2018 was a year that finally brought change for Arsenal being their final season under legendary manager Arsene Wenger, who many feel out-stayed his welcome. His final season wasn’t how things were meant to end with a 6thplaced finish in the league and a trophy less cup campaign (other than the Community Shield).

This year also represented Arsenal’s first season without Champions League football since 1998 and it began to show in their finances. Arsenal did in fact make a huge profit of £56.6m, up 60% on last year, but the underlying finances tell a different story with the profit solely due to player sales and the sale of a property (bet you didn’t see that coming).

This article analyses Arsenal’s financial status in detail, now let’s delve into the numbers.

Revenue Analysis

Arsenal saw revenue down from last year due mainly to the lack of Champions League football. Revenue was down from £427.1m to £406.4m (5%).

Matchday revenue fell from £100.0m to £98.9m (1%) as the pricing of tickets for Europa League games were lower than those for the Champions League, this combined with no FA Cup run meant that matchday takings took a slight hit, despite more home games.

Broadcasting revenue also fell, falling from £198.6m to £180.1m (9%) as Arsenal felt the lack of Champions League football despite reaching the semi-finals of the Europa League and only reaching the last 16 of the Champions League last time out. They also lost approximately £1.9m from falling one place in the Premier League.

Commercial revenue also took a hit which may be the most disappointing and unexpected. Commercial revenue fell from £117.2m to £106.9m (9%). Commercial income was down due to fans spending less on merchandise as they became angrier towards the end of Wenger’s era and the global brand of Arsenal fell as the club’s results continued to decline, leading to lower sponsorship opportunities.

‘Other’ revenue rose sharply, increasing from £8.1m to £17.3m (114%). Arsenal also operate a property business alongside football (for reasons I’m not sure of) and have done pretty well from it. Of the £17.3m, £15.0m relates to the sale of a property next to Holloway Road Station. The rest is related to ‘player trading’.

Looking forward, I would expect revenue to remain at a similar level to this year, possibly falling even due to the lack of property sales likely as the club has pretty much cleared its property portfolio. For revenue to rise a Europa League victory is necessary and a solid commercial campaign.

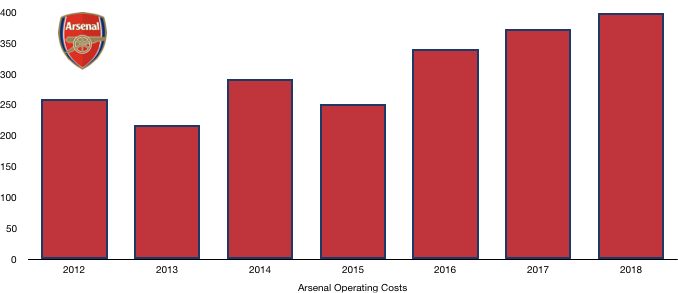

Cost Analysis

While Arsenal’s revenue is falling, its costs are rising, significantly hurting their profitability, now relying on player sales to return a profit. Costs rose from £372.0m to £445.3m (20%), a hefty increase.

A big part of this was a rise in amortisation, which increased from £77.1m to £91.8m (19%) as the club replaced some old timers such as Walcott (who no longer attracted amortisation due to being at the club for so long) with new, expensive blood. Normally a rise in amortisation indicates investment whereas in this case it’s just reinvestment of funds as the net spend was negative.

For the property sold mentioned earlier, Arsenal also had costs of £9.4m that were incurred on the property, leading to a net profit of £5.6m.

Wages were also on the rise, increasing from £199.4m to £240.1m (20%) as Arsenal abandoned their strict wage control to tie down Ozil to a bumper new contract and also to sign Aubameyang.

Many will see this as a step in the right direction however the haphazard nature of their wages now may unsettle the squad and has clearly impacted their current ability to buy players with only loans seen as being financially viable at the moment.

Of the huge increase in wages, it is worth noting that £16.8m relates to ‘exceptional costs’ which likely relate to Wenger leaving the club and a nice package for him to take away.

The increase in wages works out as an extra £783k a week which is an astronomical figure considering Arsenal also had many outgoings.

Elsewhere, Arsenal directors ‘earned’ £4.3m, up 26% on last year’s £3.4m total despite a poor season.

Arsenal saw net finances charges fall… thanks to Brexit! Arsenal’s underlying interest was similar to last year however a £3.3m gain due to favourable FX movements meant that their interest charges fell from £14.7m to £8.8m (40%).

Arsenal’s profits meant they paid tax of £13.7m, an effective tax rate of 19.5, broadly in line with the corporation tax rate of 19%.

Going forward, costs are likely to stay at similar levels as wages are likely to rise slightly again however such a rise will be offset by the lack of exceptional costs so we may even see a slight fall in costs and wages.

Transfers Analysis

Transfers are usually a sensitive subject for Arsenal fans due to the lack of ambition showed in the transfer market and it was no different this year.

In came Aubameyang (£57.4m), Lacazette (£47.7m) and Mavropanos (£1.9m) for a combined £107m, while Mkhitaryan joined in a swap deal with Sanchez.

Out went Oxlade-Chamberlain (£34.2m), Walcott (£20.3m), Giroud (£15.3m), Coquelin (£12.6m), Szczesny (£11.0m), Paulista (£9.9m) and Gibbs (£6.8m) for a total of £110m.

This led to a net transfer surplus of £3.0m compared to a net spend of £87m last year, a £90m swing. This huge drop off in spending has meant that fans are once again disgruntled as the club show again, they lack ambition to push on despite losing their top 4 spot and falling behind their rivals.

The new signings did well with Aubameyang and Lacazette adding much needed firepower however the back line is severely in need of investment.

Those leaving the club were not particularly missed however fans will be annoyed to have lost Szczesny, Coquelin and Paulista for fairly cheap given the state of the transfer market currently.

All these departures led to a profit on player sales of a remarkable £120m (£6.8m last year). This means that had the club not sold any players, a loss of £50.2m before tax would have occurred, before taking into account the property sale of an extra £5.6m in profit. These player sales are clearly masking a club whose finances are declining.

From these transfers Arsenal did pay net cash out of £28.6m as they have negotiated to receive transfer fees over a longer period, in contrast last year there was a net cash outlay of £102.5m.

Arsenal are also owed another £61.5m in transfers over next couple of years while they are owed £100.2m, meaning they are owed net £38.2m which further confuses on why they are so constrained in the transfer market currently. This will become even more confusing in the next section.

On top of this, Arsenal may also owe another £7.6m in contingent transfer fees should players meet certain clauses.

Debt Analysis

Arsenal incredibly saw cash levels increase this year which will perplex fans due to the insistence the club has no money to spend and only loans will currently do. Cash levels grew from £180.1m to £231.3m (28%) as the club decided not to spend any of the cash coming in from transfers and elsewhere and instead watching it sit pretty in the bank.

At best this is cautious, at worse it is negligent. Any business needs to reinvest its cash to expand and improve, Arsenal are not doing this and instead are letting the money go to waste by not using it to for any good purpose.

Even stranger is the fact that Arsenal have outstanding debt of £216.5m (down from £227.4m) which could at least be paid down to reduce interest charges if the club feel they don’t want to spend on transfers. All the debt is external debt and most likely could be paid down early to boost the club sustainability however the owners do not see it that way.

The above has led to Arsenal at least positively being in a net cash position of £14.8m compared to net debt of £47.4m. Arsenal’s owners seem wary to spend and this may be compounded by their worsening finances with the owners deciding to cautiously create a large buffer should their finances continue to worsen.

However, this feels to be a self-fulfilling prophecy and a lack of investment will see them perennially finish 6thif they don’t start investing or at least spending sensibly and smartly like their North London rivals.

Thanks for reading, share with an Arsenal fan!