We are back for the final instalment of our Financial Fair Play Series. In this edition we will discuss the sanctions that UEFA may impose on a club for failing Financial Fair Play and examples of when this has happened.

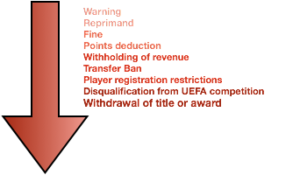

Let us first start with the possible sanctions for non-compliance with Financial Fair Play, where clubs fail in meeting the requirements we discussed in the first instalment of this series.

The lightest punishments available are warnings and reprimands, usually given in marginal cases or where there is a specific extenuating reason for non-compliance such as a one-off unexpected expense. Light punishments may also be given in the cases where there is an ‘improving trend’, where it looks likely that the club will soon meet the break even requirements.

Fines are the common penalty for non-compliance and have been issued in numerous cases, normally with part of the fine suspended and only issued if certain criteria is not met.

The rest of the sanctions are all very serious. Points deductions can have a big impact on revenue and are not handed out lightly, while withholding revenue can also cause significant damage for the club at hand in meeting their needs. Usually the amount of revenue withheld is not substantial enough to create huge cash flow issues, and in many circumstances, will be given back once certain criteria is met.

Transfers bans have been given out in a few situations and can range from just one transfer window to as many as deemed appropriate, usually capped at two. It is easy to get this mixed up with recent transfer bans for Barcelona and Atletico Madrid, however these bans were not linked to Financial Fair Play and instead to breaking transfers rules regarding players which will not be covered here.

For clubs in European competition, UEFA allows the club to register up to 25 players for use during the competition, this includes 8 home-grown players, of which 4 must be home-grown at the club. UEFA sometimes sanction a reduction of this number as a punishment for failing Financial Fair Play which can put these clubs at a serious disadvantage in the competition and significantly harm their chances of success.

The second most serious punishment is disqualification from UEFA competition. This is given out in extreme cases where the club was way below breaking even and expected to be for foreseeable future. The reason is that excess spending would give the club an unfair advantage against teams that are complying with Financial Fair Play so they should not be able to enjoy this advantage. These bans can include that the club is banned next time they qualify for the competition if they fail to do so in the season after their ban.

The worst possible punishment is retrospective stripping of UEFA competition titles, this is where other clubs can plea that the winning club gained an unfair advantage from their overspending which why the won the competition. This is a case (unlikely!) we could see this season after PSG stunning start to the season and the question marks over whether they will be able to comply with Financial Fair Play this season.

Now that we have an understanding of all the possible sanctions we will look at how these have been applied since 2013.

2013 – 2014

Probably the two most famous Financial Fair Play cases and most relevant today are related to super-rich clubs Manchester City and PSG. Both clubs had been brought by Mansour bin Zayed Al Nahyan of the UAE and Nasser Ghanim Al-Khelaïfi of Qatar respectively. Both clubs continued to flex their financial muscle going into the 2013 – 2014 season. Manchester City had a net spend of around £90m, with the significant arrivals of Fernandinho (£36m), Jovetic (£23.4m), Negredo (£22.5) and Navas (£18m) with Tevez departing for £8m. Meanwhile PSG had a net spend of around £100m with the arrivals of Cavani (£58m), Marquinhos (£28m), Cabaye (£22.5m, with Digne (£13.5m), Sakho (£17m) and Gameiro (£7m) the significant departures.

Despite this spending, Manchester City announced following the release of their annual accounts that they would fall within Financial Fair Play regulations. The main reasoning for this was a large spend on youth infrastructure which led to the building for their state of the art new training facilities, and an increase in turnover of over £40m with nearly £50m of their turnover due to peculiar image rights and property rights sales, from related parties of their Owner and New York City FC, Manchester City’s sister club. Chelsea manager at the time, Jose Mourinho openly questioned the legitimacy of Manchester City Financial Fair Play compliance calling it “dodgy financial fair play”. UEFA agreed with this assessment and rejected the legitimacy of these sales and decided that sanctions were necessary against Manchester City.

PSG had claimed compliance due in part to similar sponsorship deals to Manchester City from related parties. These claims were dismissed and PSG were also hit with the same sanctions as Manchester City.

Both clubs were handed:

- EUR 60m fines, of which EUR 40m was suspended

- UEFA squad size reduced form 25 to 21 players, this was later reduced on appeal

- Transfer spending restrictions were imposed, with PSG missing out on Angel Di Maria to Manchester United as a consequence. PSG ‘only spent’ £45m on David Luiz that season. While Manchester City had a net spend of around £50m after purchasing Bony (£29m), Mangala (£27m), Fernando (£13.5m) and Caballero (£7m) while selling Javi Garcia (£15m) and Rodwell (£11m).

- Two-year squad salary reduction plan was also imposed on the clubs.

The fine proceeds were split between all clubs in UEFA competition that met Financial Fair Play rules.

Both Manchester City and PSG have met all criteria imposed on them since the ban and since even had them softened.

Both Manchester City and PSG complained about their punishments, seeing their investment punished while other large clubs loaded up on debt to fund spending such as the Glazer-owned Manchester rivals United. Manchester City in fact were debt free which does seem rather sustainable.

PSG argued that Financial Fair Play stops new investment into football and protects already established large clubs who can spend more due to large revenue figures – “For me, Financial Fair Play is unfair. It stops new investors from coming into football. It protects the big clubs and obliges the smaller ones to remain small clubs. If investors are prevented from coming into football, they will invest in Formula One or elsewhere. It is not good for football. We are ready to work within the rules but I hope UEFA are going to change it next year because a lot of clubs have complained. I hope a solution can be found.”

2014 – 2015

Sanctions and settlement agreements were handed out to 14 clubs in 2014/2015 season, with Hull City the most notable, being the only English club sanctioned, however they received a minimal fine of EUR 600,000, with EUR 400,000 suspended and were told they must be break even by 2015/16 season to avoid further sanctions.

Roma were also subject to Financial Fair Play punishment and were handed a EUR 6m fine, with EUR 4m suspended if certain criteria is met. Their squad size was also reduced to 22 players for the following season.

Previously free spending Monaco were hit with a EUR 13m fine, with EUR 10m suspended and a squad reduction to 22 players.

Inter Milan were handed the largest fine of EUR 20m, with £14m suspended if certain criteria was met. Their squad size for UEFA competition was also reduced to 21 players for the following season. They were also hit with significant transfer spending restrictions, Inter had a negative net spend for 14/15 (-£7m) and 15/16 (-£6m), bringing in more transfer income than spending. They were also tasked with breaking even by 18/19 season.

Sporting Lisbon were also handed a fine of EUR 2m, of which all was suspended.

2015 – 2016

Hull and Sporting Lisbon both quickly exited their settlement agreement after meeting all criteria the following season.

Turkish clubs Fenerbahce, Besiktas and Galatasaray failed Financial Fair Play, Fenerbahce were issued with a EUR 7.5m fine, with EUR 5.5m suspended, while Besiktas were issues with a EUR 5.5m fine, with EUR 4m suspended, both clubs were sanctioned with a squad reduction to 22 players. Galatasaray ban was much more significant, having previously been in hot water UEFA banned them from a year of UEFA competition and imposed strict spending and wage restrictions that led to the selling of a vast number of players with income of £19m plus the wage bill savings.

Financial Fair has been a significant issue for Portuguese and Turkish clubs, who have struggled to control their spending due to large wage bills, this has led them to be less competitive in Europe with Turkish teams in particular struggling with 6 clubs so far failing Financial Fair Play. Both Galatasaray and Fenerbahce who are usually Champions League group stage participants, were unable to progress through qualifiers and their fans will not witness any European football this season.

Porto are the most recent team to be sanctioned by Financial Fair Play in June 2017 and have received a small fine of EUR 2.2m, with EUR 0.7m suspended and a squad reduction this season to 22 players. This did not stop them from qualifying in second place in their Champions League group this year though.

This is the end of this Financial Fair Play series, here at Financial Football News we will be following Financial Fair Play rulings and update you on any changes that occur this year with particular interest on the PSG story.