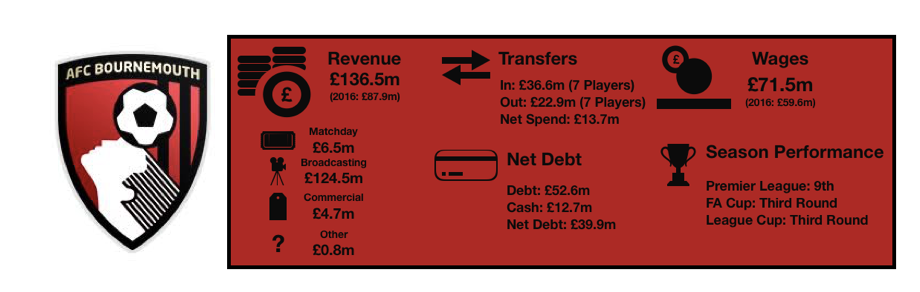

Bournemouth had a good season, finishing in the Premier League top half when survival was always the main target, achieving their highest ever Premier League finish and securing their third consecutive season in the Premier League.

Despite this success, a poor cup campaign reduced the late season excitement once survival was secured, something they will be looking to improve on in coming seasons.

Off the pitch survival told, Bournemouth’s profits soared from £2.4m to £14m after significant losses in the previous 4 seasons prior to last, showcasing the importance of Premier League survival.

Note that Bournemouth changed their accounting period so this period was only for 11 months compared to the usual 12 months, reducing their figures slightly.

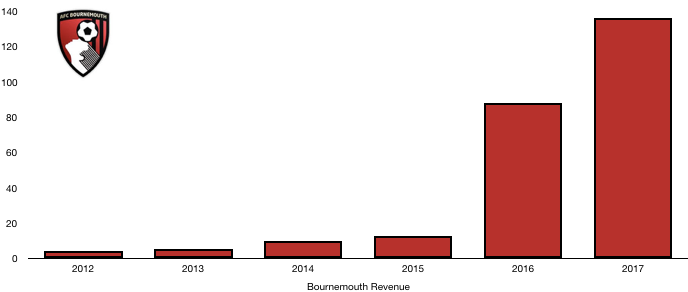

Revenue Analysis

Bournemouth have significant revenue growth with revenue increasing from £87.9m to £136.5m (55.3%) due in most part to the increased Premier League TV deal, with revenue falling in all other areas.

Matchday revenue fell slightly from £6.7m to £6.5m (3%) due to the introduction of the Premier League away ticket price cap (and the 11 month period). Bournemouth always struggle with matchday income due their small stadium size limiting revenue capabilities from this source and will look to find ways to rectify this through a new stadium or expansion.

Commercial revenue worryingly fell from £5.1m to £4.7m (7.8%), something that will need to be improved on if the club want to continue being competitive in the Premier League financially.

Broadcasting revenue soared due to record levels on the back of the new TV deal and a 9th place finish. Broadcasting revenue rose from £75.2m to £124.5m, a huge 65.6% increase which further showcases the importance of a good Premier League season to clubs.

Other revenue also fell slightly to £0.8m from £0.9m (11.1%).

Revenue is likely to increase slightly in the coming year, partly due to a full 12 months of accounts compared to the 11 for this season. Elsewhere a lower league finish is likely which will reduce earnings however a EFL Cup Quarter Final may help offset this loss of earnings. Commercial revenue improvements will be crucial and those in charge will be hoping for a good season in this regard.

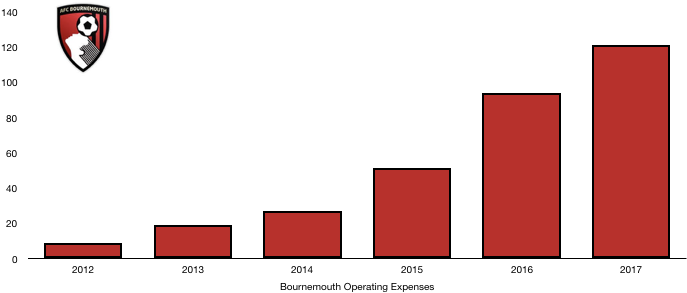

Expense Analysis

Bournemouth saw a sizeable increase in their costs over the year as they rose from £94.3m to £121.4m (28.7%) as the club continue to invest in their playing squad.

Amortisation costs rocketed from £13.2m to £19.6m, a huge 48.5% increase after the club’s transfer additions increased the value of their squad as detailed in the next section.

Finance costs fell ever so slightly to £1.5m, all due to the shorter accounting period as finance costs remained stable.

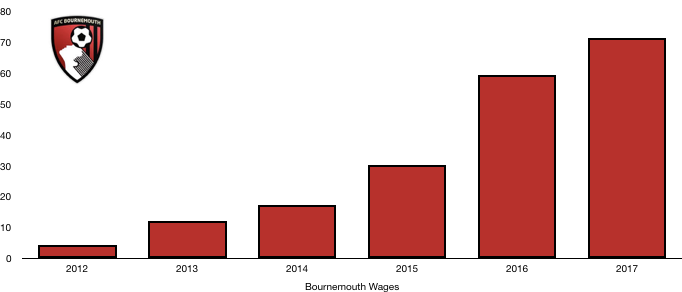

Wages continued to rise as the Bournemouth sign new players that command more lucrative wages than their existing players as they continue to improve the squad. Wages rose from £59.6m to £71.5 (20%), this represented an extra £229k a week to the club.

Their highest paid director, likely to be Chief Executive Neill Blake, was paid £1.2m in the year.

The club also only paid £0.7m in tax on their profits, working out as an effective tax rate of 4.8% as the club utilised their losses from previous years.

Bournemouth will expect expenses to continue to rise as the club consolidate their Premier League presence while improving the squad with higher paid players and new contracts to their existing stars.

Transfers Analysis

Bournemouth spent modestly in the year, seeing 7 players join the club and 7 leaving in what seemed to be an 1 in, 1 out policy.

Incoming were Ibe (£16.2m), Cook (£6.3m), Mousset (£5.9m), Smith (£3.2m), Wilson (£2.1m), Ramsdale (£0.8m) and Wilshere on loan (£2.1m) for a combined fee of £36.6m.

Out went Ritchie (£10.8m), Elphick (£3.5m), Murray (£3.2m), Tomlin (£3.2m), Rantie (£1.6m), O’Kane (£0.5m) and MacDonald (£0.3m) for a combined £22.9m.

This saw Bournemouth finish the season with a net spend of only £13.7m, considerably down from last year’s net spend of £49.0m – a 72% drop in spending.

This didn’t stop bournemouth from recorded their highest league finishing despite their new young signings struggling to bed into the squad with their best yet to come.

The club also recorded a loss on player disposals of £1.2m compared to last year’s £10.7m.

The club paid out £25.2m in cash with respect to these and previous transfers while only receiving £5.1m cash from players they have sold, this was still more than the big fat zero they received last year.

Assets/Liabilities Analysis

As Bournemouth strive to improve and be financially competitive, Bournemouth have spent the surplus cash reserves built up as cash levels dropped from £33.5m to £12.7m, a huge 62.1% fall in cash reserves. Player purchases and repayments to creditors were the primary uses of these cash as the club settle liabilities and invest in the paying squad.

Debt levels remained relatively stable at £52.6m, the slight fall primarily due to the shorter 11 month period with a small amount of the fall due to repayments on loans exceeding new loans secured by £0.7m.

The plummeting cash levels have led to their net debt position more than doubling from £19.8m to £39.9m (101.5%) which may cause some concern to the club’s supporters however it is necessary for the club to grow.

Bournemouth have also committed £3.8m to improving the club’s facilities as they look to improve the training environment.

The club may potentially be liable to pay £19.5m in future transfer fees should certain clauses be met with only £6.7m receivable should players sold meet certain clauses.

I hope you enjoyed the article, share with a Bournemouth fan!

95m in debt, not sustainable. Those in charge are masking the true state of affairs. We need Champions League football to build the planned stadium, not happening.