Manchester City had a record-breaking season on and of the pitch as their financial and footballing strategies continue to bring success.

On the pitch the investment in Guardiola has begun to pay off. Manchester City recorded the highest goals, games won and points ever in the Premier League, winning the division in the process. This was complemented by a League Cup win.

The overall goal of European glory was once again halted; however, many make them favourites this year, showing the progress made in recent times.

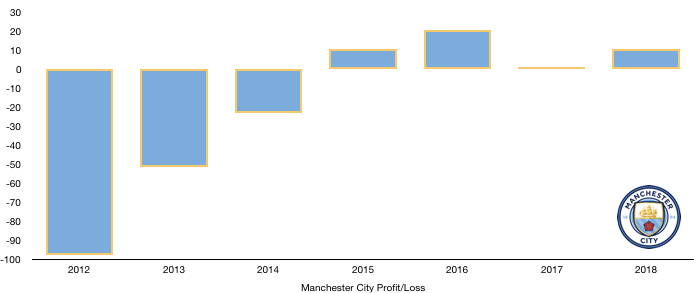

Manchester City achieved record revenue in excess of half a billion pounds while curtailing costs in order to become more financial sustainable. For the fourth year in a row Manchester City recorded a profit as they brought in £10.4m in profit this year.

Note that last year Manchester City changed their financial period to June. This meant there was a 13-month financial period last year which distorted results. As June is off season anyway, the main effect was reducing profits as it added an extra month of costs without any corresponding revenue.

Let’s delve into the numbers.

Revenue Analysis

As mentioned, Manchester City achieved record revenue in excess of half a billion pounds, growing revenue for the 10thyear in a row under their Abu Dhabi ownership. Revenue rose from £473.5m to £500.5m (5.7%) as revenue growth slowed as their sheer size makes growth more and more difficult.

Matchday revenue was the biggest growth area for Manchester City, increasing from £51.9 to £56.6m (9.1%) as Manchester City’s successes in the League Cup and the Champions League (to a lesser extent) added extra home games that helped boost matchday income. A record-breaking attendance of 54,073 at the Etihad Stadium this season also boosted this figure.

Broadcasting revenue rose only slightly from £203.5m to £211.4m (3.9%) despite winning the Premier League and League Cup, whilst also going further in the Champions League.

Commercial revenue is now vital to Manchester City’s financial strategy as it’s the main area where Manchester City can still grow substantially. It was another good year as commercial revenue grew from £203.5m to £211.4m (6.7%) as the club continued to grow in popularity due to their fantastic commercial strategy and playing style. The current deal with Nike is due to expire and a new more lucrative kit deal of around £50m a year is rumoured to be close.

Manchester City’s revenue is likely to continue to grow. Matchday income is likely to remain relatively stable while broadcasting revenue is entirely dependent on their successes on the pitch. The key area is commercial revenue which will probably rise between 5-10% next year.

Expense Analysis

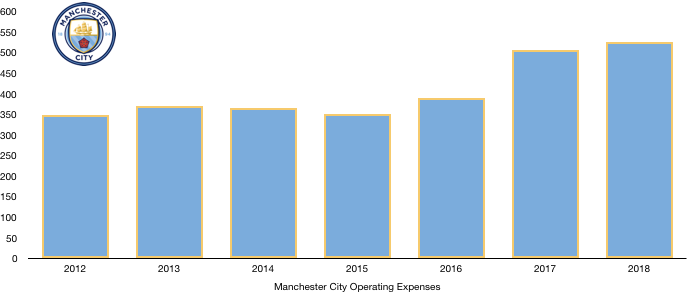

Manchester City saw a huge jump in revenue last year as they invested hugely in the Guardiola project however this year was different, and costs stabilised with a small rise. Costs to £506.0m to £525.7m (3.9%) as Manchester City look to control costs and increase profitability, all while being a success on the pitch.

Amortisation costs rose from £121.7m to £134.3m (10.4%) due to player investment and a large turnaround in players as 10 players joined and 13 departed the Etihad Stadium.

Net interest expense moved from a net interest income of £0.4m to a net expense of £1.9m as interest earned fell significantly and in repaying bank debt, Manchester City incurred additional costs of £0.7m.

Other general expenses rose from £94.2m to £105.3m (11.8%).

Manchester City paid no taxes in the year as they continue to have their profit offset against the large losses in the early years of Abu Dhabi ownership.

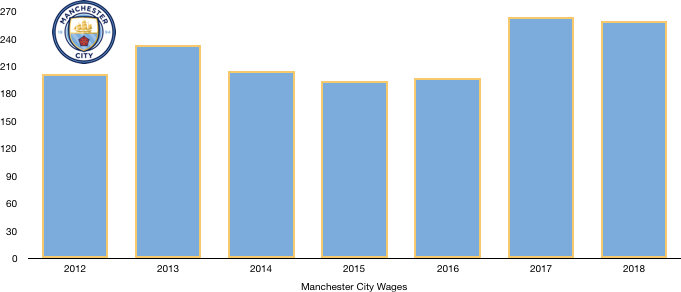

Wages surprisingly fell despite a huge transfer window, falling from £264.1m to £259.6m (1.7%) as the club sold/let go of many high earners who weren’t justifying their wages and were surplus to requirements. The likes of Bony, Nolito, Kolorov, Nasri, Clichy and Zabaleta all left.

This new tighter control of wages is helping to propel Manchester City to financial sustainability as they focus more on paying their stars huge money rather than attracting lesser talents on huge wages, Manchester City now having drawing power that means the wages offered to squad players need not be extravagant.

The drop in wages works out at a rather modest £87k less a week in wages.

No directors were paid in the period nor were any dividends paid due to having negative reserves currently.

Manchester City’s expenses will most likely remain relatively stable over the coming year. Mahrez was the only big arrival whilst Touré and Hart both departed meaning wages are likely to have in fact gone down, however new contracts to their Premier League winning stars will probably see wages increase slightly. Overall expenses are unlikely to increase by more than 5% to around £550m.

Transfers Analysis

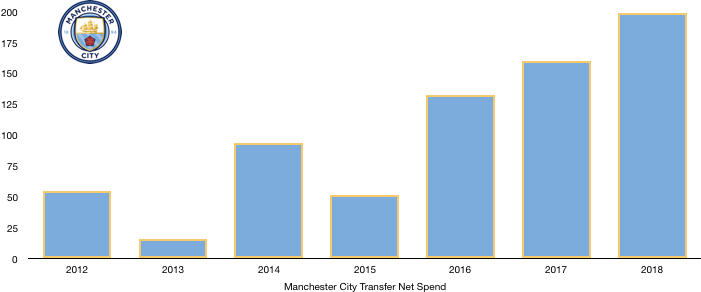

Manchester City were unbelievably active in last season’s summer and winter transfer windows buying 10 players while 13 departed.

In came Laporte (£58.5m), Mendy (£51.8m), Walker (£47.4m), Silva (£45.0m), Ederson (£36.0m), Danilo (£27.0m), Luiz (£10.8m), Harrison (£3.6m), Kayode (£3.4m) and Ilic (£2.3m) for a combined eye-watering £285.8m.

Leaving the club were Iheanacho (£25.0m), Unal (£12.8m), Bony (£11.7m), Mooy (£8.2m), Nolito (£6.3m), Fernando (£5.4m), Kolorov (£4.5m), Ntcham (£4.5m), Nasri (£3.2m), Hart (Loan – £2.1m), Sobrino (£1.8m), Zuculini (£1.1m) and Denayer (Loan – £0.5m) for a combined £86.7m.

In in all, Manchester City had a huge net transfer spend of £198.9m as they completely backed their new manager Guardiola following a disappointing first season.

He and their new players did not disappoint with Walker and Ederson proving key to their title win. Mendy would have added extra quality had it not been for injury while Danilo and Silva added significant strength in depth.

Of the players sold, only Kolorov could be argued to of been missed after Mendy’s injury with the rest not of the quality to improve Manchester City.

Manchester City made a large profit on player sales once again, earning £39.1m on these sales after selling long-serving players as well as a couple cheap youth players in Iheanacho and Unal.

Concerningly for Manchester City they owe other clubs a huge £140.5m in transfer fees, of which £102.2m is due in the next year.

This is offset a fair bit by being owed £83.1m in transfer fees, of which £53.6m is due in the next year.

Therefore, Manchester City are in a net owing position of £57.4m, of which £48.6m is due in the next year.

This is further compounded by the fact that Manchester City may owe another £158.9m in contingent transfer fees should certain clauses be met such as appearances and trophies. This may explain the lack of transfer activity of Manchester City this year however due to accounting rules, clubs do not disclose contingent transfer fees they could receive and as such they may have similar figures in this regard.

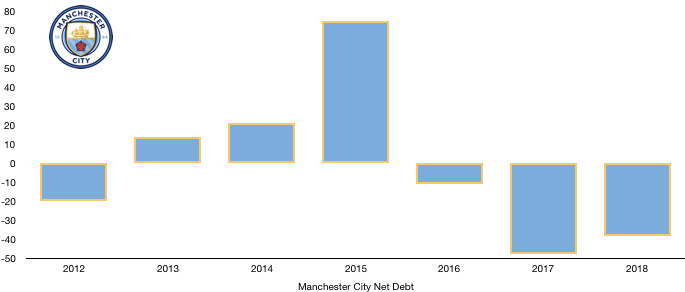

Net Debt Analysis

Manchester City released very little information relating to their cash flows this year despite their cash reserves increasing substantially, rising from £18.7m to £27.9m (49.2%) due to increased profits and incoming transfer fees received.

These added cash reserves help Manchester City to have a useful buffer should any financial surprises spring up.

Debt levels remained essentially the same, falling from £66.3m to £66.0m, however this debt is now all ownership debt after repaying all external loans this year and relates entirely to debt on the Etihad stadium of which £63.8m is due after 5 years or more so will have no short-term effect on Manchester City’s finances.

Hence net debt has fallen from £47.6m to £38.1m (20%) as Manchester City continue their drive to being financially sustainable and show their rivals how to operate efficiently and successfully.

Manchester City are quickly becoming a financial role model of a club and their rivals must wise up fast in order to compete on and off the pitch.

If you want to compare this to last year report, read it here.

Thanks for reading, share with a Manchester City Fan!