Chelsea followed their Premier League title winning campaign with a poor defence of that title after Conte clashed with the board and players, eventually leading to his departure.

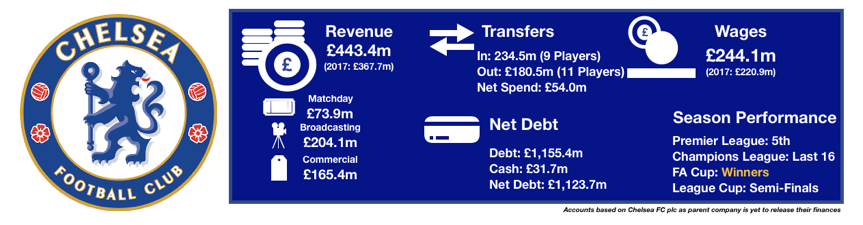

Despite a 5thplaced finish and hence no Champions League football this season, Chelsea won the FA Cup to end Conte’s reign on a high and also reached the League Cup Semi-Finals.

Despite these highlights a poor Premier League season and Champions League campaign (out in round of 16), was not good enough and their ruthless Russian showed as much.

Despite these shortcomings, Chelsea recorded a profit of £24.9m, a huge swing from the loss of £14.2m incurred in 2017. This was predominately due to a huge increase in income from player sales.

Let’s delve into the numbers.N

Revenue Analysis

Chelsea reached record levels of revenue despite a disappointing league and European campaign.

Revenue rose from £367.7m to a record breaking £448.0m (22%), primarily due to a return to the Champions League.

Matchday revenue rose from £65.5m to £73.9m (13%) with Chelsea having more home games due to a return to European football following a 1-year hiatus.

This was boosted by fans also spending more money at games and the higher pricing of Champions League games.

Chelsea’s inability to reach the latter rounds meant the rise was less pronounced then it would have been hoped for.

Broadcasting revenue rose significantly from £162.4m to £204.2m (26%) as a return to the Champions League after a season of no European football boosted revenue substantially.

This increase was reduced by a drop in Premier League prize money as they moved from Champions to 5th. This negative effect however was slightly offset by their fantastic FA Cup triumph.

Commercial revenue rose from £139.8m to £169.9m (22%) after new deals with Nike and Sony came into effect, having a large, positive effect on revenue.

This was supplemented by many smaller deals as the commercial team had another good season of growth while fans also continued to increase spending on merchandise.

Looking ahead, we expect revenue to most likely flatline as positive and negatives from this season offset each other.

A demotion to Europa League football will probably see broadcasting revenue fall unless they win it (similar situation to Manchester United a couple seasons ago).

This demotion will also affect matchday income as ticket prices will be lower however, Chelsea are still in the Europa League and have a good chance of winning the competition which may boost next year’s revenue.

Therefore, the key to any increase in revenue will most likely be whether commercial revenue increases.

Costs Analysis

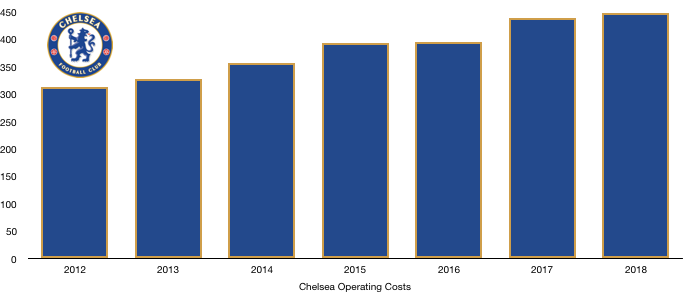

Chelsea saw record breaking costs in the same season as record breaking revenue. Costs rose from £439.5m to £523.6m (19%). This rate of growth being less than the growth in revenue enhanced profitability, building the foundation of their profit this year and also show an improved cost control while still delivering financial growth.

Amortisation rose significantly from £90.0m to £127.3m (41%) due to substantial player investment last season.

The significant investments made didn’t pay off last season with fans not having much hope it will long term either unfortunately.

Chelsea also had exceptional costs of £6m due to the club buying back some licensing rights for future exploitation which may enhance commercial revenue going forward.

Wages rose by a much smaller amount, increasing form £220.9m to £244.1m (11%) as their new signings replaced players on comparatively high wages. The extra wages worked out as an extra £446k a week for Chelsea which is relatively small for a club the size of Chelsea.

The West Londoners also had net interest expense of £1.5m, a sizeable increase from last year’s £0.1m.

Chelsea also paid tax of £5.4m, giving them an effective tax rate of 18%, in line with the statutory rate of 19%.

Looking ahead, Chelsea are likely to see a rise in costs after their two marquee signings in the summer and only Courtois departing permanently. This may see profitability decline as we expect cost growth to outstrip revenue growth this year.

Transfers Analysis

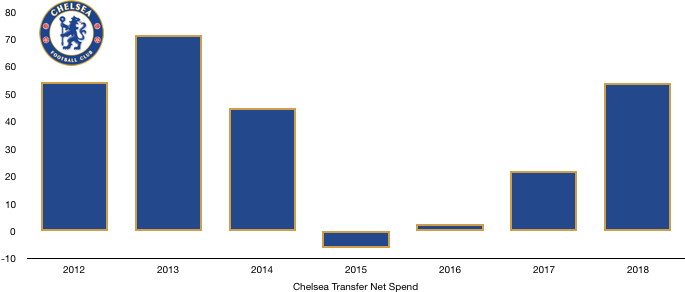

Chelsea had a busy season in the transfer market as 9 players arrived and 11 departed Stamford Bridge.

In came Morata (£59.4m), Bakayoko (£36.0m), Drinkwater (£34.1m), Rudiger (£31.5m), Zappacosta (£22.5m), Emerson (£18.0m), Giroud (£15.3m), Barkley (£15.2m) and Ampadu (£2.5m) for a combined eye-watering £234.5m.

Out went Costa (£59.4m), Matic (£40.2m), Ake (£20.5m), Cuadrado (£18.0m), Begovic (£10.4m), Traore (£9.0m), Zouma (Loan – £7.0m), Atsu (£6.8m), Chalobah (£5.7m), Musonda (Loan – £2.3m), Batshuayi (Loan – £1.4m) for a nearly as eye-watering £180.5m.

This meant Chelsea more than doubled their net spend from £21.9m to £54.0m (147%), which is still relatively small compared to some of their rivals.

The signings have not yet lived up to their billings (and seem unlikely to), especially Morata and Drinkwater/Bakayoko who seem like downgrades to both Costa and Matic.

Rudiger has proven to be a good signing while Ampadu and Barkley still have an abundance of potential, with the latter coming into his own this season. Giroud has proven to be a good back-up option since his arrival too.

Despite this, Chelsea successfully let go of some deadwood at good prices. This led to Chelsea making a huge £113m (2017: £69.2m) profit on player sales, leading to their hugely profitable year. Without the significant departures at Chelsea, they would have surely made a loss.

With no such major overhaul this season, profits are likely to be much smaller, if not a loss.

From a cash perspective, Chelsea spent £191.7m in actual cash while only receiving £91.8m themselves, a net cash outlay of £99.9m which depleted Chelsea’s cash reserves.

Chelsea also owe £150m in transfer fees, of which £92.4m is due this year.

However, Chelsea are owed a larger amount of £169.4m, of which £136.2m is due this year meaning Chelsea will have no issues paying off these transfer fees without extra cash injections.

In addition to this, Chelsea may also owe an additional £4.7m in contingent transfer fees.

Debt Analysis

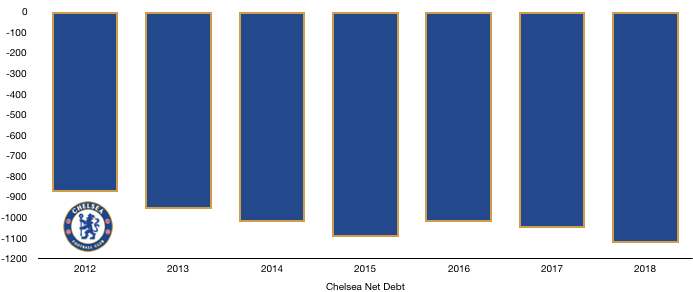

Roman Abromovich bank rolls the Chelsea machine and has invested huge sums to turn them into the European powerhouse they are today. The Russian billionaire provided an additional £69.1m of debt to Chelsea in 2018.

This takes Chelsea’s debt owed to Roman to £1,155.4m from £1,086.3m (6%), an astronomical figure. Chelsea fans need not worry however about this debt, despite being repayable on demand, it will only be paid back to Roman when and if he sells the club, at which point the total takeover fee will be used to repay him.

Chelsea are valued at well over £2bn and as such Roman will be confident he will make a good return on his investment of nearing on £1.2bn (plus the initial acquisition cost) all those years ago.

Cash wise, Chelsea saw cash levels remain fairly stable, falling from £33.0m to £31.7m (4%) due mainly due to a large transfer outlay which used the additional revenue made this year.

As such, net debt rose from £1,053.3m to £1,123.7m (7%) which as mentioned should not be too much of a concern to Chelsea fans.

Roman has had his difficulties with the UK as of late after being refused a visa etc., however this should not be enough to see him sell the club.

The only concern is the time it is taking to make Chelsea self-sufficient. Roman will be hoping that additional revenues will soon mean that his cash injections will be less frequent which is not yet the case.

This is unlikely to be the case for a while with their squad in desperate need of significant investment to bring it up to the standards set by Liverpool and especially Manchester City.

Thanks for reading, share with a Chelsea Fan!