Chelsea had a turbulent 2019. After missing out on the top 4 in 2018, Conte lost his job and Chelsea were condemned to the Europa League. Sarri-ball entered Stamford Bridge and renewed optimism following a strong start to the season that saw them neck and neck with title rivals Manchester City and Liverpool.

However, things soured, with Sarri-ball deemed ‘boring’ and points began to be dropped, leaving Chelsea in a top 4 battle and calls for Sarri out. Sarri turned it around following an eventful League Cup final loss where Kepa refused to be subbed off, with Chelsea going on to lift the Europa League and finish 3rdin the Premier League, a good season by anyone’s standards.

Despite this, Sarri sought pastures new and landed nicely on the Juventus job, leading to club legend Frank Lampard taking the reins for the new season, under the constraints of a transfer ban.

This article analyses the financial effects of Chelsea’s lack of Champions League football and whether a Europa League win was enough to aid their finances.

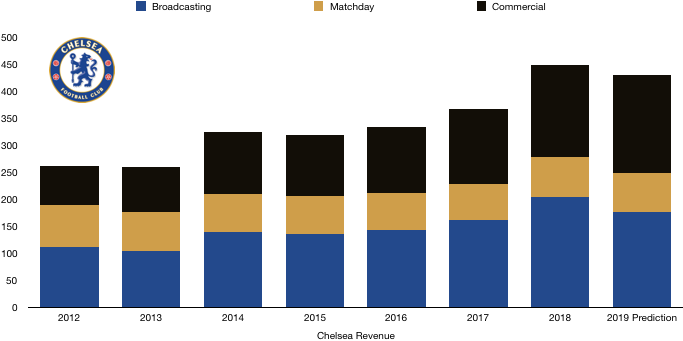

Revenue Prediction

Chelsea saw their revenue balloon to record levels in 2018, rising from £368m to £448m after a return to the Champions League. Things were not so rosy in 2019 after dropping out of the competition once again…

Matchday Revenue

Chelsea’s matchday revenue was £74m in 2018, up from £65m in 2017 due to the lack of Champions League games. Chelsea dropped into the Europa League in 2019 and did in fact have 1 more home game. However, the lower pricing of Europa League games compared to the Champions League should see a drop in matchday revenue of around £2m to £72m. This drop could be more significant depending on the ticket price drop of the Europa League, however their appearance in the final should negate this.

Broadcasting Revenue

Chelsea’s broadcasting revenue broke the £200m barrier for the first time in 2018 at £204m thanks to their Champions League return.

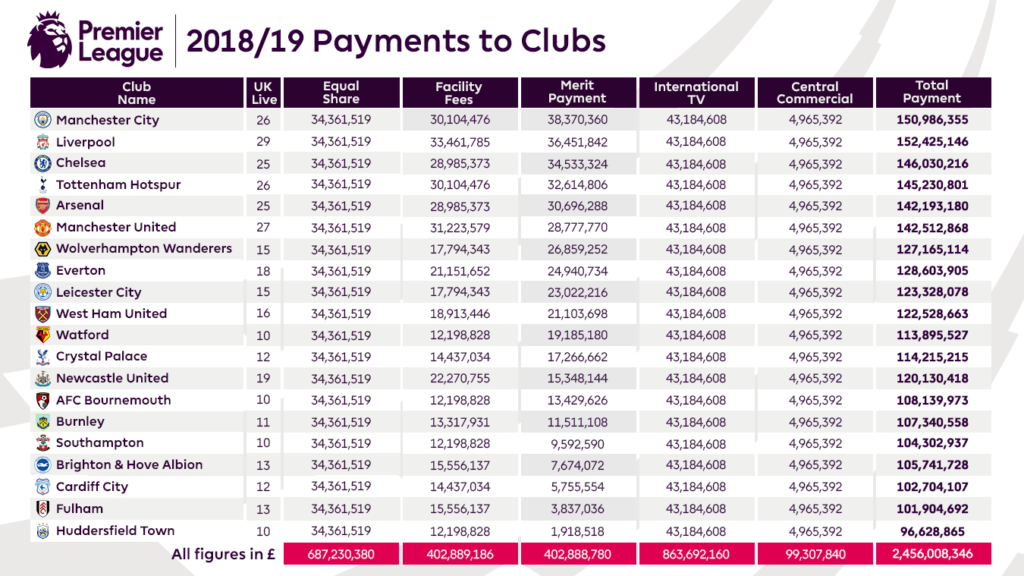

An improved Premier League performance (moving from 5thto 3rd) boosts Premier League distributions by £4m for Chelsea to £146m, this is despite featuring on TV once less in the season.

The 2018 FA Cup winners fared far worse in last season’s competition, exiting in the 5thround to Manchester United (who they beat in the 2018 final). This saw their total prize money fall from around £3.5m to £0.3m, despite total prize money in 2019 doubling from 2018 levels.

Chelsea reached the League Cup final in 2019, going one step further than in 2018. The prize money on offer is immaterial to Premier League clubs and isn’t considered in our analysis.

Now to Europe. Chelsea reached the Last 16 in the 2018 Champions League, being eliminated by Barcelona. They fared much better in the lesser Europa League, beating London rivals Arsenal in the final to claim their second Europa League trophy.

You may think the prize money on offer for winning the Europa League would rival that of only reaching the Last 16 of the Champions League. WRONG.

UEFA confirmed that Chelsea received a humungous £58m from their 2018 Champions League campaign.

As for the 2019 Europa League campaign based on the guidance provided by UEFA on distributions, Chelsea stand to make the around £30m from the trophy winning exploits. This is a £28m drop in prize money despite winning a trophy, showing why the top six fight tooth and nail for those top four places.

In total, broadcasting is revenue is likely to fall by around £27m to £177m, a drop of 13%.

Commercial Revenue

Chelsea saw a big boost in commercial revenue in 2018, rising from £140m to £170m on the back of their lucrative Nike kit deal.

No such big deal was secured in 2019 meaning the rise will be a lot less. Chelsea did secure a lucrative new sleeve sponsor in Hyundai worth £5m a year while Chelsea would have also secured new partnerships with commercial companies.

Therefore, we suspect a rise of around £12m to £182m to a prudent estimate for the Blues.

Total Revenue

Overall despite a trophy winning season, there was always likely to be a drop in revenue following their inability to qualify for the Champions League.

Combining the above predictions, Chelsea are likely to see a £18m drop in revenue from £448m to £430m, almost entirely due to their drop from the Champions League to the Europa League, despite winning the competition.

A larger rise in commercial revenue than predicted here would close the gap (while a smaller one would widen it). Chelsea did fortunately qualify for the Champions League for the 19/20 season so their revenue should bounce straight back up (provided they reach the knockout stages).

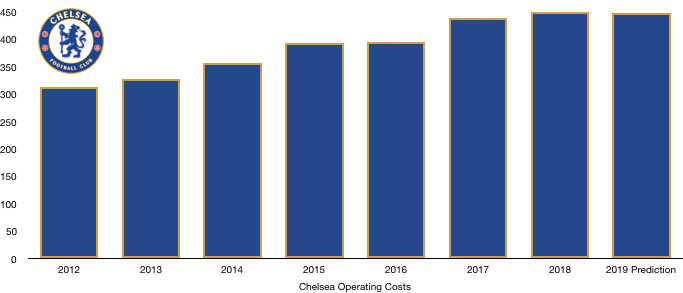

Costs Prediction

With record revenue came record costs for Chelsea in 2018, with costs breaking the £500m barrier for the first time at £524m, well in excess of their revenue last year, showing their lack of profitability.

Fortunately, costs are likely to experience a smaller increase than in 2018.

Amortisation

Chelsea had amortisation of £127m in 2018, up from £90m in 2017 due to reinvestment in the playing squad.

In 2019, Chelsea broke the world record transfer fee for a goalkeeper in Kepa (£72m) to replace the outgoing Courtois (£32m). The other big transfers were Jorginho and Pulisic (who joined in January and was loaned back to Dortmund for the remainder of the season).

Based on the transfer fees and contract lengths of the new signings and those sold, we expect amortisation to rise by around £18m to £145m for Chelsea. This is on the basis that both Courtois and Fabregas had already been amortised to close to zero when they were sold.

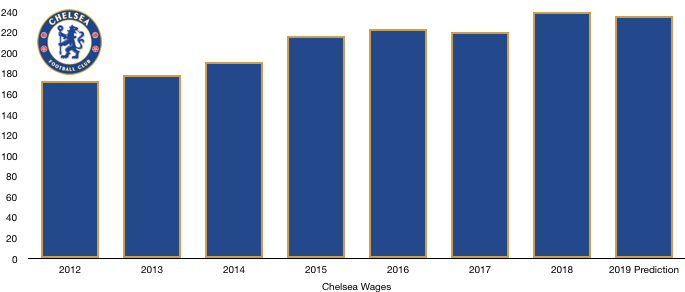

Wages

Chelsea have one of the world’s highest wage bills at £246m, only Manchester United, Manchester City and Liverpool had greater wage bills in the Premier League than Chelsea.

Wages are the most difficult area of finances to predict due to the opaque nature and privacy of these amounts.

Chelsea signed Kepa, Jorginho, Pulisic (loaned straight back out), Higuain (on loan), Kovacic (on loan) and Green in 2018. They sold Courtois and Fabregas while they also loaned out a whole host of fringe players.

Based on the data available, wages are likely to fall by around £10m to £236m based on the loaning out of a large number of players. The wages may however be higher if they are paying the wages of any of the players loaned out.

Other Costs

Chelsea have seen a steady rise in other expenses, rising from £129m in 2017 to £151m in 2018. We expect this to continue with a £10m rise in 2019 to £161m.

Chelsea are likely to have other costs relating to the sacking of Conte that will likely see costs rise. A rumoured pay-out of £9m is expected based on information from various sources, taking pay-offs by Abramovich to an outstanding £92m during his time at the club.

Total Costs

Based on these additional costs, we expect total costs to increase by around £27m from £524m to £551m, largely due to amortisation rising and the compensation due to Conte.

This means that before taking into account transfers, Chelsea continue to be losing money, approximately £80m, a huge amount that could quickly cause financial issues for Abramovich who will have to continue footing the bill.

Transfers Analysis

Chelsea had a busy summer of outgoings with various loan deals while key players had to be replaced. Courtois (£32m) was replaced with Kepa (£72m) and Fabregas (£8m) was replaced with Jorginho (£51m). Pulisic was also brought in for the 19/20 in anticipation of the sale of Hazard, which was duly completed and their now active transfer ban.

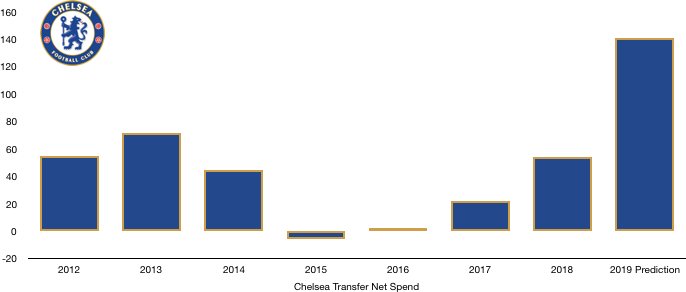

This took Chelsea to a net spend of £141m, up significantly on the £54m spend in 2018 as Chelsea looked to back Sarri in the transfer market, while they also had one eye on their transfer ban.

Kepa has proven a good signing despite a few troubles while the quality of Jorginho cannot be denied, fans are still adapting to his playing style and main qualities. Neither Fabregas nor Courtois were particularly missed.

With sales much lower than in 2018, there will be a steep drop off in profit on players sales which was £113m in 2018. Courtois and Fabregas were sold for a combined £40m and this should be all profit based on both players being at the club for a long time. Therefore, Chelsea’s profit on player sales is likely to fall by a huge £73m, meaning profitability will take a huge hit.

This may be reduced slightly by the number of loan fees the club received in 20189which is likely to be between £15-20m.

Chelsea are in an okay position regarding transfer fees owed. Chelsea owe clubs a huge £136m in fees in 2018/19 and a further £33m after this, however they are also owed £92m in 2018/19 and £58m after this.

Therefore, Chelsea are in a net creditor position of £44m this year however after that date they are owed £25m so the differences aren’t huge and shouldn’t affect transfer plans.

Profit/Loss Prediction

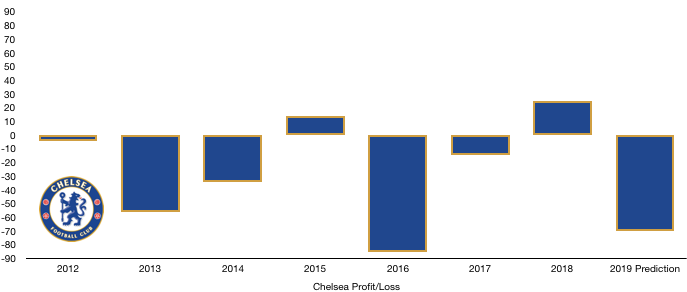

Chelsea made a profit before tax of £30m in 2018, largely due to profit on player sales of £113m.

With revenue due to fall by £18m, costs to rise by £27m (including Conte compensation), profit on player sales to fall by £72m and loan fees to up around £17m, we expect profits to fall by an eye-watering £100m, meaning a loss of around £70m in 2019.

This isn’t great new for Chelsea and their owner, although it would largely have been expected due to the lack of Champions League football, lack of player sales and the sacking of Conte.

With the return to Champions League football and the sale of Hazard, this is merely a timing issue with Chelsea likely to return to a profit in a huge way next year so fans should not worry too much.

The only issue is without player sales, the underlying profitability is poor and unsustainable, however this is an issue common for the majority of Premier League clubs.

I hope you enjoyed this article! Share with a Chelsea fan and look out for when the actual finances are released to see how we fared!