2018 was a difficult year for Barnsley as they battled bravely against relegation to no avail. The mid-season departure of Paul Heckingbottom to Leeds was a huge blow and didn’t help their battle for survival in the Championship as the club fell to a 22ndplaced finish.

Off the pitch, their long-time owners, the Cryne family, sold 80% of the club to international investors. Shortly following this, Patrick Cryne passed away, may he rest in peace following his services to the club. His son, James Cryne, continues to hold the 20% stake in Barnsley.

Barnsley did return to a loss-making position last year however, the fall in player sales being the main reason. Barnsley recorded a loss of a measly £0.2m (essentially breaking even), after recording a £12.8m profit last year (of which £13.6m related to player sales).

Let’s delve into the numbers.

Revenue Analysis

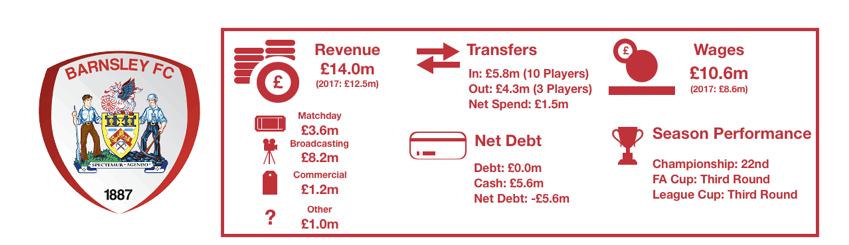

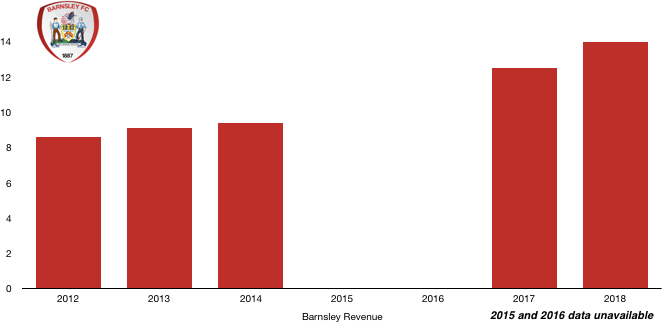

Barnsley’s second successive season in the Championship brought with it an increase in revenue. Revenue rose from £12.5m to £14.0m (12%).

Matchday revenue fell slightly from £3.7m to £3.6m (3%) as attendance fell slightly as relegation loomed. Barnsley will be hoping a more successful season in League One will see matchday revenue rise.

Broadcasting revenue increased despite relegation, rising from £7.2m to £8.2m (14%) as the club benefitted from an increase in distributions from the EFL. Broadcasting revenue will experience a large fall after relegation as the prize money available in League One is much lower than that available in the Championship.

Commercial revenue increased from £1.1m to £1.2m (9%) despite relegation as Barnsley managed to attract new sponsors. Barnsley will be hoping they can retain these sponsors despite relegation as they plot an immediate return to the Championship.

Other revenue doubled from £0.5m to £1.0m (100%).

Looking ahead, Barnsley will see an inevitable drop in revenue as broadcasting revenue plummets following relegation. The magnitude of the fall will depend on whether they can bounce back immediately and also whether they can increase matchday or commercial revenue which is a possibility but will be difficult.

Costs Analysis

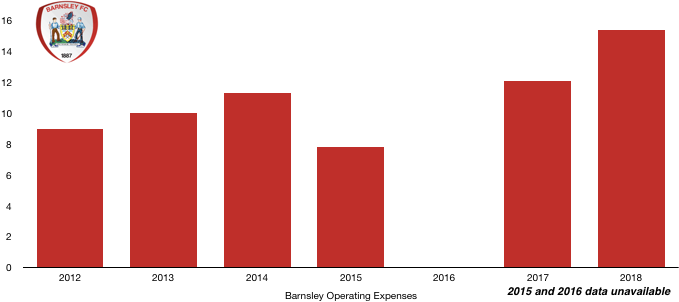

Barnsley saw a rise in costs as they attempted to avoid relegation. Costs rose from £12.1m to £15.4m (27%), a rise that is significantly more than the 12% growth in revenue, hence Barnsley’s profitability took a hit.

Amortisation doubled from £1.1m to £2.2m (100%) as the club invested more heavily than usual in their playing squad as they looked to push on last season following survival in the previous campaign. This unfortunately didn’t materialise.

Lease charges on facilities remained stable at £150k.

Interest charges rose 54% from £100k to £154k.

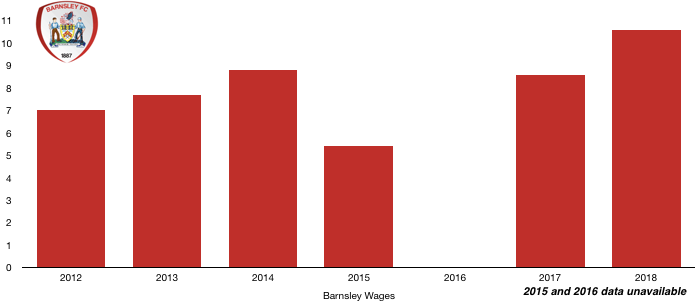

Barnsley’s wages increased significantly from £8.6m to £10.6m (23%) as the club invested in their players and attracted new players at higher earnings. This rise would have been larger had it not been for relegation and the relegation wage drop clauses that brings.

This wage rise is the equivalent of an extra £38k per week, a lot for a club the size of Barnsley.

Directors also saw their wages rise significantly, increasing from £131k to £185k (41%) despite relegation, maybe a sign of good will to the directors staying following a change in ownership.

Looking ahead, costs are likely to fall as the club reacclimatise to life in League One. Relegation wage drop clauses will come into full effect. However, Barnsley did not sell many players this season in the hope of an immediate return to the Championship so wages and costs in general may not fall that much. If this is the case, Barnsley may experience a big financial loss this year.

Transfer Analysis

Barnsley had a very active transfer season last year as they attempted to kick on in the Championship with a raft of new players.

In came McGeehan (£1.0m), Thiam (£1.0m), Moore (£0.8m), Potts (£0.8m), Pinnock (£0.5m), Pearson (£0.5m), Knasmullner (£0.5m), Lindsay (£0.4m), Mallan (£0.3m), McCarthy (£0.2m) for a combined £5.8m.

Exiting Barnsley were Roberts (£3.6m) and MacDonald (£0.7m) for a combined £4.3m.

This led to a net spend of £1.5m, a huge change from last season’s negative net spend of £9.8m.

Despite staying up last year, the exits of key players Bree, Mawson and Hourihane have come back to bite Barnsley and the investments made were not enough to combat this and survive.

Barnsley recorded a profit on player sales of £3.8m in the year on the back of the two player sales, down from £13.6m.

Interestingly, Barnsley spent cash of £5.2m in the year on transfer fees but only received £10k cash after apparently negotiating terrible payment terms on the sale of Roberts and MacDonald.

Even more interesting is that their accounts say they are only owed £2.6m in transfer fees so the rest of the fees must be contingent based. In contrast, Barnsley owe clubs £1.3m in transfer fees, all of which is due this year.

Barnsley may owe a further £3.3m based on contingent transfer fees that will become payable should certain transfer clauses be met.

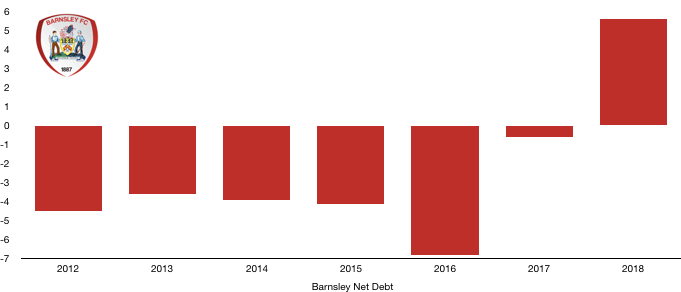

Debt Analysis

Barnsley have historically been a well-run club financially with low levels of debt and this continued and even improved this season.

Cash levels fell slightly from £5.7m to £5.6m (2%) as the club reinvested the majority of the cash received from last season’s transfers on new players and higher costs.

Barnsley are now also remarkably debt free! Their owners converted their loans into share capital to eliminate their debt completely and will now only benefit from the club being successful when they choose to sell. The debt was converted as part of the acquisition of the club and means they are now self-sufficient.

This led to the club moving into a net cash position of £5.6m which is fantastic news for the club.

Now it will be interesting to see where the club goes from here. Promotion is very much on the cards so the fans will be hoping that their new owners invest more cash into the club or makes use of their cash reserves of £5.6m, although this amount may be needed to combat the fall in revenue Barnsley will experience on the back of last year’s relegation.

It is also worth noting that Barnsley are well within the Financial Fair Play rules and should have no problem meeting its requirements for the foreseeable future.

Thanks for reading – Share with a Barnsley Fan!