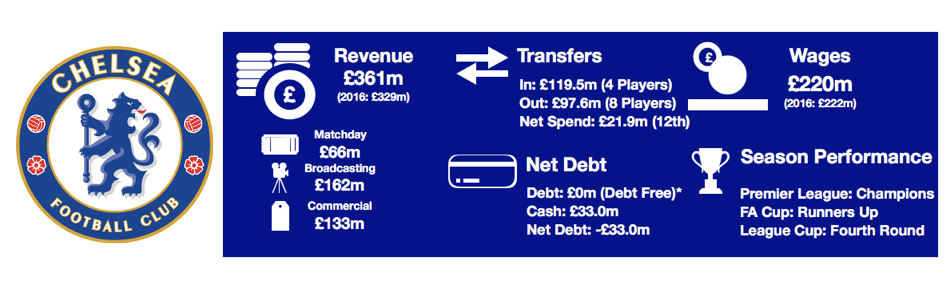

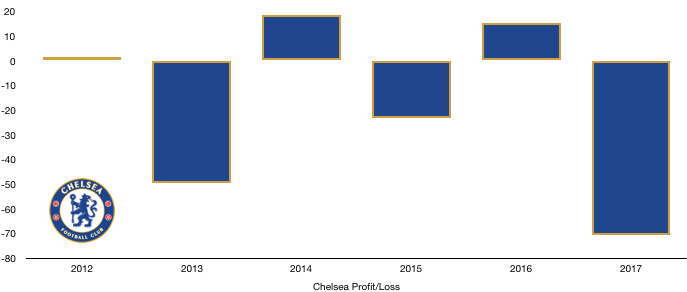

Chelsea had an excellent season, becoming Premier League champions with relative ease, while also returning to profit thanks to some remarkable transfer dealings. Revenues rose over £30m to £361m despite the lack of European football at Stamford Bridge in 2016/17 season. This article will analyse the different aspects of their financial performance.

Let’s delve into the numbers.

Revenue Analysis

Chelsea’s revenue reached record levels of £361m, up a solid 10% from the previous year despite the lack of European football. The rise was due to considerable commercial and broadcasting successes.

The club gained the majority of their £17m commercial revenue rise from their lucrative sponsorship deal with energy drink company Carabao – who also sponsor the League cup as they look to tap into the UK football market. They also will start seeing the benefits of their record sponsorship deal with Nike next season.

Becoming Premier League Champion pays, with revenues up £20m. More prize money and live games will have been awarded to Chelsea over the course of the season, boosting their broadcasting revenues – especially with the new TV deal kicking in. A successful FA Cup run will have also boosted this figure in the absence of Europe.

Matchday revenues were down £4m due to the lack of European football enjoyed in previous seasons, which would have been worse without their strong FA Cup run to the FA Cup final.

Expense Analysis

Operating expenses fell to £414.7m (7.9%), this was due to the exceptional costs incurred last year of £67m to cancel their Adidas contract in order to sign with Nike, while the severance package paid to Jose Mourinho cost the club another £8m. Excluding that costs, operating expenses actually rose 10.5%, with Administrative expenses up £22m and other costs up £18m.

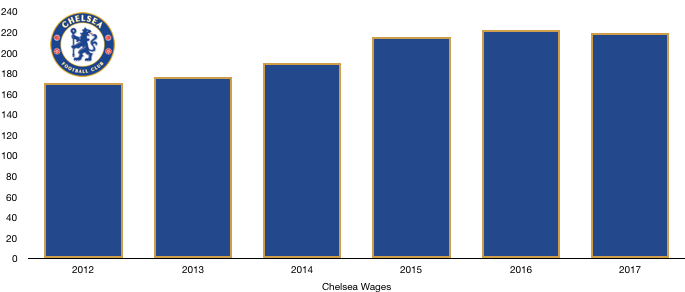

Wages were actually down by £3m to £220m after a successful summer clear out, letting go of some high earners which reduced wages slightly.

This is even more surprising as total staff numbers rose by 27 to 812 (3.4%), with playing staff and coaches up by 15 to 152 (10.9%).

Player amortisation costs rose to £88.5m from £70.9m (24.8%) due to high transfer fees.

Transfer Analysis

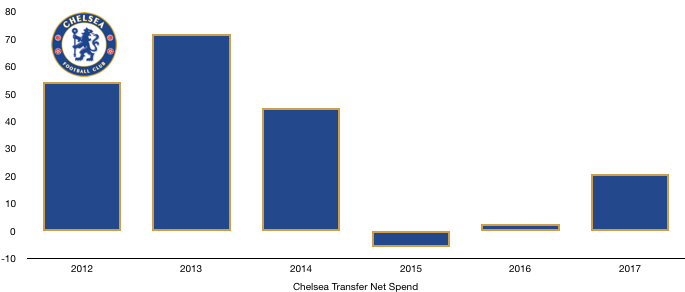

Chelsea had a great transfer window, bringing in 4 players at a cost of £119.5m, with the highlight being N’Golo Kante for £32.2m. Also following Kante to the club were Michy Batshuayi (£35.1m), David Luiz (£31.5m) and Marcus Alonso (£20.7m).

Chelsea took full advantage of the Chinese Football League prior to the Chinese FA tax being imposed, selling Oscar to Shanghai SIPG for £54m helping the club make a huge profit on disposal of £69.2m.

Oscar was one of six players to leave permanently with Papy Djilobodji (£8.6m), Patrick Bamford (£6.2m), Stipe Perica (£4.1m), Marko Marin (£2.7m) and regrettably for Chelsea, Mohammed Salah left for a measly £13.5m. Branislav Ivanovic and John Mikel Obi also departed on free transfers, helping to reduce their wage bill.

Chelsea also made a significant amount on loan fees, receiving £8.6m loaning various players that were surplus to requirements, hoping a good season can help them retrieve higher fees from them in the following season.

This took Chelsea to the title despite having only the 12th highest net spend of £21.9m, meaning their impressive title winning campaign came at a very economic price, much to the delight of management.

Assets & Liability Analysis

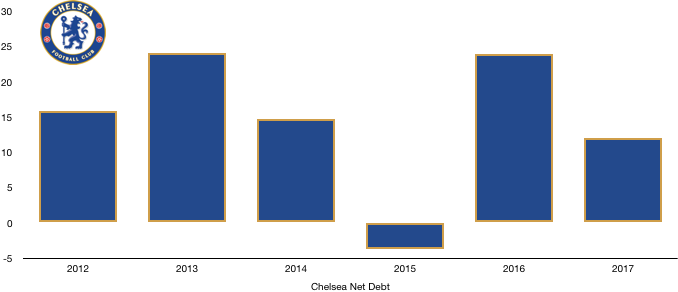

Chelsea are debt free… technically. The football club, Chelsea FC plc, is owned by a company called Fordstam Limited, who in turn are ultimately owned by Russian Billionaire Roman Abromovich. In Fordstam Limited, there are debts of over £1bn, with that amount increasing by £40m last year. The debt used to channel through Chelsea FC plc, however all this debt was converted to equity through Fordstam Limited.

Fordstam Limited accounts are yet to be released and are expected around April, which will shed light on any increases in the debt levels of the club in 2017.

Essentially Roman owes Roman money, which he can only regain through shares of the profit each year, something which Chelsea are not principally run to do.

Before, Roman Abramovich could just pump money into Fordstam Limited which was funnelled down to Chelsea FC, however with Financial Fair Play limitations now in play, this is no longer an option, forcing Chelsea to be a much more sustainable unit.

This is part of the reason for their new business model, buying a number of bright young players and sending them on loan, in the hope they turn into superstars that can join the first team, or be good enough to be sold at a nice profit.

There is no issue with the debt as far as Roman Abramovich is concerned, with the Billionaire having no plans to sell for the foreseeable future, and if he did the new prospective owners would have to buy the club as well as all the debt within Fordstam Limited.

As for Cash levels, they have steadily improved after a dip in 2015, Cash rose by 22% to £33m, showcasing the more sustainable nature of the club.

Thanks for reading – Please share with a Chelsea fans!