Newcastle are back in the Premier League after their shock one-year hiatus, winning the Championship and reaching their only goal of their season – promotion. The retention of Rafael Benitez was key to this as he kept fans on side and happy with the team.

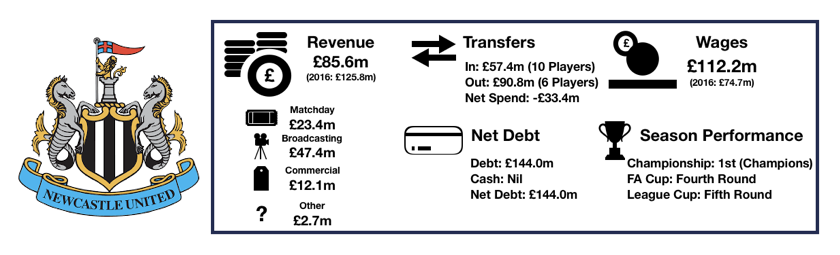

The effects of relegation were however felt this season when it comes to Newcastle’s finances with a huge loss of £41.3m for the year compared to a profit of £4.6m in the prior year, a massive £45m swing.

Let’s delve into the numbers.

Revenue Analysis

Revenue was unsurprisingly down, falling from £125.8m to £85.7m (31.9%) after three years of £100m+ revenue. All areas of revenue were down as Newcastle felt the full force of relegation.

Matchday revenue fell slightly, decreasing from £24.7m to £23.4m (5.3%), falling for the second consecutive year as fans begin to lose hope under controversial owner Mike Ashley. A mass exodus was avoided due to the retention of Rafael Benitez who the Newcastle fans built such a great affinity with despite his short tenure to date.

Broadcasting revenue dropped more significantly, falling from £72.7m to £47.4m (34.8%) after relegation caused them to miss out on the riches of the Premier League, with revenue only offset by the parachute payments Newcastle received. This shows the huge contrast in finances available with Newcastle not being able to gain anything extra having won the Championship and still experienced a drop of third in revenue.

Commercial revenue halved, falling from £25.1m to £12.1m (51.8%) after losing their Premier League status activated break clauses in their sponsorship deals while they also missed out on revenue from Premier League central sponsors. Despite the best efforts of Newcastle’s commercial team, the club could not attract new sponsors to bridge the financial gap.

Other revenue fell from £3.3m to £2.7m (18.2%).

Revenue is likely to soar to record levels after promotion back to the Premier League, with revenue likely to break the £150m barrier next season for Newcastle after an impressive 10th placed finish on their return. All areas are expected to rise with Commercial and Broadcasting revenue where the majority of this income will arise.

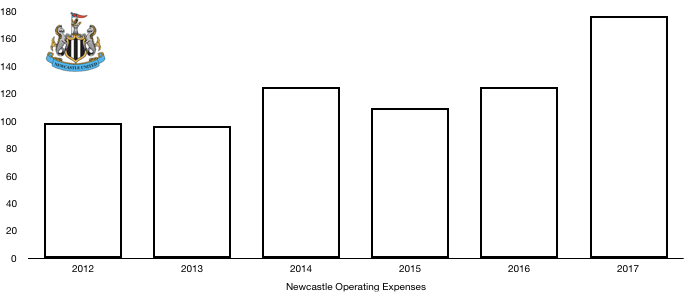

Expense Analysis

Newcastle’s expenses soared despite relegation worryingly, rising from £124.9m to £176.6m (41.4%) as the club chased an immediate Premier League return.

Amortisation costs which signify player investment, rose from £28.3m to £35.8m (26.5%) as the club spent heavily in the summer, and despite more significant outgoings in pure monetary terms, amortisation costs rose due to the initial costs of those outgoings being lower than the costs of those coming in with Wijnaldum and Sissoko being sold for significant profits.

Newcastle saw depreciation costs rise from £2.7m to £3.5m (29.6%) on the back of capital additions to the club’s infrastructure.

Newcastle had a good year from an interest point of view as they gained finance income of £1.9m after favorable conditions on their financial instruments as well as a change in complex accounting treatments.

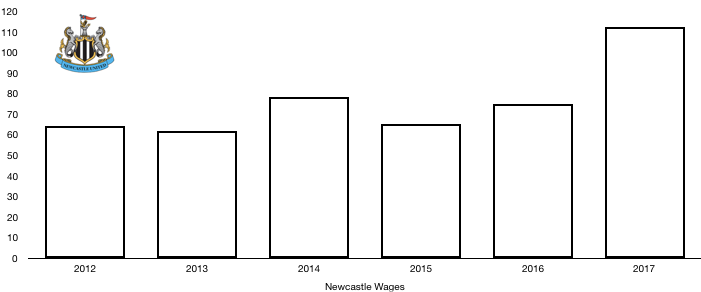

Wages grew hugely in the year, rising from £74.7m past the £100m barrier to £112.2m (50.2%) despite relegation which is unusual to say the least. This could be due to a lack of preparation for the Championship with players not having relegation wage drop clauses which has significantly hurt the club’s finances while the new signings also seem to have commanded sizeable wages. Newcastle would have also seen a huge bump in wages as they paid out on promotion bonuses and wage uplifts on the back of their promotion which won’t grate on the owners as it’s just a price of success. This huge wage increase was an extra £721k a week, burning a massive whole in Mike Ashley’s pocket!

The only director paid didn’t fare so well from this wage increase earning £150k, the same as last year, as payments were waved on the back of fan unrest as they looked to try and gain popularity to no avail. It was confirmed in the accounts that no pay was funneled through another group company.

Newcastle also had tax ‘income’ of £5.5m due to the large loss made this year and the fact it can be used against future profits in order to reduce future tax bills.

Transfer Analysis

There was plenty of transfer activity on tyneside as Newcastle looked to gain promotion back to the Premier League with 10 players going the Toon Army and 6 departing.

In came Ritchie (£10.8m), Gayle (£10.8m), Sels (£5.9m), Hanley (£5.9m), Clark (£5.4m), Yedlin (£5.3m), Diame (£4.9m), Murphy (£3.2m), Hayden (£2.6m) and Lazaar (£2.6m) for a combined outlay of £57.4m.

Out went Sissoko (£31.5m), Wijnaldum (£25.8m), Townsend (£14.0m), Janmaat (£8.0m), Cabella (£7.2m) and Cisse (£5.3m) for a combined inflow of £90.8m.

This saw the club gain a net income of £33.4m compared to a huge net spend of £93.2m last season, representing a monumental £126.6m swing in transfer spending as the club looked to improve their finances as they prepared for a season in the Championship.

The signings all did well under Benitez’s tutelage with Ritchie, Gayle, Yedlin and Diane in particular impressing while it was generally accepted Newcastle received good fees for the departing players in particular Sissoko.

Newcastle made a healthy £42.3m accounting profit on player sales due to purchasing the likes of Sissoko and Wijnaldum for minimal fees compared to the fee received this year.

In terms of cash however, Newcastle had a cash outflow due to unfavorable terms being agreed on the outgoing transfers with the majority due over four years. This meant Newcastle only received cash of £44.4m from transfers while paying out £55.5m meaning a net cash outlay of £11.1m however this is still a lot less than last year’s net cash outlay of £70,7m.

A good thing for Newcastle fans however is that the club are still owed transfer fees on past transfers of £66.2m, with £27.5m of that due in the current year which may loosen the purse strings further in the coming year. This is compared to Newcastle only owing £18.2m in past transfer fees however £14.6m of that is due this year.

Newcastle have a small amount of contingent transfers fees with a potential £3.9m due if certain clauses are met.

Assets/Liabilities Analysis

Newcastle saw debt levels rise understandably as they looked to return to the Premier League immediately, spending all that seemed to be available.

Newcastle have recently depleted cash reserves from the high of £48.3m in 2015 to the zero they have now as they entered their overdraft facility in order to maximise the usage of funds this year. This is a result of relegation and the large loss incurred this year and the fact the transfer fees they are owed are spread thinly over 4 years, hence the vital cash injection provided by Mike Ashley of £15m despite wanting to sell the club.

Debt levels also rose as a result of the after mentioned loan from Mike Ashley. Debt levels rose from £129.0m to £152.3m (18.1%) as the club also used an overdraft facility of £8.3m to meet short term cash needs. This also the first time in 3 years that Mike Ashley has made a net loan to Newcastle showcasing his desire for the club to be self sufficient however even he realized the paramount need to get back quickly to the Premier League for his chances of selling up.

This led to net debt levels rising from £127.3m to £152.3m (19.6%) as a result of the cash drop and rising debt which they will be hoping will reduce as they look to return to profitability on the back of promotion.

This however may be affected by their ongoing issues with HMRC that may result in a sizeable fine for unpaid taxes relating to the underpayment of National Insurance contributions that resulted in a search warranted being required by HMRC in a hugely publicized raid in 2015. No estimation has yet been made by Newcastle on the size of this potential fine.

Thanks for reading, share with a Newcastle fan!

Theo, thanks so much for the post.Really thank you! Keep writing.custom essay writing