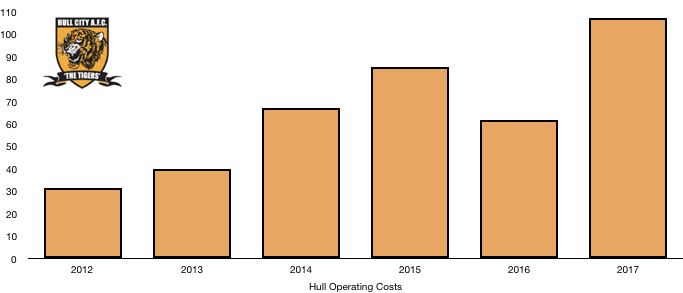

Hull’s expenses soared after promotion, rising from £61.8m to £107.5m (73.9%) as the club attempted to compete financially to survive.

Amortisation costs rose significantly, increasing from £20.7m to £32.6m (57.5%) showcasing some player investment but not enough on a club’s Premier League return, indicating a conservative approach as they looked for a sustainable solution to Premier League survival.

The club also paid £690k to lease their KC Stadium home, an increase of £68k on last season as prices rice.

Hull saw a slight increase in interest costs, rising from £3.9m to £4.3m (10.3%) due to their relatively high debt levels that goes some way to explain their prudent financial approach as of late.

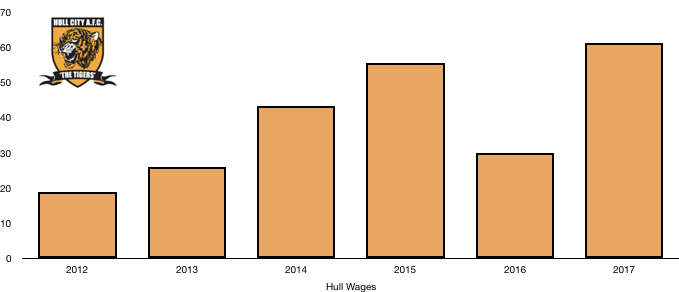

Wages more than doubled from £30.0m to £61.3m (104%) on the back of compulsory wage uplifts on existing players who the majority of would have had promotion wage rises locked into their contracts. The club also would have seen wages increase after incoming players demanded high wages from the new Premier League club. This huge wage increase represents an astonishing £602k a week extra on what the club were paying players last year.

Hull had a low tax bill this year after utilising some of last year’s losses to reduce the amount of tax payable. Hull paid a measly £0.9m in tax representing a 2.5% effective tax rate.

Hull will expect expenses to fall as relegation wage drop clauses come into effect while players were sold reducing the wage bill even further whilst also reducing amortisation costs. A drop of over 50% is very possible as the club reacclimatise to the Championship.

Transfers Analysis

Hull went for quantity in the summer when quality was what was needed. However, with the purse strings tightly held by the owners, Hull brought in 9 players while only 3 departed to try and compete.

In came Mason (£13.9m), Grosicki (£8.1m), Henriksen (£4.8m), Marshall (£3.7m), Evandro (£2.3m), Keane (£1.1m) and Weir (£0.2m) while Ranocchia (£1.2m) and Elabdellaoui (£0.9m) both arrived on season long loan deals. This came in at moderate transfer outlay of £36.0m.

Out went Snodgrass (£10.8m), Livermore (£10.4m) and Diame (£4.9m) for a combined total of £26.0m.

This meant Hull had a prudent £10.0m net transfer spend on their Premier League return, this was still a significant increase on the £21.3m in net transfer income Hull received after relegation.

Hull’s signings did okay, none were ground-breaking successes and neither were any resounding flops considering prices and expectations – you get what you pay for.

Hull spent cash in the year on transfers of £32.4m compared to £9.9m last year. They also brought in cash of £33.3m compared to £19.8m after the significant sales of last season began to pay the cash they owed. This interestingly shows that Hull brought in more cash on players then they spent, showcasing a lack of ambition to stay in the Premier League.

Hull made a huge profit on player disposals as this figure rose from £13.0m to £29.9m (130%) after the transfers of Snodgrass, Livermore and Diame.

Hull also have potential contingent transfer fees payable of £3.2m, whilst they still owe £6m for previous transfers and are owed a chunky £15m.

Asset/Liability Analysis

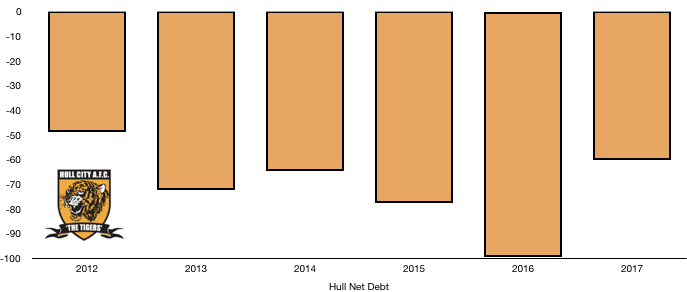

Keeping with Hull’s theme for the year is their debt levels, further prudence in this area led to cash levels rising while debt levels fell as the club used their Premier League return as a short-term cash boost.

Cash levels exploded, rising from a measly £1.3m to a healthy £21.1m after a profitable year and the huge cash inflow from transfer sales.

Debt levels fell considerably, declining from £100.6m to £81.3m (19.2%) as the club looked to become more sustainable after repaying some debt with their cash surplus rather than invest in players, potentially to aid compliance with Financial Fair Play after previous run-ins with UEFA.

Net debt levels dropped significantly, falling from £99.3m to £60.2m (39.4%) as the club became more conservative and the owners will be hoping this puts the club in good stead despite disillusioning previous managers in Steve Bruce and Marco Silva who both thought it was a tough ask.

Thanks for reading, Share with a Hull City Fan!