Since its announcement in September 2009, Financial Fair Play has divided opinion. The ever polarising Platini remarked “Fifty per cent of clubs are losing money and this is an increasing trend. We needed to stop this downward spiral. They have spent more than they have earned in the past and haven’t paid their debts. We don’t want to kill or hurt the clubs; on the contrary, we want to help them in the market. The teams who play in our tournaments have unanimously agreed to our principles…living within your means is the basis of accounting but it hasn’t been the basis of football for years now”. Financial Fair Play was aiming to change this.

Promoting sustainable spending was the aim, with excessive spending a thing of the past, this was the message Platini was sending. Fast forward to 2017 and PSG have spent around 200m on Neymar and effectively spent (when the loan becomes permanent) £160m on a break-out teenager with 1 year of first team football.

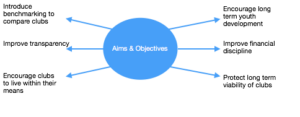

This series will explore what exactly Financial Fair Play aims to achieve, its rules and how they have been enacted and bypassed to date. We will first look into the rules to gain a better understanding into UEFA’s thinking behind this regime.

Financial Fair Play rules are fairly broad, the main financial requirement is the break even requirement. This is a requirement to limit losses incurred by clubs, it is based on a clubs income and expenses, with the aim of encouraging sustainable spending such that clubs ‘break-even’ and don’t over extend themselves.

All clubs in UEFA competition must comply with the rules, which are based over a rolling three-year period (e.g for 2017 it will be based on the 14/15, 15/16 and 16/17 seasons).

The break-even requirement is that relevant expenses must not exceed relevant income by more than EUR 5m over the rolling three-year period. This loss can be increased to EUR 30m if the excess (EUR 25m) is contributed by a related party.

Club must also avoid having overdue payments to other clubs for transfers, employees and Government.

As an example if the Break even results 14/15 was +10m, 15/16 was +5m and 16/17 was -20m the club would still be within the requirements as the net result would be -5m. The result could be anywhere up to -45m if and only if the extra above the -5m was covered by contributions from related parties.

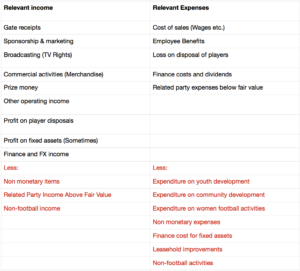

Below is a breakdown of what is included in ‘relevant income’ and ‘relevant expenses’, which from now on we will just call income and expenses respectively:

The main technical area around this is profit on disposal of players, this is a bit more complex than just taking taking the difference between transfer fee paid and transfer received.

Players are (rightfully so) treated as assets for football clubs, they are therefore assumed to depreciate over the time they are at the football club (Not always true, look at Zlatlan!). The profit is then the transfer fee received minus the depreciated value of the player.

For more details on the technical side of this, check out this post explaining player disposals here.

This is an area that can be very useful in complying with Financial Fair Play. Players can sometimes be sold who have a low book value can be sold for a large fee due to their ability, making a large ‘profit’ on that player and potentially saving the company from breaking (pardon the pun) the break-even requirements.

Another area that causes controversy for Financial Fair Play is related party transactions. An obvious deceitful way to pass Financial Fair Play is to use a company that the mega-rich club owner owns and plug money into the club through a ‘sponsorship’ which will increase income and meet break-even requirements.

In an effort to stop that, UEFA have stated that related party transactions must be at their fair value, such that if they were not related the payment would be the same. This is difficult to prove however as what exactly is fair? Often comparisons will be made with other similar deals, however this is not always available and fair value is open to debate so as of now is still a grey area for Financial Fair Play.

The same scenario may play out with expenses, where the related party charges the club a lower fee than otherwise would be ‘fair’ for instance stadium maintenance costs or other services.

Expenditure on youth development, community development and women’s football are all taken off the expense figure to encourage spending in these areas. Youth development will aid sustainable growth for clubs and help bring through more youth players with more of a focus on homegrown talent. Community development will help keep clubs in touch with their local community and fans which is harder than ever with the growing money in the game. A focus on women’s football is essential to building the game to higher level and encouraging girls to take up the sport.

Clubs may also be proactive and choose to voluntarily sign up to Financial Fair Play and break-even requirements. You may wonder why clubs would risk the extra burden of these rules, clubs with aspirations to qualify for UEFA competition may want to be proactive in meeting the requirements to avoid a shock once qualifies. Clubs may also want to self-impose financial discipline in order to achieve sustainability.

If you enjoyed this article, keep informed on the latest financial football news by signing up to our newsletter below: