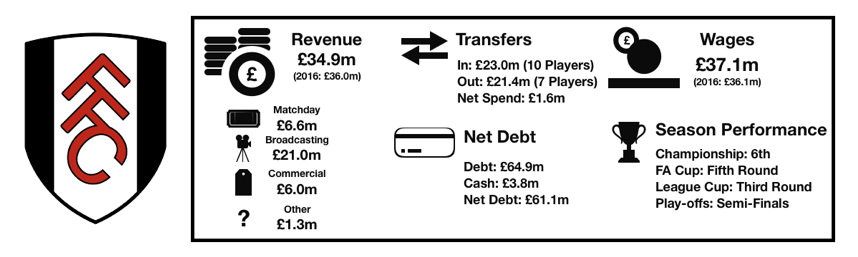

Fulham endured their third consecutive year in the Championship, enjoying their best campaign since relegation after finishing in the last playoff spot. However, their season finished in disappointment after a semi-final defeat to Sheffield Wednesday. This misery was relatively short lived as they bettered that performance this year to gain promotion back to the Premier League.

However, yet another season in the relative poverty of the Championship led to yet another loss-making season, with a loss of £21.3m incurred (2016: £12.5m), something they will be hoping will change after promotion.

Let’s delve into the numbers.

Revenue Analysis

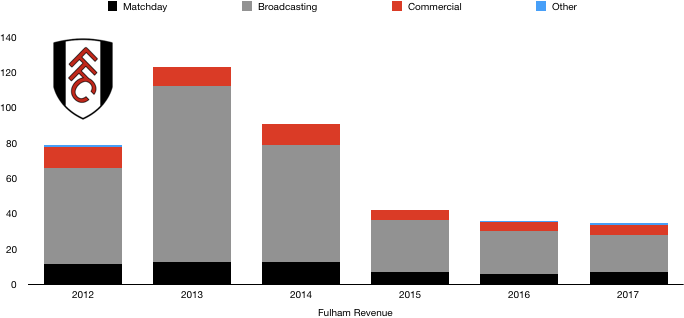

Fulham’s revenue remained fairly stable this year, falling ever so slightly from £36.0m to £34.9m (3.1%).

Matchday revenue rose from £5.7m to £6.6m (15.8%) on the back of an impressive campaign for the West Londoners, led by Slaviša Jokanović, the club began playing an attractive brand of football that stuck bum to seats and increased gate receipts. This was supplemented by their domestic cup performance after a run to the FA Cup Fifth Round.

Broadcasting revenue dropped, falling from £24.6m to £21.0m (14.6%) as parachute payments dropped £4.2m, outweighing the increased revenue from a good league campaign and their FA Cup revenue.

Commercial revenue rose from £4.7m to £6.0m (27.6%) in what was a good commercial campaign for the club as their football on the pitch led to their popularity of it enhance. Fulham exploited the London premium in commercial revenue and will be looking to exploit this further after promotion.

Other revenue rose from £1.0m to £1.3m (30%).

Revenue should rise after experiencing a promotion winning campaign this season with the extra revenue gained from the additional TV games and improved league position, however this will be the last year of parachute payments which may negate this rise. However, another good commercial campaign as well as rising matchday revenue should help Fulham to higher revenue next season.

Expense Analysis

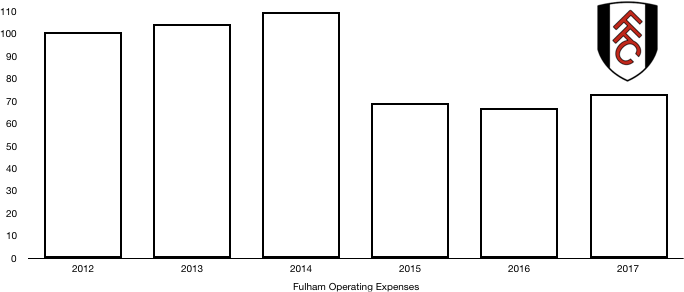

Fulham saw a steady increase in expenses despite stable revenue as expenses rose from £66.8m to £73.1m (9.4%).

Amortisation costs more than doubled, soaring from £6.3m to £15.2m (141.3%) after Fulham invested significantly in new players, a worthwhile investment after gaining promotion partly on the back of this.

The club also incurred impairment losses as they had to write off costs incurred on an alternative proposal for their Riverside Stand redevelopment that was not used. This impairment loss added a sizeable £7.1m to their costs for the year.

Fulham had minimal finance costs as all debt owed and owing are to their owner’s interest free.

The club for obvious reasons paid not tax due to their loss-making status, carrying sizeable tax losses of £44m that can be used should they return to profitability on their Premier League return as they hope to.

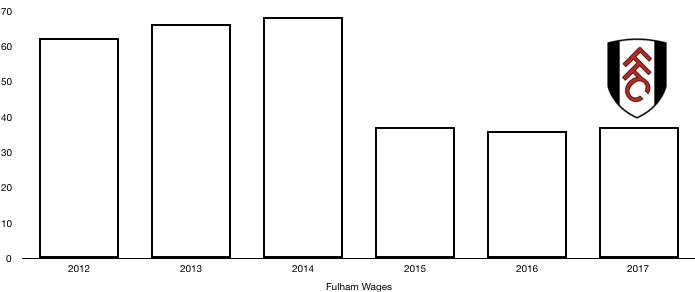

Wages remained stable despite player investment, rising by £1m to £37.1m (2.8%) after the departures of high wage players Mitroglou and McCormack offset the wages of their new signings.

Directors pay rose after a good season, increasing from £795k to £955k (20.1%) with the highest paid director receiving £726k.

Transfers Analysis

Fulham enjoyed a productive transfer season with lots of transfer activity as 10 players joined while 7 departed Craven Cottage.

In came Sigurdsson (£4.2m), Kebano (£4.0m), Sanchez (£3.6m), Johansen (£2.1m), Button (£2.1m), Ayite (£1.8m), McDonald (£1.4m), Madl (£1.4m) and Odoi (£0.9m) while Martin joined on loan for £1.6m, coming in at a total outlay of £23.0m.

Out went McCormack (£12.9m), Mitroglou (£6.3m), Stekenlenburg (£0.9m), Smith (£0.5m), Lonergan (£0.3m), Pringle (£0.3m) and Amorebieta (£0.3m) for a combined £21.4m.

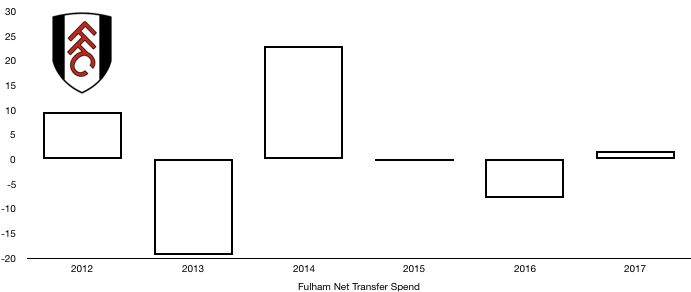

This saw Fulham have a net transfer spend of £1.6m compared to a net transfer income of £7.8m last year as Fulham began to show more ambition as fans grew impatient on waiting for a Premier League return.

It was Fulham’s cheaper deals that worked out the best for the club with McDonald and Odoi impressing while managing to get good fees for the wantaway duo of McCormack and Mitroglou was a huge success.

Fulham made an accounting profit on player sales of £17.4m as they profited on the sale of McCormack in particular.

Fulham owe £10.0m in transfers fees to clubs while they are owed £12.8m, putting them in a healthy position as far as transfers goes while they may owe an additional £0.8m if certain contingent transfer clauses are met by ex-players.

Fulham paid out cash of £16m in the year while £10.3m cash came back in to the club from transfers at a net cash outlay of £5.7m, down from £8.1m last year despite having net transfer income last year.

Assets/Liabilities Analysis

Fulham’s new found ambition saw debt levels soar as the club looked to finally return to the Premier League.

Cash levels fell from £5.6m to £3.9m (30.4%) on the back of the club’s loss-making status while their transfer activity also further depleted cash, resulting in Fulham’s owners boosting cash levels with a £29.5m loan to allow further investment to take place. Fulham also invested £12.5m in the club’s infrastructure with the purchase of Motspur Park which is adjacent to their current training facilities.

Debt levels nearly doubled, rising from £36.4m to £65.7m (80.5%) on the back of the after mentioned loan from Khan. All debt is owed to the owners with Fulham having no bank debt and minimal finance leases. The new loan was mainly used to support transfer activity and the stadium redevelopments as Fulham look to grow as a club as they prepare for their Premier League return.

Net debt hence more than doubled from £30.8m to £61.8m (100.1%) as Fulham test their sustainability limit and took bogger risks to secure a Premier League return. Fulham are going to reap the rewards of this in due course once their new Premier League riches become apparent. The future looks bright for Fulham.

Thanks for reading, share with a Fulham fan!