Stoke City ended a decade of Premier League football with relegation after a dismal 19th placed finish. The knock-on effect of this relegation has huge ramifications on their finances going forward and even in their final Premier League season.

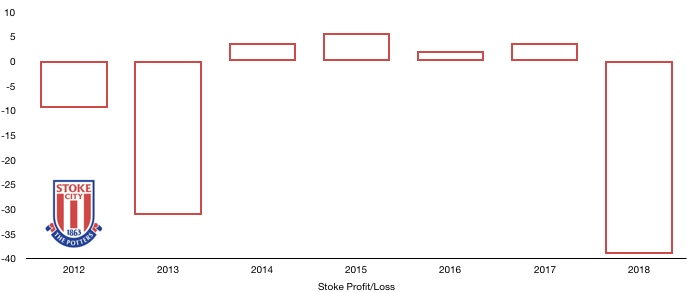

Despite no lack of investment in the playing squad, Stoke failed to meet expectations on and off the field leading to a huge loss of £31.9m after 4 years of profit. This loss was exclusively due to player related costs (excluding wages) which will be detailed below.

This article analyses the financial accounts of Stoke City for the 2017/18 season, let’s jump right into the numbers.

Revenue Analysis

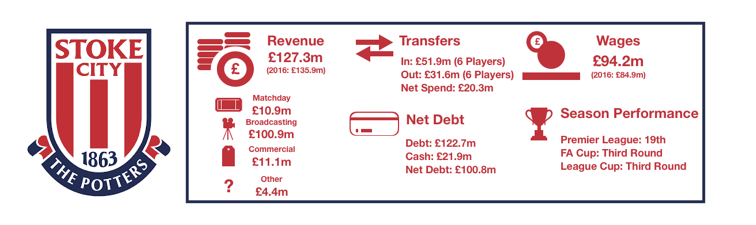

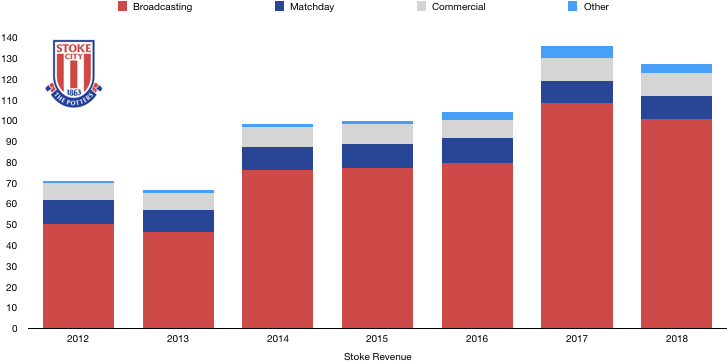

After year on year revenue growth since 2013, Stoke experienced their first of what is likely to be a long decline in revenue as revenue fell from £140.0m to £127.2m (9.1%).

Matchday revenue surprisingly increased albeit marginally, rising from £10.5m to £10.9 (3.8%). Being the club’s last season in the Premier League, their fans apparently didn’t want to miss the action, supporting their team passionately and commendably so until the end of the season. A return to the Championship is likely to see matchday revenue fall as ticket prices drop as well as attendance.

Commercial revenue remained stable, increasing by 1% to £11.1m as Stoke failed to attract new sponsors and will be worried of the impending departures as their current sponsors look to exit their deals. This is likely to see commercial revenue falling sharply next year as sponsors activate exit clauses and penalties relating to Stoke’s relegation.

Broadcasting revenue was the only area of revenue to actually fall, decreasing from £108.7m to £100.9m (7.2%) as the club finished 19th, 6 places lower than the previous season. This saw revenue drop by around £1.5m per place, with the club also achieving the same Third Round domestic cup performance as last year. Broadcasting will see the biggest drop in revenue as the riches of the Premier League will no longer be available to Stoke, with a drop of around 50% a big possibility.

Overall Stoke have a troubling financial year ahead with revenue likely to drop by more than a third to £70m or less as fans, sponsors and Premier League TV money begin to disappear.

Expense Analysis

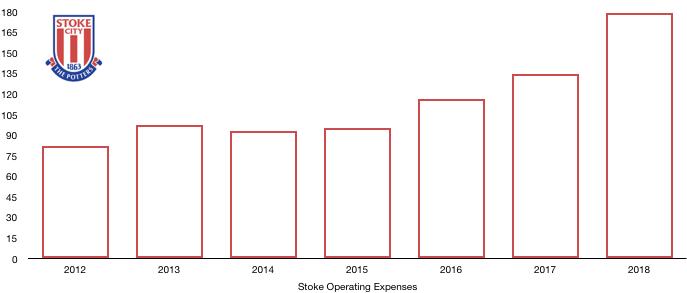

Stoke worryingly saw a large increase in their costs in 2017/18 despite poor performance and dropping revenue. Stoke’s operating costs rose from £134.8m to £179.7m (33.3%). This continues an upward trend in costs since 2014 for Stoke who grew in ambition after surviving a few years in the Premier League.

The main culprit for this rise was player amortisation which more than doubled from £23.6m to £55.9m (136.9%) with £29.4m of this due to impairment of players deemed worthless following relegation. Such an impairment is very rare and shows poor buying decisions given the size of the impairment. Outside of this, Stoke invested heavily in the club during the season with no success as the wrong players were purchased for large sums.

Lease rentals of the stadium and training ground remained at £2.1m.

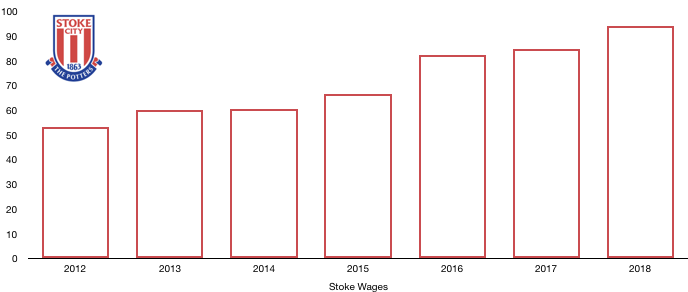

Wages also rose, increasing from £84.9m to £94.2m (11.0%) as new players joined for high wages, replacing players on lower wages in the process. This rise will be reversed next year as some high earners leave following relegation (e.g. Shaqiri) while relegation wage drop clauses are likely to come into effect. If such clauses were not in place for players such as Joe Allen and Charlie Adam etc. Stoke may struggle to remain financially competitive with such high wages on their books.

The wage rise is equivalent to an extra £179k a week.

As a personal cost to relegation, Stoke’s directors saw their pay fall from £806k to £711k (13.4%) after such a poor season.

With all of Stoke’s debt being from their owner, Stoke only have interest income which is minimal at £52k.

Stoke will need to get their costs under control after relegation unless they manage a quick return to the top flight, wages will fall next year as mentioned above as will amortisation as there is unlikely to be an impairment again as well as players likely to be leaving, reducing amortisation further. Stoke will be hoping to reduce operating costs to around £120m.

Transfer Analysis

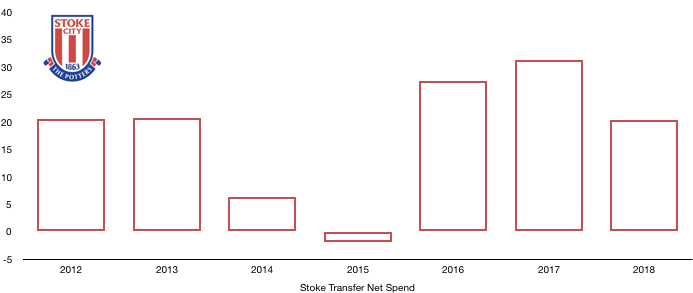

Stoke had a busy transfer season in 2017/18 with 6 players arriving and 6 departing the Britannia Stadium.

In came Kevin Wimmer (£17.5m), Badou Ndiaye (£14.4m), Kurt Zouma (Loan – £7.0m), Bruno Martins Indi (£6.9m), Moritz Bauer (£5.6m) and Konstantinos Stafylidis (Loan – £0.5m) for a combined £51.9m.

Out went Marko Arnautovic (£20.1m), Joselu (£5.0m), Phillip Wollscheid (£2.3m), Jonathan Walters (£2.1m), Glen Whelan (£1.5m) and Phil Bardsley (£0.8m) for a combined £31.6m.

This gave rise to a net transfer spend of £20.3m, down on last year’s net spend of £31.3m.

The transfers clearly did not go to plan with Wimmer in particular being an expensive mistake as the players failed to perform for Hughes or Lambert, costing Stoke their Premier League status.

One positive is the profit on players sales (from an accounting perspective) was high at £22.3m, primarily due to the sale of Arnautovic.

From a cash perspective, it was an expensive transfer window to as the club spent £56.4m in cash while only receiving £27.6m, giving a net cash outlay of £28.8m, slightly less than last year’s £30.6m net outlay.

Worryingly Stoke also owe a further £36.1m in transfers of which £30.3m is due in the next 12 months while they are only owed £18.9m in transfers of which all is due in the next 12 months.

Stoke have minimal contingent transfer clauses with only a potential outlay of £600k expected.

Net Debt Analysis

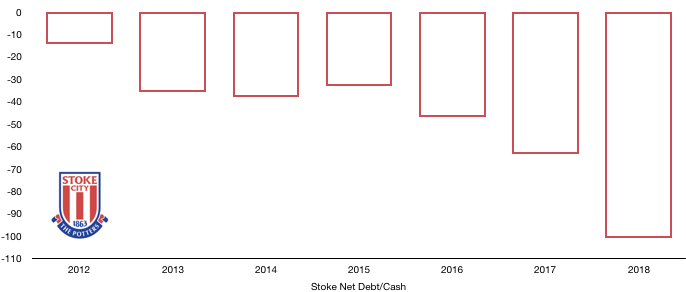

Stoke have a strong cash position as their cash in the bank rose, increasing from £12.4m to £21.9m (76.6%) despite making a loss this year as they brought in some transfer income (£27.6m) as well a cash injection from Mr. Coates of huge £47m.

As alluded to above, debt rose from £75.7m to £122.7m (62.1%) as Mr. Coates injected £47.0m in cash to help with the running of the club showing their financial vulnerability and lack of sustainability, it was also possibly required to comply with Financial Fair Play rules.

Peter Coates is most likely hoping to not have to continue plugging money into the club however this may be needed over the next couple of seasons to keep the club ticking over as they get their finances under control.

All in all, this means Stoke’s net debt rose from £63.3m to £100.8m (59.2%), a substantial increase that is not sustainable in the long run. Stoke must find a way to either control their costs or secure a rapid return to the Premier League, I know what their fans will be hoping for. However, after a poor start to the season it remains to be seen whether Mr. Coates will tighten the purse strings and focus on financial survival over promotion.

Stay tuned to Financial Football News for further in-depth analysis of the finances of all Premier League and Championship clubs and much more by following our social media platforms (via the logos at the bottom of this page) and signing up to our newsletter.