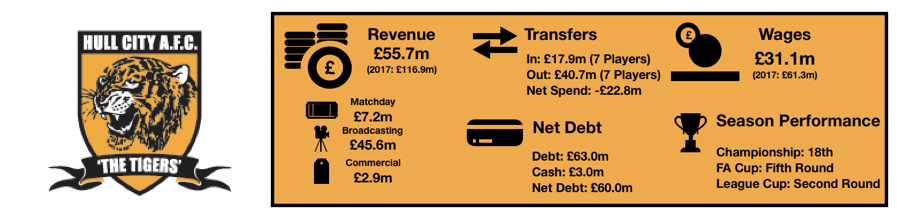

Hull are back in the Championship after a disappointing Premier League return saw the club relegated after an 18thplaced finish in the Premier League, a position they would achieve again in the Championship after a poor return to the division.

A decent FA Cup run to the Fifth Round was a brief highlight as the club struggled to reacclimatise to life in the Championship. Such a poor season has seen expectations diluted with the owners seemingly unwilling to spend big in order to achieve promotion.

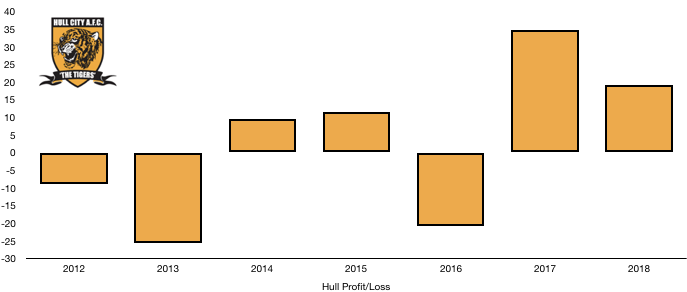

Relegation halved revenues however costs also fell by a similar level meaning the club still remained very profitable, achieving a profit of £19.3m which was still a drop from last year’s record-breaking £34.8m profit.

Let’s delve into the numbers.

Revenue Analysis

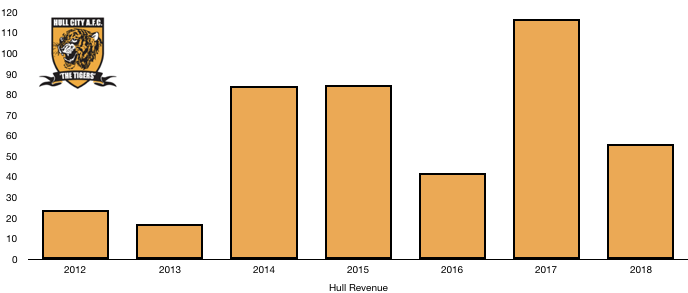

Hull were braced for a steep drop in revenue after relegation with 80% of their revenue coming from broadcasting revenue. This meant revenue more than halved from £116.9m to £55.7m (52.4). All areas of revenue more than halved for Hull as they saw first-hand the cost of relegation.

Broadcasting revenue has already been eluded to as the main cause of this huge drop, more than halving from £93.9m to £45.6m (51.4%) as the club saw significantly reduced TV payments, even with the parachute payments received. This figure will continue to drop as parachute payments drop unless Hull navigate a quick return to the Premier League.

Matchday income also fell significantly, falling from £16.1m to £7.2m (55.3%) as the lack of Premier League worthy opponents saw a fall in ticket prices and sales. Fans want value and the fall in value is clear to see with the lack of games against the likes of Manchester City, Manchester United and Liverpool.

A common theme is concluded by the huge drop in commercial income as it more than halved from £6.9m to £2.9m (58.0%) as sponsors ran away after Hull lost their Premier League status with the fall in brand exposure to companies large when not featuring on TV as much and even when they are, to a much smaller audience.

Hull will expect revenue to fall again next year as parachute payments fall. This could be balanced by an improved league position and improved domestic cup performances however matchday income is unlikely to rise significantly without vast improvements on the pitch and the same can be said of commercial income. We expect revenue to fall closer to the £45m mark.

Expense Analysis

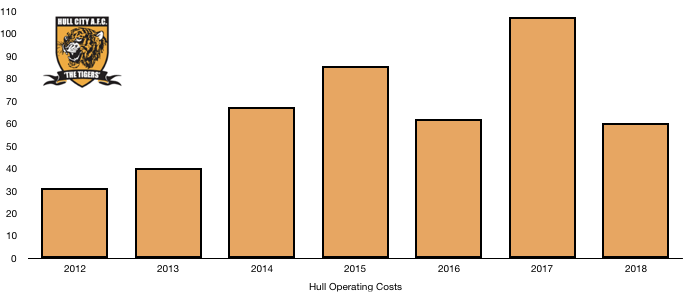

As revenue halved, Hull had to reduce expenses significantly to avoid incurring huge losses. Hull were successful in doing this as expenses fell from £107.5m to £60.3m (43.9%).

Amortisation costs fell dramatically from £32.6m to £12.3m (62.3%) as the club sold a few of their star players who were brought only a year or two earlier. This shows the true costs of their transfers as they saved costs on recent signings by necessity and also by force as players forced through moves to remain in the Premier League.

Hull also spent £760k leasing the KC Stadium, a £70k rise in costs in this area.

The club saw adverse movements on their foreign exchange hedges and operations as they lost £761k on these movements as the pound weakened.

Hull saw a decrease in interest costs, falling from £4.3m to £3.1 (27.9%) as the club paid off bank loans early and took on more owner debt (more on this later).

After another profitable year and no losses to offset profits against, Hull have begun paying a lot of tax, incurring UK tax of £4.4m this year. This works out at an effective tax rate of 18.6% which is essentially in line with the UK corporation tax rate of 19% after a few tax adjustments.

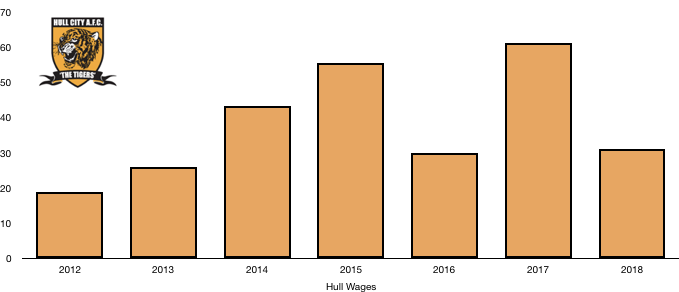

Hull would have had relegation wage drop clauses within the majority of player contracts and this has led to wages pretty much halving from £61.3m to £31.1m (49.3%) as player wages dropped due to clauses and the club also selling a few high earners.

Wages dropped by a substantial £30.2m, a huge £581k a week fall in wages. Interestingly, they are more or less back to same levels of their last Championship season where wages were £30m.

Hull will now look to carefully manage costs as they plot a strategy for returning to the Premier League or remaining profitable as a well-run Championship club. Wages are likely to remain at a similar level next year to now, either decreasing or increasing by a relatively small amount of no more than 10%.

Transfers Analysis

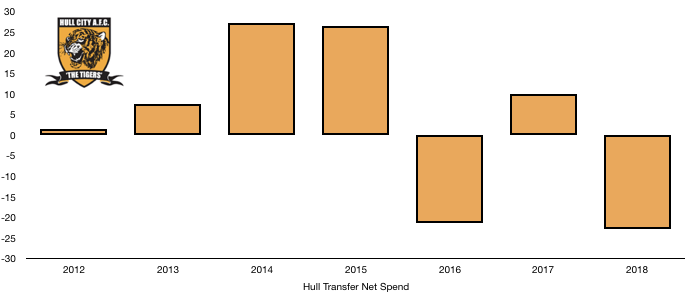

Hull saw a huge squad overhaul in the summer as they braced themselves for life back in the Championship, with many high earners and star players departing meaning replacements were required.

In came Stewart (£4.1m), Dicko (£3.4m), Toral (£3.0m), Kingsley (£3.0m), Irvine (£1.9m), Mazuch (£1.8m) and MacDonald (£0.7m) for a combined £17.9m.

Departing the KC Stadium were Clucas (£14.7m), Maguire (£12.3m), Robertson (£8.1m), Jakupovic (£2.1m), Huddlestone (£2.0m), Elmohammady (£1.0m) and Davies (£0.5m) for a huge combined £40.7m.

This meant Hull had a net transfer income of £22.8m as they sold a raft of players that impressed in the Premier League and decided not to reinvest this in its entirety and gamble on an immediate return to the Premier League.

The new signings obviously struggled as indicated by the poor league position achieved however this wasn’t helped by managerial change and a lack of clarity.

The players sold all impressed at their new clubs, especially Maguire and Robertson and were sorely missed by Hull last season.

Hull spent cash in the year on transfers of £16.9m compared to £32.4m last year. They also brought in cash of £31.3m compared to £33.3m after the significant sales of last season began to pay the cash they owed. This interestingly shows that Hull brought in more cash on players then they spent yet again as the owners continue to show a cautious approach to Hull’s finances.

Hull made a huge profit on player disposals for the second year in a row as this figure rose from £29.9m to £30.9m (3.3%) after the transfers of Clucas, Maguire and Robertson.

Hull are owed a further £20m in player transfer fees which will boost cash and club finances with £10.5m of that amount owed within the next year.

In comparison, Hull owe other clubs £7.5m in transfer fees with £5.8m owed within the next year.

Hull also have potential contingent transfer fees payable of £1.1m whilst they could be owed a further £8.7m in contingent transfers fees should certain clauses be met.

Net Debt Analysis

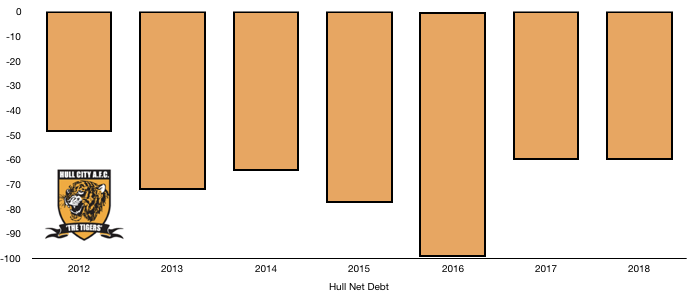

As eluded to last year and again this year, Hull are becoming a much more prudent and cautiously run club in terms of their finances and have taken this approach into managing their debt levels.

Last year Hull looked to boost cash levels, however this year they have used those extra reserves to pay off bank loans. Therefore, cash levels have significantly dropped, falling from £21.1m to £3.0m (85.8%).

Contributing to this was the £21.3m repayment in loans, net cash received from transfers of £17.1m and profit for the year of £19.3m.

Debt levels fell considerably yet again, declining from £81.3m to £63.0m (22.5%) as the club looked to become more sustainable after repaying all of their bank debt with their cash surplus rather than invest in players, potentially to aid compliance with Financial Fair Play after previous run-ins with UEFA.

To supplement this Allam has injected a further £3.0m in cash, increasing loans owed to him to £63.0m.

Net debt levels remained stable, falling from £60.2m to £60.0m as the club became continued to be conservative and the owners will be hoping this puts the club in good stead for an assault on promotion over the next year or two.

If you want to compare this to last year report, read it here.

Thanks for reading, Share with a Hull City Fan!