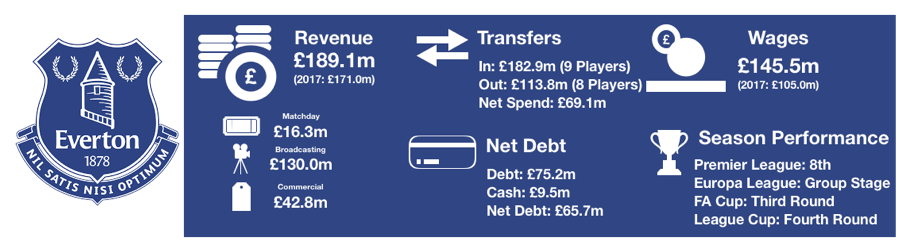

Everton had an average season at best in 2018, finishing 8th but failed to progress far in any of the cup competitions, exiting both domestic cup by the Fourth Round and only reaching the group stage of the Europa League, a competition they weren’t in the following season following their 8th placed finish.

Fans were obviously discontent, not only with results, but also performance which ultimately led to the sackings of both Ronald Koeman and Sam Allardyce and appointment of Marco Silva, moves that proved expensive for the club, and will be even more so after the settlement with Watford.

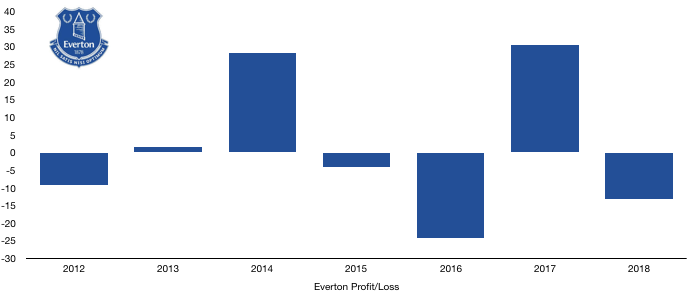

The lack of progress last year and rising costs meant Everton went from a profit of £30.6m to a loss of £13.1m despite recording a huge profit on player sales due to Lukaku.

Let’s delve into the numbers.

Revenue Analysis

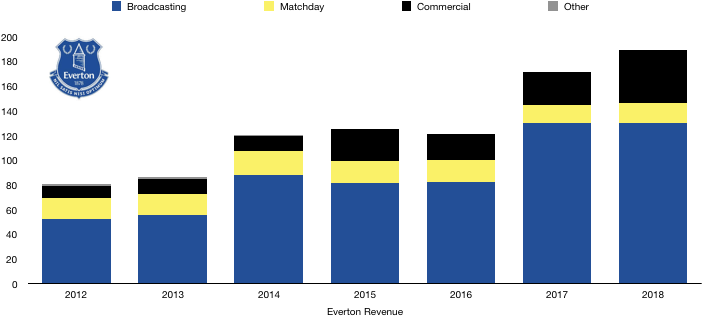

Everton saw a decent rise in revenue in 2018, rising from £171.3m to £189.2m (10%) due mainly to their Europa League campaign.

Broadcasting revenue fell slightly from £130.5m to £130.0m (0.3%) as they fell a place in the Premier League. This drop was offset slightly by featuring in more live games than usual (19), earning Everton, £22.3m.

Matchday revenue rose from £14.1m to £16.3m (16%) on the back of record season ticket sales of 31,282 and more home games due to their Europa League campaign.

Commercial revenue increased significantly, rising from £26.8m to £42.9m (60%). It is worth noting included within this sum is £22.1m of ‘other commercial activities’ which Everton have included their Europa League revenue in (last year’s figure was £11.4m by comparison), distorting this figure substantially. Sponsorship, advertising and merchandising rose from £15.4m to £20.7m (34%) which is still substantial commercial growth.

Commercial revenue is however helped by the training ground sponsorship of £6.0m received from USM, who are owned by their owners.

Looking ahead, another disappointing seems to be on the horizon which will see a dip in revenue for Everton. Matchday revenue will take a hit due to the fall in home games without the Europa League while the lack of European football will also impact their revenue by between to £7-10m due to the fall in prize money. Under their new CEO, commercial growth has been strong which will be key to any rise in revenue to offset the unavoidable drop due to performances on the pitch.

Costs Analysis

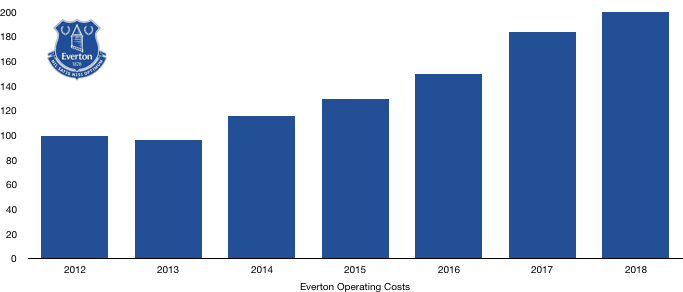

Everton saw costs balloon from £183.6m to £287.2m (56%), outpacing revenue growth significantly, hurting profitability.

A major reason for the rising costs was a huge increase in player investment as there was a sharp rise in amortisation, which grew from £37.3m to £66.9m (79%). The player investment failed to really improve the squad but did show huge ambition by Everton in attempting to challenge the top 6.

Everton also had exceptional one-off costs of £40m as they spent £11.4m on planning their new stadium, paid severance pay to their ex managers of £14.4m and also impaired the value of a players at the club by £8.2m (likely to be Bolasie).

Net interest costs fell from £9.0m to £2.8m (69%) due to exceptional costs last year of £7.0m due to early settlement fees on loans, which taken out means interest costs actually rose by 40%.

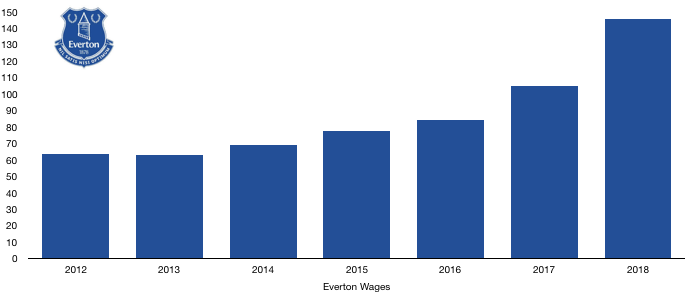

Wages rose by over £40m from £104.7m to £145.5m (39%) as their new signings attracted sizeable wage packages as Everton moved towards a more ambitious wage structure.

This wage rise works out an astronomical extra £785k a week to the club’s wage bill, unheard of figures for Everton who have been incredibly frugal for many a year.

Everton’s directors saw a large rise in their pay, increasing from £1.6m to £2.5m (56%) despite an unconvincing season.

Looking ahead, Everton were once again busy in the transfer market and are likely to see a rise in costs once again. Any rise in costs is likely to hit profitability further due to the unlikelihood of a rise in revenue this year, meaning Everton’s owners are likely to have to put more money into the club.

Transfers Analysis

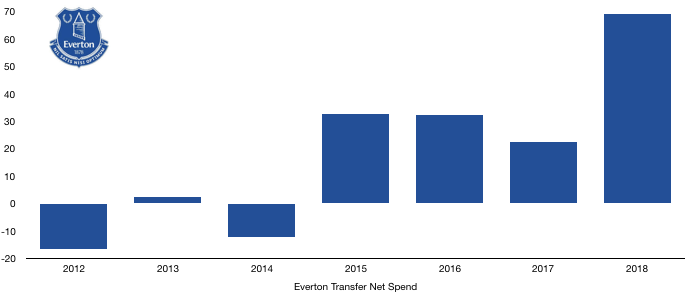

Everton had huge transfer season last year spending and receiving just under £300m in total as 9 players entered Goodison Park and 8 departed.

Joining Everton were Sigurdsson (£44.5m), Pickford (£25.7m), Keane (£25.7m), Klaasen (£24.3m), Walcott (£20.3m), Tosun (£20.3m), Vlasic (£9.7m), Onyekuru (£7.2m) and Sandro (£5.4m) for a combined eye-watering £182.3m.

Leaving Everton were Lukaku (£76.2m), Barkley (£15.2m), Deulofeu (£10.8m), Cleverley (£8.4m), Lennon (£1.5m), Barry (£1.0m), Lookman (Loan – £0.5m) and McGeady (£0.3m) for a combined £113.8m.

This led Everton to a net spend of a sizeable £69.1m up a staggering 206% from 2017.

The signings in the main failed to live up to their price tags, Sigurdsson failed to bring his consistent quality, while Keane and Walcott did okay and Tosun and Klaassen were busts. The one standout was the signing of Pickford, who has since established himself as England’s no.1.

The sales of Barkley and the Belgium hitman Lukaku were sorely missed while the pace of Deulofeu, who has since starred at Watford was also a miss. The sales of Cleverley, Lennon and Barry managed to bring in decent transfer fees and make some room on the wage bill.

The sales of Lukaku and Barkley meant Everton recorded a profit on player sales of £87.8m, which was still not enough to help Everton to a profit, showing the club is heavily loss making and profitability needs to improve substantially to avoid substantial losses in the next couple of years (unless star players are sold, which isn’t a long-term solution).

In cash terms Everton’s transfer outlay was even larger than the net transfer spend. Everton spent cash of £155.8m and only received cash of £52.6m, a net result of £103.2m as they negotiated unfavourable terms on the sale of Lukaku.

This will however be recouped in future years as they are owed £109.6m in transfers, of which £64.3 is due this year.

In contrast, Everton owe £88.4m, of which £55.2m is owed this year. Everton are hence in a net owed position of £21.2m which may help with future transfer windows.

Everton could also potentially owe another £41.4m in transfer fees if certain clauses are met. There are also loyalty bonuses that could become payable of £31.2m, a sizeable cost if the conditions are met. Everton’s board have stated it is unlikely they will at this stage.

Debt Analysis

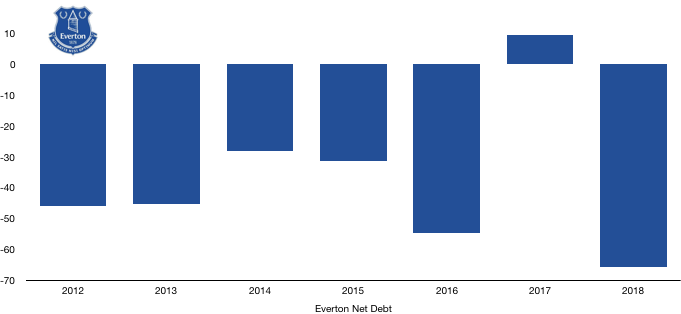

Cash levels at Everton remained stable, falling slightly from £9.6m to £9.5m (1%) as the huge transfer outlay and rising costs were funded by new loans (£75m) and equity investment (£45m) of a huge £120m, showcasing the ambition their owners have for the club going forward.

Everton received new funding from their owners, part equity and part new debt, which was £75.2m of the total. Following the change in ownership last year, there was no debt in the club, meaning a huge increase to £75.2m was incurred.

Last season was a huge statement of intent by the new owners that fans will be hoping continues going forward.

Net debt hence changed from a net cash position of £9.6m and to a net debt position of £65.7m as their debt profile changed again following the change in ownership.

Going forward Everton’s new owners are going to have to invest further due to the rising losses of the club on the back of rising costs that isn’t being met by any meaningful rise in revenues as performances on the pitch struggle to match the investments made off the pitch.

Evertonians alike will be hoping that going forward funds will be spent more wisely, leading to a more sustainable Everton in the future.

Thanks for reading – Share with an Evertonian!