This is the second instalment of our Financial Fair Play Series. In this article we will discuss the key issues for clubs complying with Financial Fair Play going forward and the loopholes that can be used to exploit Financial Fair Play rules.

The key message from UEFA for Financial Fair Play is ‘living within your means, spending should not exceed income by more than a minimal amount (€5m over 3 years). This puts budget constraints on clubs looking to grow, as these clubs can only increase spending if income is growing. Normally, income only grows if spending grows first (if spent wisely), making the whole situation like a dog trying to catch its tail. Think Manchester City, their revenue is has only in the last few seasons begun to catch up with their spending after their successes have led to increased income from sponsors, merchandise, prize money and gate receipts.

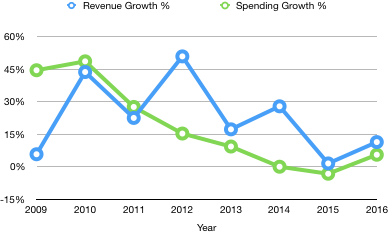

As the graph above shows, Manchester City had an initial sharp increase in spending which was lagged by income with the % rise catching up later. Without that initial large spending the subsequent rise in income would not have occurred and Manchester City would not have the large income figures they have today. In a Financial Fair Play world, such spending would not have been allowed and Manchester City would not have been able to compete with the big boys at that time, leading to one less big team then we have currently.

Southampton, a club who were at once aspiring to greater things in the Premier League have identified this as a problem. Cortese, the club chairman said “we will grow our commercial income but if we cannot close the gap commercially, which will probably be the case for all time, we have to use other aspects [such as youth development].”

Big clubs income usually grows quicker than small clubs meaning the gap will keep growing over time. Small clubs are then posed with the difficulty of making their income go further. The options are clear: spend on youth development, make shrewd signings or become commercially astute to increase income through shirt sales, sponsors and match-day sales.

The Loopholes

On to the most controversial aspect of Financial Fair Play, loopholes. Due to the tough constraints on clubs to comply with Financial Fair Play, many free-spending clubs have sought ways to by-pass the rules or at least make them easier to comply with.

There are many ways to comply without seeking loopholes. Some spending is exempt from Financial Fair Play such as spending on youth development, community development and women’s football, all of which can help boost income (discussed here). Good youth development can bring through talented youngsters who can improve the club’s performance on the pitch, helping to increase prize money, shirt sales and match receipts, or through selling them for large fees. Community development can help enhance the fan base, increasing match day receipts and shirt sales. Women’s football is becoming more and more popular, meaning a good women’s football team can bring in larger revenues than ever before.

Transfers are also key to complying with Financial Fair Play. Profit on player sales is calculated differently to the straightforward sale value – cost (for me details click here). Some players with low book value can hence be sold at significant fees to allow for spending to increase.

However these options are all long term, the benefits will not be seen immediately which in a modern football world where patience is no longer a virtue, is not good enough for footballers, managers and owners. Meeting Financial Fair Play rules in the short term when spending is high is a challenge, many clubs have used related parties to boost income. Related parties are any companies with strong links to the owners of the clubs, these companies can be used to bring in money to artificially pass Financial Fair Play.

UEFA allows related party transactions as long as they are at fair value, such that if they were not related, a similar price would be charged. So for instance, Etihad have a £350m, 10-year contract to sponsor Manchester City. To see whether this at fair value, UEFA would compare this funding to similar deals where clubs were not related to sponsoring company with a similar stature to Manchester City at the time of the agreement. Newcastle also have a similar arrangement with their stadium named the Sports Direct Stadium, a company owned by their owner Mike Ashley.

There are obvious difficulties in measuring fair value as there are not always similar transactions from other clubs to compare, and the club can always argue their case that it is fair representation. This makes related party transactions a significant difficulty for UEFA when applying Financial Fair Play rules. Ex-Chelsea Chairman Buck Buck is hopeful that such issues do not arise: “Uefa now has to wrestle with third party sponsorships. We are all hopeful Uefa will apply these rules in a fair and equitable manner.”

We hope you enjoyed this article please share if so and check back for the final instalment of this Financial Fair Play series and other news when we get it, sign up here and we will notify you when new articles are published!

Stay tuned to Financial Football News for further in-depth analysis on all Financial Fair Play developments and much more by following our social media platforms (via the logos at the bottom of this page).