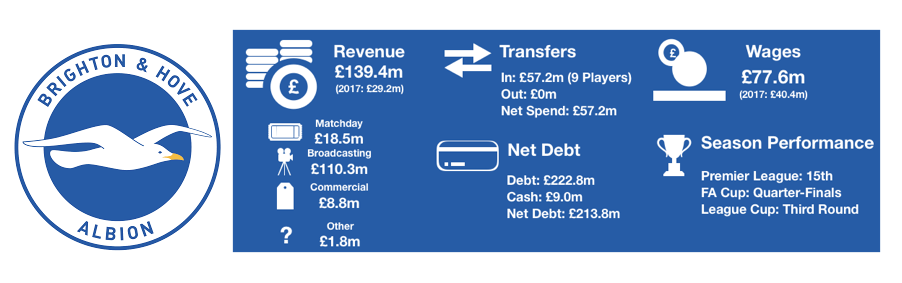

Brighton enjoyed their first-ever season in the Premier League. A 15thplaced finish exceeded many people’s expectations and a solid FA Cup run meant it was an unforgettable season for Brighton fans.

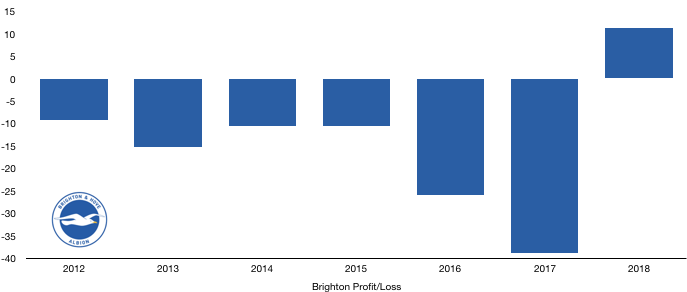

Brighton’s newfound Premier League status yielded huge boosts to their finances as the club recorded their first profit in years at record levels of £11.3m after recording a loss of £38.9m last year, showcasing the riches available in the Premier League.

Let’s delve into the numbers.

Revenue Analysis

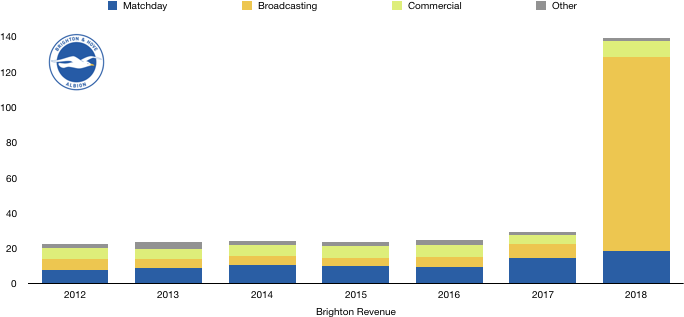

Brighton saw their revenue soar to record heights, rising from £29.2m to £139.4m (377%) as the riches of the Premier League flowed into the club.

Matchday revenue rose from £14.8m to £18.5m (25%) as attendances grew on the back of promotion from 27,966 to 30,403 (9%) and ticket prices also rose, boosting matchday takings considerably. A run to the FA Cup Quarter Finals also boosted revenue by providing two extra home games.

Broadcasting revenue increased by over £100m, rising from £7.7m to an eye-watering £110.3m (1,332%). The Premier League really showed the reason for its tag as the richest league in the world by this astronomical rise in revenue for Brighton.

Brighton were shown on TV for 13 Premier League games and achieved a solid 15thplaced position, while they also reached the FA Cup Quarter Finals which further boosted their broadcasting revenue.

The new Premier League status of Brighton yielded new opportunities for commercial growth which they took full advantage of. Commercial revenue increased from £5.1m to £8.8m (73%), a figure that should only grow as long as Brighton stay in the Premier League.

Other revenue increased from £1.6m to £1.8m (13%).

Looking ahead Brighton should see another rise in revenue this season. Matchday revenue should increase slightly due to their run to the FA Cup Semi-Final and increasing attendances. Broadcasting revenue should increase due to their FA Cup exploits, however should they finish 16thor lower, revenue may actually fall. Brighton’s commercial revenue should increase to £10m+ otherwise it would have been a disappointing commercial campaign.

A target revenue of £145m sounds reasonable, with the hope of pushing past the £150m barrier a possibility.

Costs Analysis

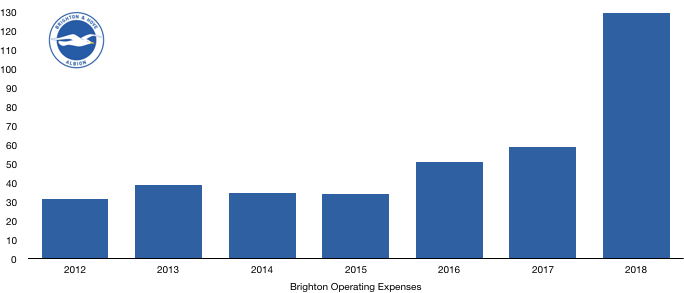

Brighton saw their costs more than double, soaring from £59.0m to £130.0m (120%). This rise in costs still paled in comparison to the rise in revenue, meaning profitability was strengthened significantly.

Player investment on promotion was apparent due to amortisation more than tripling, increasing from £6.3m to £19.3m (206%). Brighton made sure they were Premier League ready by recording their largest ever transfer spend.

Costs also rose due to investment in the women’s squad (part of the above amortisation) and investment in club facilities (which increased depreciation significantly).

Brighton also saw facilities damaged or that were no longer fit for purpose, which led to an impairment of £1.9m on certain equipment and facilities.

Brighton also had interest charges of £785k in the year due to interest on transfer fees which were not yet paid after negotiating instalments on their recent transfers.

A tax charge of only £0.8m was paid in the year, an effective tax rate of 6.6%. This is mainly due to Brighton being able to offset this year’s profit with previous losses the club recorded to reduce their tax liability.

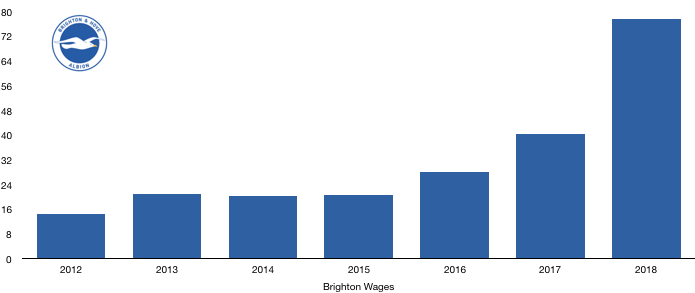

Wages nearly doubled, increasing from £40.4m to £77.6m (92%) as new Premier League ready players attracted Premier League level wages while current players were rewarded with new, lucrative contracts and bonuses.

The increase in wages cost Brighton an eye-watering extra £715k a week, a huge sum for a club the size of Brighton, although not unusual when clubs are promoted to the Premier League for the first time.

Directors saw a modest rise in salary despite survival, as remuneration rose from £1,673k to £1,855k (11%). Their CEO, Phil Barber, has attracted interest from other Premier League clubs so Brighton may be forced to increase this substantially this year to hold onto their talented CEO.

Looking ahead, Brighton’s costs are only going to increase as long as the club remain in the Premier League. New players will attract higher wages year by year while higher transfer fees will increase amortisation as well.

Transfers Analysis

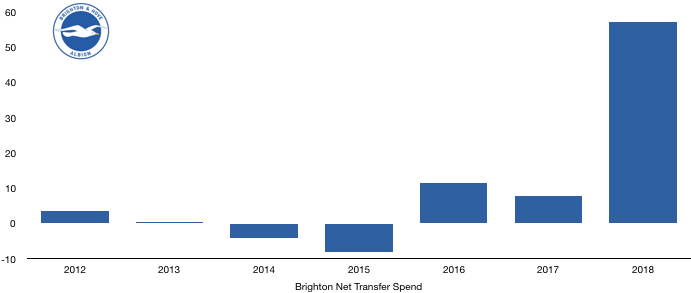

Brighton had a busy transfer window of incoming players, with 9 players joining. Surprisingly, Brighton did not sell any players for transfer fees in the season (although Murphy and Goldson left in June before the end of Brighton’s financial year, affecting finances slightly).

In came Locadia (£15.3m), Izquierdo (£13.5m), Propper (£11.7m), Ryan (£5.4m), Suttner (£4.1m), Gross (£2.7m), Schelotto (£2.7m), Norman (£1.3m) and Ahannach (£0.5m) for a combined £57.2m.

With no outgoings, Brighton recorded a record-breaking net transfer spend of £57.2m, their third successive net transfer spend.

All the signings contributed to their Premier League survival with Gross proving to be one of the signings of the season while Propper, Ryan, Izquierdo and Locadia all impressed.

Brighton recorded a profit on player sales of £3.4m as the 2018/19 summer transfer sales of Goldson and Murphy were completed in June, before the end of Brighton’s financial year so was included in their finances despite not relating to the 17/18 season.

In cash terms, Brighton saw a huge outflow in cash as they spent £41.7m in cash and only received a measly £0.7m.

Brighton also owe a further £19.0m (of which £9.9m is due this year) while they are only owed £2.9m (of which £1.5m is due this year), a net position of owing £16.1m (of which £8.4m is due this year).

Although not ridiculously large, this may still affect future transfer plans.

Brighton could also potentially owe a further £6.3m if certain transfer clauses are met, although they could potentially be due £3.3m themselves if certain transfer clauses are met in their favour.

Debt Analysis

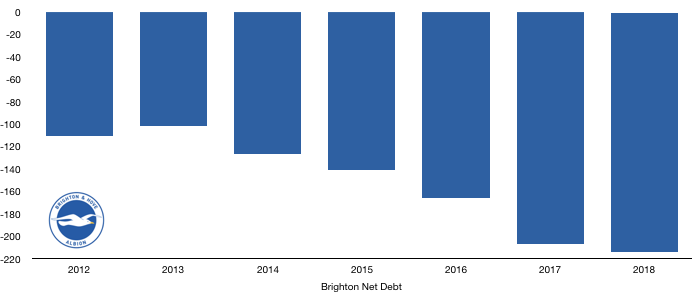

Brighton’s first-ever Premier League season saw a huge increase in their cash reserves, taking them from an overdraft of £16.2m to having actual cash of £9.0m, a £25.2m swing.

This improvement in cash was largely due to the astronomical rise in revenue and the profit this brought. This cash was largely committed to transfers (£40m) and improving the club facilities (£10m). This did need a bit of funding, and their owners obliged by providing a loan of £32m.

The above mentioned loan from their owners of £32m increased their debt from £190.7m to £222.8m (17%) as A G Bloom provided further interest-free loans to Brighton to help their successful survival battle. This huge £223m of investment to date shows the huge sums it can take to bring a club to the Premier League.

However, this is only the start and further investment is likely to be needed to keep Brighton in the Premier League.

Net debt rose slightly, increasing from £206.9m to £213.8m (3%) as the rise in cash was bested by the rise in owner debt. Brighton are well on their way to becoming a sustainably run club, although their Premier League status is paramount to this goal.

There is still some way to go and further investment will be required before they are self-sufficient which is likely to take another 3/4 years of Premier League football. The current investment and funding is being spent wisely, improving both the playing squad’s quality and the quality of their facilities and as long as this continues, the club are in safe hands.

Thanks for reading – Share with a Brighton fan!