Aston Villa endured their first season in the Championship for 28 years in 2017, hoping for an immediate return to the Premier League that they are so used to. This unfortunately for them did not materialise after a disappointing season, finishing 13th and never really looking like promotion challengers despite the significant talent within the squad which was still suffering from the shock of relegation.

It was a significant period of change for the club, with J Xia taking over control of the Midlands club for $87m from controversial American Randy Lerner.

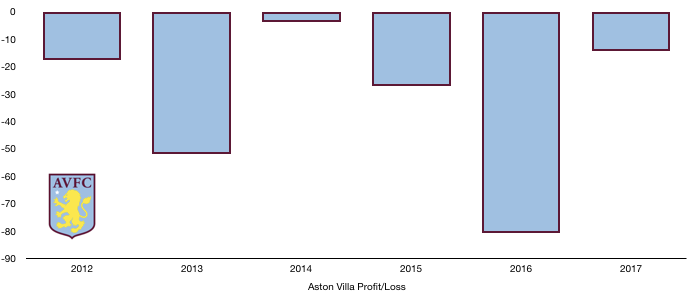

There were immediate positives in their finances with Aston Villa cutting down their losses from £80.7m to £14.5m (82.3%) as the club look to stabilise their finances.

Let’s delve into the numbers.

Revenue Analysis

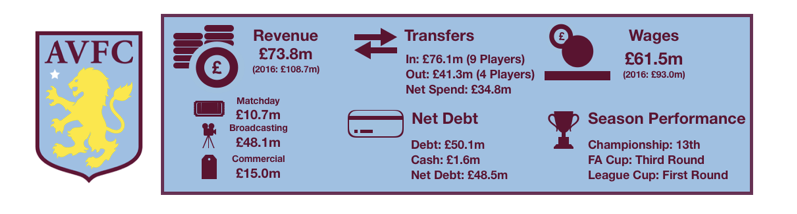

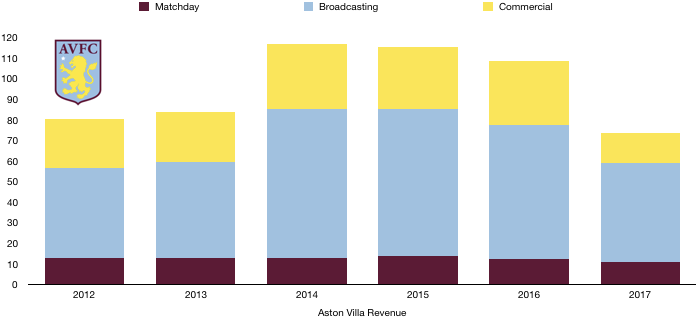

Aston Villa saw revenue unsurprisingly drop after relegation, falling from £108.8m to £73.8m (32.2%) which wasn’t as dramatic a drop as expected.

Matchday revenue fell slightly, decreasing from £12.5m to £10.7m (14.4%) as fans left in their droves after losing hope in a disappointing season after initial high expectations. The club also saw matchday revenue drop due to lower prices as Aston Villa had to drop prices to keep fans at the ground.

Broadcasting revenue dropped significantly, falling from £65.0m to £48.1m (26.0%) after relegation from the riches of the Premier League were felt, this was compounded by a low Championship finish. The drop in revenue was offset significantly by parachutes payment that will drop further next year.

Commercial revenue more than halved, falling from £31.2m to £15.0m (51.9%) after merchandise sales fell significantly and commercial partners exercised their break clauses to leave their sponsorship contracts with Aston Villa unable to bridge this financial gap with new sponsorships.

Aston Villa will see revenue drop significantly again as parachute payments fall further after a second consecutive year in the Championship. Aston Villa reached the Playoff Final so could see revenue rise on the back of this after a good campaign that may lead to matchday and commercial revenue beginning to rise again. Aston Villa can also expect more in revenue from their Championship campaign after a higher league finish and more TV games. Failure to secure promotion though will not see any significant rise in revenue however.

Expense Analysis

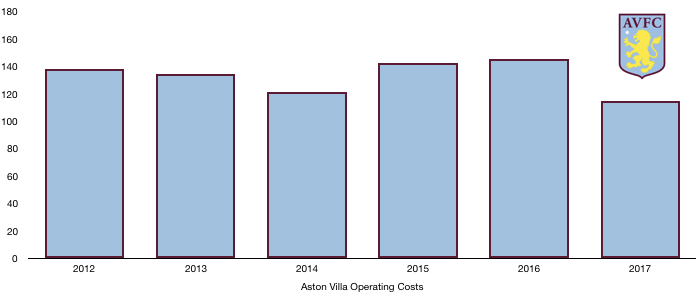

Aston Villa saw expenses drop significantly, falling from £145.2m to £114.9m (20.9%) as the club looked to acclimatise to their new financial reality in the Championship.

Amortisation grew significantly despite relegation after significant player investment, rising from £16.0m to £23.7m (48.1%) as the club looked to gain an immediate return to the Premier League. Aston Villa also had exceptional amortisation costs of £34.8m after having to impair the value of multiple players who lost their value after relegation.

Depreciation costs fell from £3.7m to £2.9m (28.6%) as the club saw less investment in infrastructure and the demising value of Villa Park. Villa Park saw its value written down significantly from £85.3m to £39.2m (54%) after relegation and other factors reducing its value.

Aston Villa have minimal finance costs will all interest on the debt to their owners currently being waved, seeing a net finance costs of only £61k compared to net finance income in the previous period of £589k after positive gains on their financial instruments.

Aston Villa invest heavily in their local community also, putting £2.0m into the community as they continue their reputation as a club for the local community.

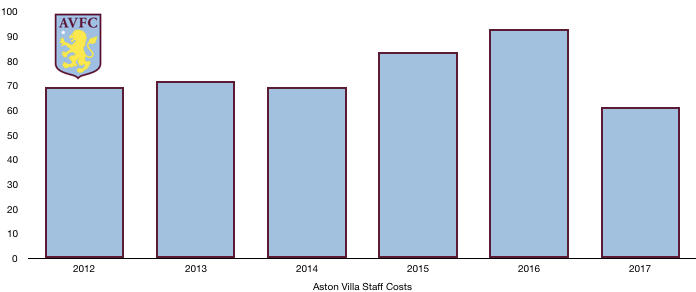

Wages dropped by a third, falling from £93.0m to £61.3m (33.9%) as relegation wage drop clauses came into effect and other high earners left the club for pastures new. This drop works out as a huge £606k a week less in wages for the club as they look to stabilise financially.

As part of this Aston Villa directors saw their pay drop off a cliff, falling from £2,960,343 to £357,795 (87.9%) as they saw the effects of failure rightly take effect with only 1 director paid this year after a second consecutive poor campaign where they failed to meet their objectives.

Transfers Analysis

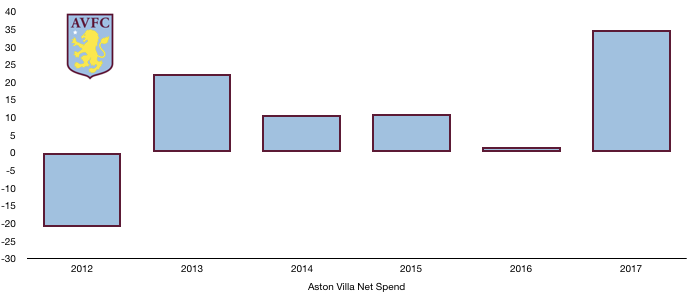

Aston Villa could not be faulted by fans for a lack of ambition in gaining promotion straight back to the Premier League, spending heavily in order to achieve this objective. This did not go to plan after a huge 14 signings and 8 departures in a busy recruitment drive by the club that proved unsuccessful.

In came McCormack (£12.9m), Kodjka (£11.6m), Hogan (£9.5m), Chester (£8.4m), Tshibola (£5.3m), Gollini (£4.5m), Jedinak (£4.1m), Elphick (£3.5m), Adomah (£3.2m), Hourihane (£3.2m), Bree (£3.2m), Lansbury (£3.1m), De Laet (£2.1m) and Bjarnason (£1.8m) for a combined £76.1m.

Out went Gueye (£7.7m), Traore (£7.4m), Gestede (£6.4m), Clark (£5.4m), Ayew (£5.3m), Westwood (£5.2m), Sinclair (£3.7m) and Siegrist (£0.2m) for a cool £41.3m.

This surprisingly saw a huge increase in transfer net spend from £1.6m to £34.8m, despite being in the Premier League the previous season as Aston Villa went all in to gain immediate promotion back to the Premier League. This screamed of too little too late when they should have invested while still in the Premier League.

Unfortunately for Aston Villa, recruitment was poor and excessive with players unable to gel due to the sheer volume of signings while the players departing enjoyed good season elsewhere in particular Gueye, Ayew and Sinclair.

Aston Villa saw a huge influx of cash from sales this year and previously with £43.5m incoming while they spent cash of £57.8m compared to a net influx of £11.6m.

Worryingly Aston Villa owe a mouth watering £67.9m in the future for transfers while only being owed £23.6m a situation which may cause them issues over the next two years should promotion not be achieved, especially after significant transfer activity this year as well.

Aston Villa only owe £3.4m from potential contingent transfer fees.

Assets/Liabilities Analysis

Aston Villa are deceivingly look relatively stable financially despite relegation and another loss making season.

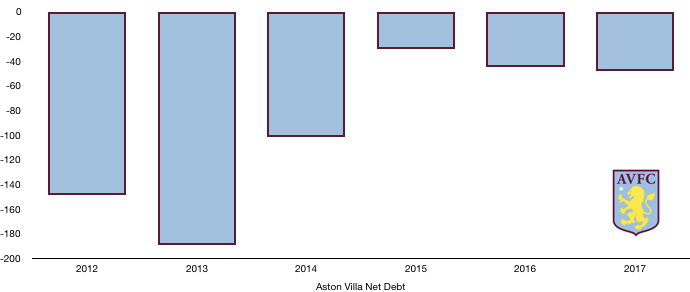

Aston Villa’s low cash levels increased from £0.6m to £1.6m despite making a loss this year due to transfer fees received and new loans. Aston Villa have historically always ran as a club with low cash reserves, maximising the usage of their funds to the best of their ability while running the risk of insolvency.

Aston Villa saw debt levels increase, rising from £45.6m to £50.1m (9.9%). This compromises of an increase of £15m in owner debt after the change in hands from Lerner to Xia, replacing £10.5m in bank debt. It’s been an ambitious start to life under Xia in terms of investment within the club remaining relatively healthy financially, however after missing out on promotion agonisingly, he may have to rethink his plans to invest heavily as their finances may begin to unravel.

Net debt hence rose from £45m to £48.5m a modest 7.8% increase as the club remain in a very similar financial position to last year, however another season in the Championship will see this position deteriorate further as Aston Villa struggle to control their finances.

Thanks for reading. Share with an Aston Villa fan!