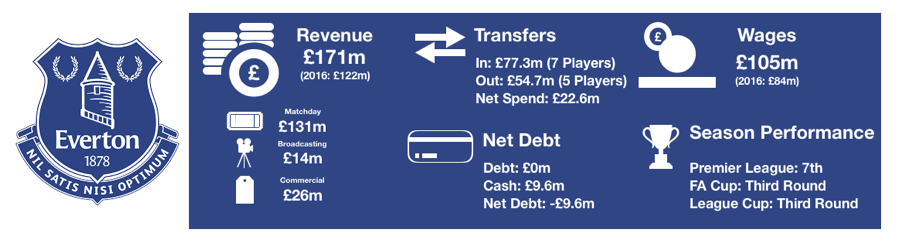

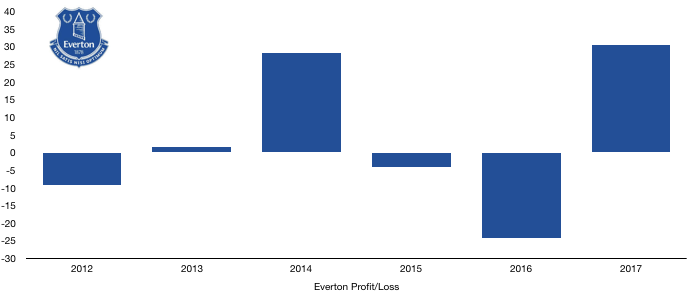

Everton had a promising season on and off the pitch in 16/17, returning to Europe with a 7th place finish accompanied with semi-finals in both domestic cups. Off the field Everton returned to profit, recording a profit of £30.6m, an increase of £54.9m. Revenues increased significantly which we will look at in the next section and Everton are now debt free after a cash injection from owner Farhad Moshiri. This article will analyse the different aspects of their financial performance.

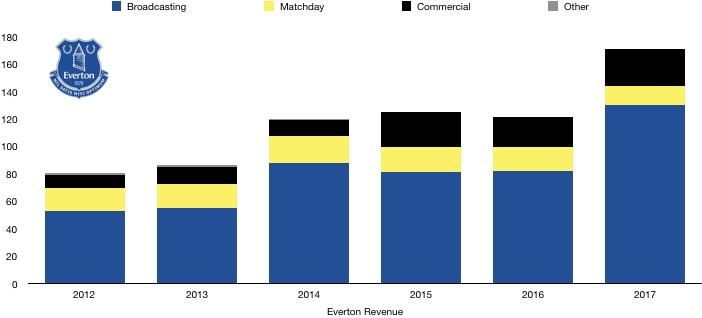

Revenue Analysis

Everton’s revenue reached record levels of £171.3m, up an outstanding 50% from the previous year. The rise was due to considerable commercial and broadcasting successes.

Everton gained £6m from the sponsoring of their Finch Farm training ground by USM, who suspiciously are a company chairmanned by Farhad Moshiri. Such deals are however becoming more commonplace in the football world and such contacts can prove very useful.

The club also announced lucrative sponsors, with their new main sponsor Sport Pesa (£10m), new betting partner William Hill and their first sleeve sponsor in Angry Birds.

This has all lead to commercial revenue rising 65% to £26.8m. Broadcasting revenue rose significantly due to this being the first season of the new £5bn TV rights deal and also £14.8m prize money for finishing 7th in the league.

Matchday revenue was down £3.5m due to poor performances in the domestic cups, with two third round exits compared to two semi-finals in 2015/16. However this was supplemented by a rise of 12% in season tickets sales, although this impact was subdued by lower prices.

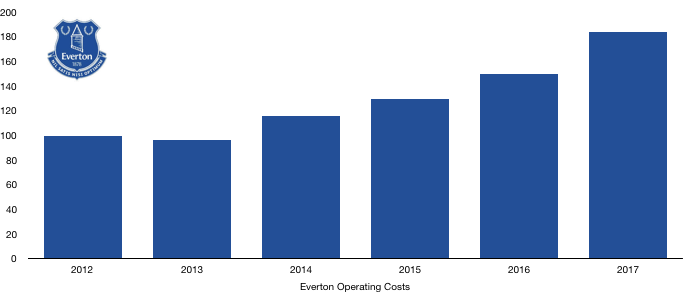

Expense Analysis

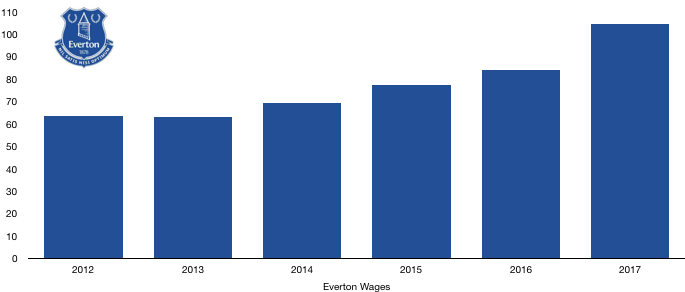

Operating expenses increased significantly to £183.6m (22%), this was largely due to a £20.7m increase in wages (24.6%) and a £14.9m increase in player amortisation (66.5%).

This increase would be even larger if not considering the £11.3m severance package given to Roberto Martinez and his team in the 2015/16 season. A similar expense will appear in next years accounts in respect of Ronald Koeman.

Wage growth is largely attributable to the renewing of contract and the transfer dealings which saw 7 new players come in. Ronald Koeman wages were also suspected to be much higher than Martinez’.

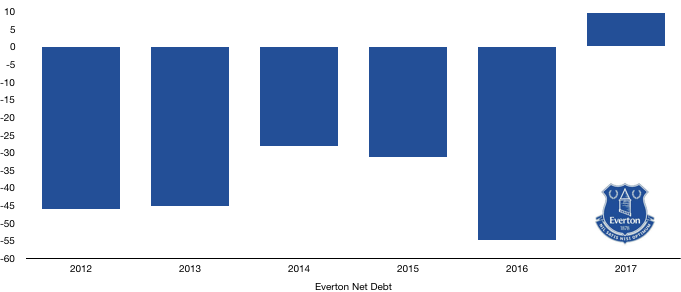

Finance expenses were considerable larger with a cost of £7m paid as a penalty for early payment of loans, which now leave the club debt free.

Directors received salaries of £1.6m, more than double last year’s figure of £770k with the highest paid director gaining a salary of £588k.

Everton have made a loss in recent years, meaning them turning into profit only lead to a tax charge of £50k. Should they continue to make profit, this amount will more closely reflect the tax rate.

Transfer Analysis

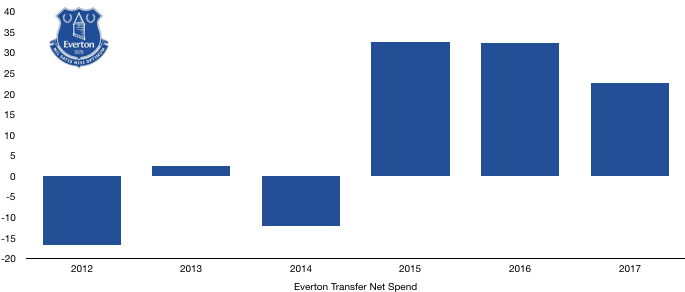

Everton were forced to have a busy transfer window with the sale of key England defender John Stones for £50m to Manchester City. This lead to a influx of 7 new players for combined fees of £77.3m.

In came Bolasie (£26m), Schneiderlin (£20.6m), Williams (£12.6m), Lookman (£7.9m), Gueye (£7.7m), Calvert Lewin (£1.6m) and Stekelenburg (£900k). Other departures included Gibson, Oviedo, Pienaar and Howard for combined fees of £4.1m, with Deulofeu loan move bringing in £630k.

This took Everton to having only the 11th highest net spend of £22.6m, meaning their 7th place finish gave them good value for money, with Gueye particularly impressing last season at such a modest fee.

Assets & Liability Analysis

Debt levels have been fairly constant in recent years at around £40m, however this cash injection is a clear sign of the club’s intention going forward.

This is great news for Everton fans, with Moshiri putting his money where his mouth is with considerable investment into the club, with the recent renovations of Goodison Park and Finch Farm.

Fans will be hopeful of a continued search for a bigger stadium to meet demand, highlighted by the rise of 12% in season tickets.

Thanks for reading – Share with an Everton Fan!